Form 5471 Overview Who, What, and How

What is the Form 5471?

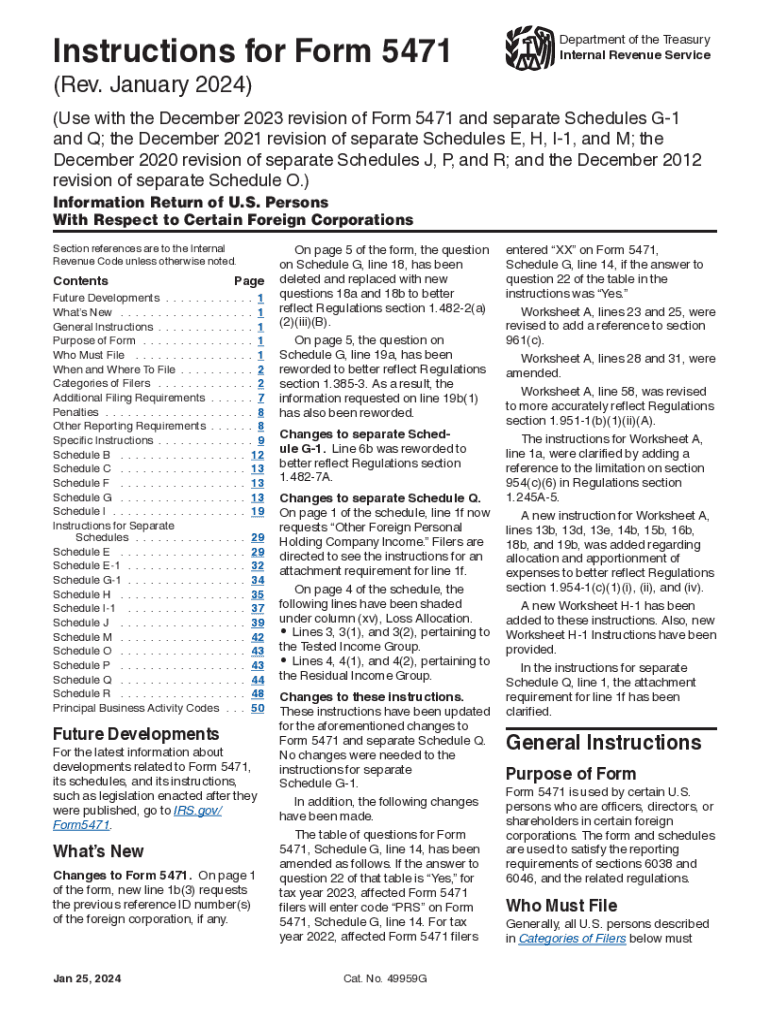

The Form 5471 is a U.S. tax form used to report information about certain foreign corporations in which U.S. taxpayers have an ownership interest. This form is primarily utilized by U.S. citizens and residents who are officers, directors, or shareholders in a foreign corporation. It aims to provide the IRS with details about the foreign entity's financial activities, ensuring compliance with U.S. tax laws.

Steps to Complete the Form 5471

Completing the Form 5471 involves several key steps to ensure accuracy and compliance. First, gather all necessary information about the foreign corporation, including its name, address, and Employer Identification Number (EIN). Next, determine the correct category of filer, as this affects the specific information required on the form. After that, fill out the relevant sections, which may include financial statements, ownership details, and income sources. Finally, review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

The deadline for filing Form 5471 typically aligns with the due date of the U.S. taxpayer's income tax return, including extensions. For most taxpayers, this means the form is due on April 15, with an automatic six-month extension available. However, if the taxpayer is outside the United States on the due date, they may qualify for additional extensions. It is crucial to adhere to these deadlines to avoid penalties.

Penalties for Non-Compliance

Failure to file Form 5471 can result in significant penalties. The IRS imposes a penalty of $10,000 for each annual return that is not filed on time. If the IRS determines that the failure to file was intentional or due to negligence, additional penalties may apply. Moreover, non-compliance can lead to increased scrutiny of the taxpayer's financial activities and potential legal consequences.

Eligibility Criteria

To determine eligibility for filing Form 5471, taxpayers must assess their ownership in foreign corporations. U.S. citizens and residents who own at least ten percent of a foreign corporation's stock are generally required to file. Additionally, officers or directors of the foreign corporation may also need to complete the form, regardless of their ownership percentage. Understanding these criteria is essential for ensuring compliance with U.S. tax regulations.

Required Documents

When preparing to file Form 5471, several documents are necessary to provide complete and accurate information. Taxpayers should collect financial statements of the foreign corporation, including balance sheets and income statements. Additionally, documentation regarding ownership percentages, corporate structure, and any transactions between the U.S. taxpayer and the foreign corporation will be required. Having these documents ready can streamline the filing process and help avoid errors.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 5471 overview who what and how

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the instructions 5471 for using airSlate SignNow?

The instructions 5471 for using airSlate SignNow provide a comprehensive guide on how to effectively utilize our eSigning features. These instructions cover everything from document preparation to sending and signing, ensuring a smooth experience for users. By following these instructions, you can maximize the benefits of our platform.

-

How much does airSlate SignNow cost for accessing instructions 5471?

airSlate SignNow offers various pricing plans that include access to instructions 5471. Our plans are designed to be cost-effective, catering to businesses of all sizes. You can choose a plan that fits your needs and budget while gaining access to all the necessary instructions and features.

-

What features are included in the instructions 5471 for airSlate SignNow?

The instructions 5471 for airSlate SignNow include detailed descriptions of features such as document templates, team collaboration, and advanced security options. These features are designed to enhance your eSigning experience and streamline your document workflows. By following the instructions, you can leverage these features effectively.

-

How can I benefit from following the instructions 5471?

By following the instructions 5471, you can ensure that you are using airSlate SignNow to its full potential. These instructions help you understand the platform's capabilities, leading to improved efficiency in document management. Additionally, you can avoid common pitfalls and enhance your overall user experience.

-

Are there any integrations available with airSlate SignNow as per instructions 5471?

Yes, the instructions 5471 detail various integrations available with airSlate SignNow, including popular tools like Google Drive and Salesforce. These integrations allow you to streamline your workflows and enhance productivity. By utilizing these integrations, you can connect your existing systems with airSlate SignNow seamlessly.

-

Can I access instructions 5471 on mobile devices?

Absolutely! The instructions 5471 for airSlate SignNow are accessible on mobile devices, allowing you to manage your documents on the go. This mobile accessibility ensures that you can follow the instructions anytime, anywhere, making it convenient for busy professionals. Our mobile app is designed to provide a user-friendly experience.

-

Is there customer support available for questions about instructions 5471?

Yes, airSlate SignNow offers dedicated customer support for any questions regarding instructions 5471. Our support team is available to assist you with any queries or challenges you may face while using the platform. You can signNow out via chat, email, or phone for prompt assistance.

Get more for Form 5471 Overview Who, What, And How

Find out other Form 5471 Overview Who, What, And How

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract