Form 941 for Employer's QUARTERLY Federal Tax 2024-2026

Understanding Form 2678

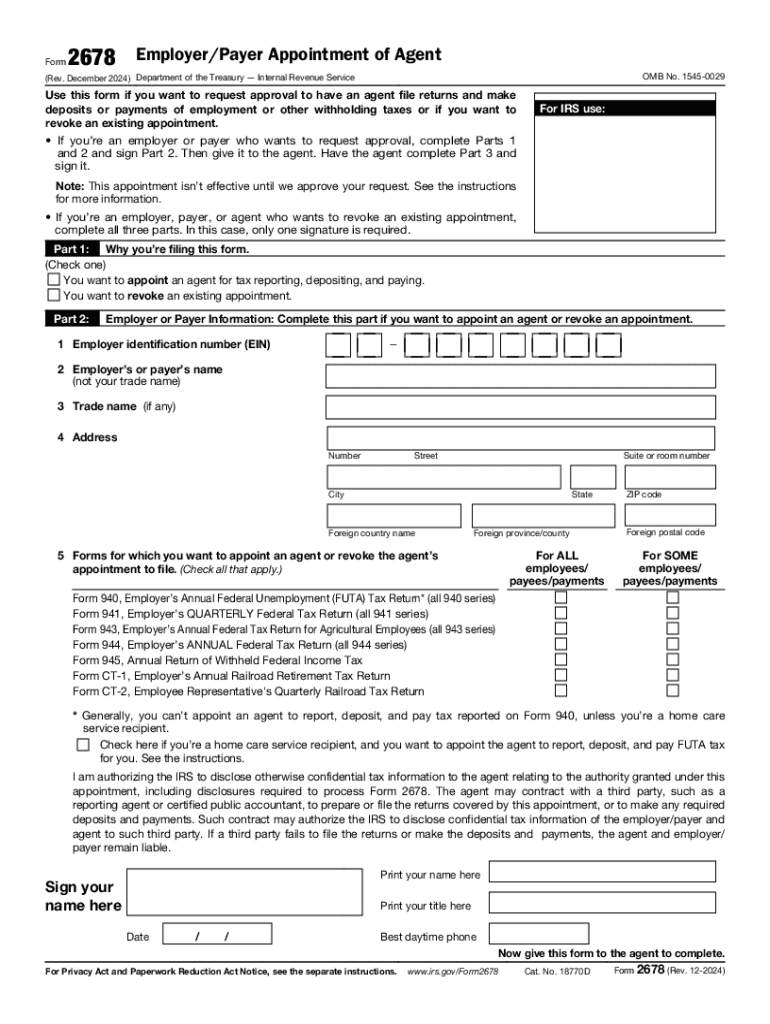

Form 2678, also known as the IRS Payer Appointment, is a critical document used by businesses to appoint an agent to act on their behalf in matters related to federal tax. This form allows the appointed agent to handle specific tax responsibilities, ensuring compliance with IRS regulations. It is essential for businesses that require assistance in managing their tax obligations, particularly in complex situations involving multiple tax types.

How to Obtain Form 2678

Businesses can easily obtain Form 2678 by visiting the official IRS website. The form is available for download in PDF format, allowing users to print and complete it at their convenience. Additionally, it can be requested through various IRS offices or by contacting the IRS directly for assistance. Ensuring you have the most current version of the form is crucial for compliance.

Steps to Complete Form 2678

Completing Form 2678 involves several key steps:

- Begin by entering the name and address of the business appointing the agent.

- Provide the name and address of the appointed agent, ensuring accurate contact information.

- Specify the tax types for which the agent is being authorized to act.

- Include the signature of the business owner or an authorized representative, along with the date.

After filling out the form, it should be submitted to the IRS as instructed in the accompanying guidelines.

Legal Use of Form 2678

Form 2678 is legally binding once completed and submitted, granting the appointed agent the authority to act on behalf of the business in specified tax matters. This form is essential for compliance with IRS regulations, as it formalizes the relationship between the business and the agent. Failure to properly complete or submit this form may result in delays or complications in tax matters.

Filing Deadlines for Form 2678

While there are no specific deadlines for submitting Form 2678, it is advisable to complete and file the form as soon as the need for an agent arises. Timely submission helps ensure that the agent can effectively manage tax responsibilities without delays. Businesses should also be aware of any related tax filing deadlines that may impact their overall compliance.

Penalties for Non-Compliance

Failure to submit Form 2678 or to properly appoint an agent can lead to significant penalties. The IRS may impose fines for non-compliance, and businesses may face difficulties in managing their tax obligations. It is crucial to ensure that this form is completed accurately and submitted in a timely manner to avoid any potential issues.

Create this form in 5 minutes or less

Find and fill out the correct form 941 for employers quarterly federal tax

Create this form in 5 minutes!

How to create an eSignature for the form 941 for employers quarterly federal tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to 2678?

airSlate SignNow is a powerful eSignature solution that allows businesses to send and sign documents electronically. The reference to '2678' highlights a specific feature or pricing tier that may be relevant for users looking for efficient document management solutions.

-

How much does airSlate SignNow cost for users interested in 2678?

The pricing for airSlate SignNow varies based on the features and number of users. For those interested in the '2678' plan, it offers a competitive rate that includes essential features for document signing and management, making it a cost-effective choice for businesses.

-

What features are included in the 2678 plan of airSlate SignNow?

The 2678 plan includes a range of features such as unlimited document signing, templates, and advanced security options. This plan is designed to meet the needs of businesses looking for a comprehensive eSignature solution.

-

What are the benefits of using airSlate SignNow with the 2678 plan?

Using airSlate SignNow with the 2678 plan provides businesses with a streamlined process for document management. It enhances productivity by reducing turnaround times for signatures and offers a user-friendly interface that simplifies the signing process.

-

Can airSlate SignNow integrate with other software while using the 2678 plan?

Yes, airSlate SignNow supports integrations with various software applications, even on the 2678 plan. This allows businesses to connect their existing tools and workflows, enhancing overall efficiency and collaboration.

-

Is airSlate SignNow secure for handling sensitive documents under the 2678 plan?

Absolutely, airSlate SignNow prioritizes security, especially for users on the 2678 plan. It employs advanced encryption and compliance with industry standards to ensure that all documents are handled securely.

-

How can I get started with airSlate SignNow's 2678 plan?

Getting started with the 2678 plan is easy. Simply visit the airSlate SignNow website, select the 2678 plan, and follow the prompts to create your account. You'll be able to start sending and signing documents in no time.

Get more for Form 941 For Employer's QUARTERLY Federal Tax

Find out other Form 941 For Employer's QUARTERLY Federal Tax

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template