Form 8952 Application for Voluntary Classification

What is the Form 8952 Application for Voluntary Classification

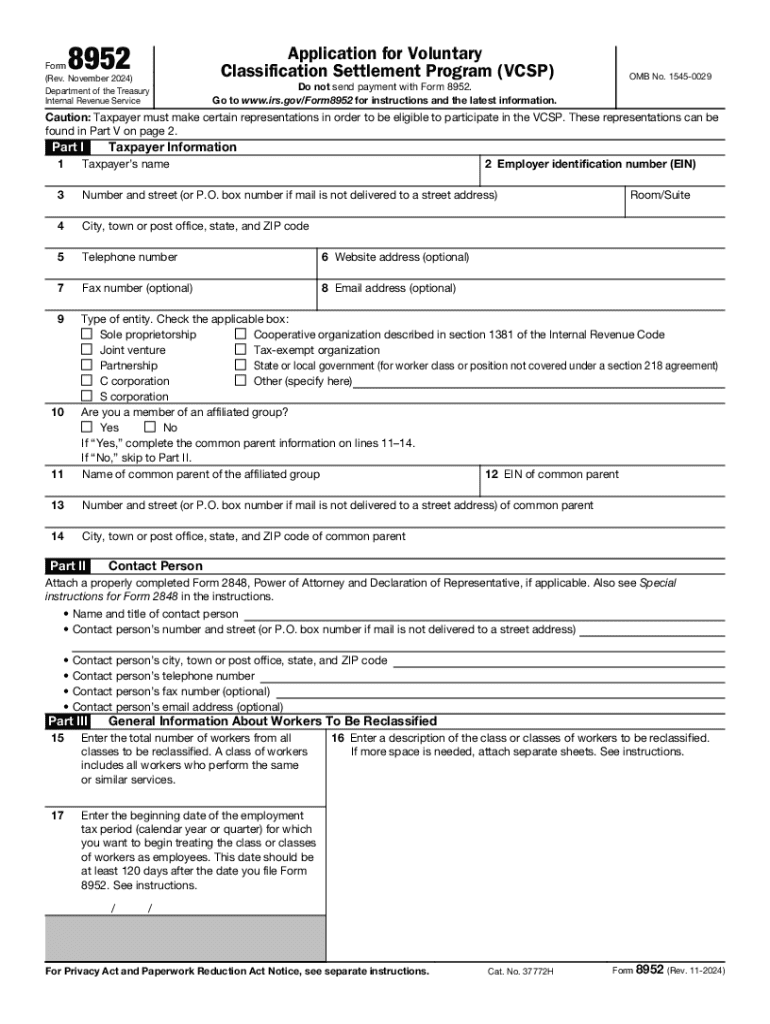

The IRS Form 8952 is specifically designed for businesses seeking to participate in the Voluntary Classification Settlement Program (VCSP). This program allows employers to reclassify their workers as employees rather than independent contractors, thereby reducing the risk of potential tax liabilities associated with misclassification. By filing this form, businesses can obtain a settlement that significantly minimizes their exposure to back taxes and penalties for prior misclassifications.

How to Use the Form 8952 Application for Voluntary Classification

To effectively use the Form 8952, businesses must first ensure they meet the eligibility criteria outlined by the IRS. Once eligibility is confirmed, the application process involves completing the form accurately and submitting it to the IRS. The form requires detailed information about the business, including the nature of its operations and the classification of its workers. After submission, businesses should await a response from the IRS regarding their application status and any further instructions.

Steps to Complete the Form 8952 Application for Voluntary Classification

Completing the Form 8952 involves several key steps:

- Gather necessary information about your business and workers.

- Fill out the form, ensuring all sections are completed accurately.

- Review the form for any errors or omissions.

- Submit the form to the IRS, either electronically or by mail.

It is crucial to follow the IRS guidelines closely to avoid delays in processing your application.

Eligibility Criteria for the Form 8952 Application for Voluntary Classification

To qualify for the Voluntary Classification Settlement Program, businesses must meet specific criteria. They should have consistently treated the workers in question as independent contractors and must not be currently under audit by the IRS or any state agency regarding the classification of these workers. Additionally, the business must have filed all required federal tax returns for the previous three years.

Filing Deadlines / Important Dates

Timely filing of the Form 8952 is essential for businesses wishing to participate in the VCSP. The IRS recommends submitting the form at least 60 days before the start of the tax year in which the business intends to change the classification of its workers. This timeline ensures that the application is processed in time for the business to implement the changes for the upcoming tax year.

Required Documents for the Form 8952 Application for Voluntary Classification

When completing the Form 8952, businesses should prepare to provide several supporting documents. These may include:

- Records of payments made to the workers in question.

- Documentation that outlines the nature of the work performed.

- Any prior tax filings relevant to the classification of these workers.

Having these documents ready can streamline the application process and facilitate a quicker response from the IRS.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8952 application for voluntary classification

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS Form 8952 and why is it important?

IRS Form 8952 is a tax form used by employers to request a waiver of the penalty for failing to file certain tax forms on time. Understanding this form is crucial for businesses to avoid unnecessary penalties and ensure compliance with IRS regulations.

-

How can airSlate SignNow help with IRS Form 8952?

airSlate SignNow provides an efficient platform for businesses to prepare, sign, and send IRS Form 8952 electronically. This streamlines the process, reduces paperwork, and ensures that your form is submitted accurately and on time.

-

What are the pricing options for using airSlate SignNow for IRS Form 8952?

airSlate SignNow offers various pricing plans to accommodate different business needs, starting with a free trial. Each plan includes features that simplify the eSigning process for IRS Form 8952, making it a cost-effective solution for businesses of all sizes.

-

Is airSlate SignNow secure for handling IRS Form 8952?

Yes, airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect sensitive information on IRS Form 8952. You can trust that your documents are safe and compliant with industry standards.

-

Can I integrate airSlate SignNow with other software for IRS Form 8952?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to manage IRS Form 8952 alongside your existing workflows. This integration enhances productivity and ensures that all your documents are easily accessible.

-

What features does airSlate SignNow offer for completing IRS Form 8952?

airSlate SignNow includes features such as customizable templates, automated reminders, and real-time tracking for IRS Form 8952. These tools help streamline the signing process and ensure that all parties are informed and engaged.

-

How does airSlate SignNow improve the efficiency of submitting IRS Form 8952?

By using airSlate SignNow, businesses can eliminate the delays associated with traditional paper forms. The platform allows for quick eSigning and instant submission of IRS Form 8952, signNowly improving overall efficiency.

Get more for Form 8952 Application For Voluntary Classification

Find out other Form 8952 Application For Voluntary Classification

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT