1 Stone 501C Organization Charitable Organization Scribd 2014

IRS Guidelines for Form 2678

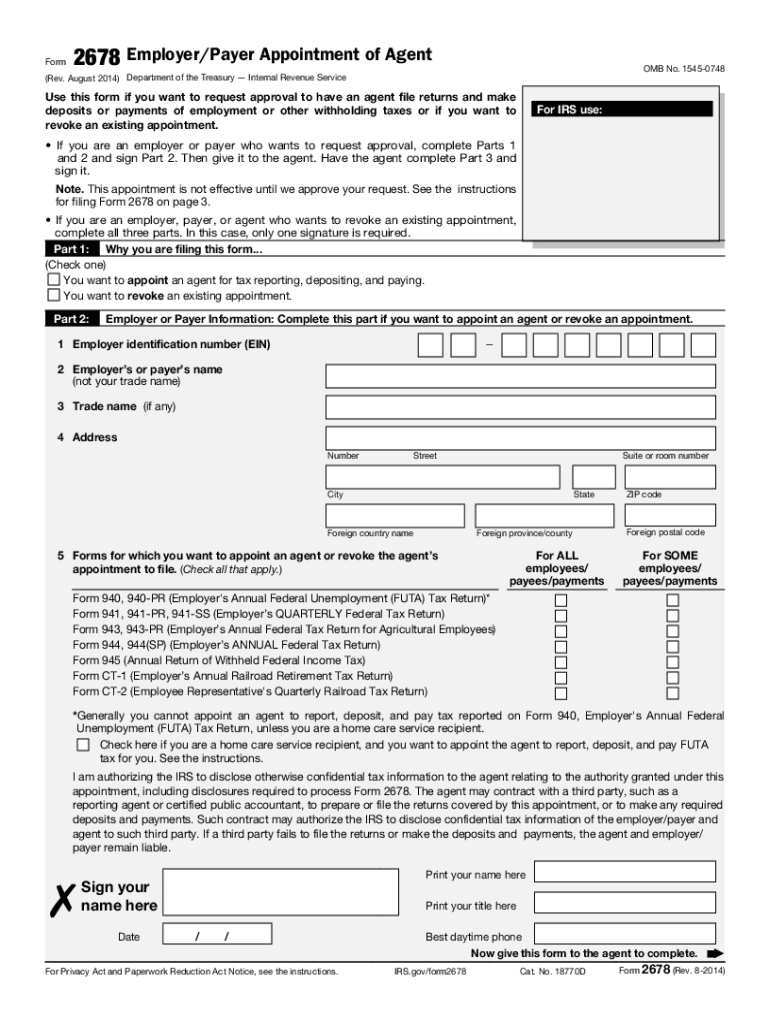

The IRS 2678 form, also known as the IRS appointment agent form, is essential for businesses that wish to appoint an agent to act on their behalf for tax purposes. Understanding the guidelines set forth by the IRS is crucial for ensuring compliance and avoiding potential issues. The form must be filled out accurately, reflecting the correct information about both the appointing entity and the appointed agent. It is important to review the IRS instructions carefully to ensure that all required fields are completed and that the form is submitted in a timely manner.

Steps to Complete the IRS 2678 Form

Completing the IRS 2678 form involves several key steps. First, gather all necessary information, including the legal name, address, and taxpayer identification number of both the appointing entity and the agent. Next, fill out the form with accurate details, ensuring that you follow the IRS guidelines closely. After completing the form, review it for any errors or omissions. Once verified, the form can be submitted either online or via mail, depending on your preference. It is advisable to keep a copy of the completed form for your records.

Required Documents for Form Submission

When submitting the IRS 2678 form, certain documents may be required to support the appointment. These can include proof of identity for the appointed agent, such as a driver's license or Social Security card, and any relevant business registration documents for the appointing entity. Having these documents ready can streamline the submission process and help ensure that the appointment is processed without delay.

Form Submission Methods

The IRS 2678 form can be submitted through various methods, providing flexibility to users. The most common methods include online submission through the IRS website or mailing a physical copy to the appropriate IRS address. When submitting online, ensure that you have a reliable internet connection and that you follow all prompts carefully. For mail submissions, it is recommended to use a trackable mailing service to confirm that the form has been received by the IRS.

Penalties for Non-Compliance

Failure to submit the IRS 2678 form correctly or on time can result in penalties for both the appointing entity and the appointed agent. These penalties may include fines or additional scrutiny from the IRS. It is essential to adhere to all filing deadlines and ensure that the form is completed accurately to avoid these potential consequences. Regularly reviewing IRS updates and guidelines can help keep you informed about any changes that may affect compliance.

Eligibility Criteria for Appointing an Agent

To appoint an agent using the IRS 2678 form, certain eligibility criteria must be met. The appointing entity must be a legitimate business operating within the United States, and the appointed agent must be qualified to act on behalf of the entity for tax matters. This typically includes having a valid taxpayer identification number and being in good standing with the IRS. Understanding these criteria is vital for ensuring that the appointment is valid and recognized by the IRS.

Quick guide on how to complete 1 stone 501c organization charitable organization scribd

Effortlessly Complete 1 Stone 501C Organization Charitable Organization Scribd on Any Device

Managing documents online has gained popularity among companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents since you can obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools needed to draft, edit, and electronically sign your files quickly without delay. Handle 1 Stone 501C Organization Charitable Organization Scribd on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The Easiest Method to Modify and eSign 1 Stone 501C Organization Charitable Organization Scribd with Ease

- Acquire 1 Stone 501C Organization Charitable Organization Scribd and select Get Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize important sections of the documents or conceal confidential information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you want to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate issues of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management requirements in just a few clicks from your preferred device. Modify and eSign 1 Stone 501C Organization Charitable Organization Scribd to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1 stone 501c organization charitable organization scribd

Create this form in 5 minutes!

How to create an eSignature for the 1 stone 501c organization charitable organization scribd

The best way to create an electronic signature for your PDF online

The best way to create an electronic signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The best way to generate an eSignature straight from your smartphone

The way to create an electronic signature for a PDF on iOS

The best way to generate an eSignature for a PDF document on Android

People also ask

-

What is airSlate SignNow 2678 and how does it work?

airSlate SignNow 2678 is an electronic signature platform that allows businesses to send, sign, and manage documents efficiently. The platform provides an intuitive interface that simplifies the signing process for both senders and recipients, ensuring secure and legally binding signatures.

-

How much does airSlate SignNow 2678 cost?

The pricing for airSlate SignNow 2678 varies based on the selected plan, which can cater to different business needs. Typically, there are monthly and annual subscription options that offer various features, ensuring businesses of all sizes can find a plan that fits their budget.

-

What features does airSlate SignNow 2678 offer?

airSlate SignNow 2678 provides a variety of features, including document templates, real-time tracking, and advanced security measures. These features are designed to enhance the signing experience while ensuring compliance and document integrity.

-

Can I integrate airSlate SignNow 2678 with other applications?

Yes, airSlate SignNow 2678 offers robust integrations with popular applications like Salesforce, Google Drive, and Microsoft Office. This functionality allows users to streamline their workflows and access documents from within their preferred tools.

-

What are the benefits of using airSlate SignNow 2678?

By using airSlate SignNow 2678, businesses can reduce turnaround time for document signing, improve efficiency, and enhance customer satisfaction. The platform's ease of use makes it accessible for all users, leading to a better overall experience.

-

Is airSlate SignNow 2678 secure for sensitive documents?

Absolutely, airSlate SignNow 2678 employs strong security protocols, including data encryption and secure cloud storage. Users can trust that their sensitive documents are protected against unauthorized access, ensuring peace of mind during the signing process.

-

How can I get started with airSlate SignNow 2678?

Getting started with airSlate SignNow 2678 is simple. Prospective users can sign up for a free trial on the website, allowing them to explore the features and benefits before committing to a subscription. This hands-on experience helps users understand how it can meet their specific needs.

Get more for 1 Stone 501C Organization Charitable Organization Scribd

- Tefra application form arkansas department of human

- Payment adjustment year 2019 medicare ehr incentive program critical access hospital reconsideration application ehr critical form

- California san francisco registration form

- Haampquotbry la ude papers past form

- Metlife statement of health fill online printable fillable form

- Witness expenses form

- Idaho personal property declaration form

- Does this project need srcirbiacuc or other pre approval form

Find out other 1 Stone 501C Organization Charitable Organization Scribd

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed