Form CT 3 General Business Corporation Franchise Tax Return Tax Year

Understanding the 2024 NY CT 3 General Business Corporation Franchise Tax Return

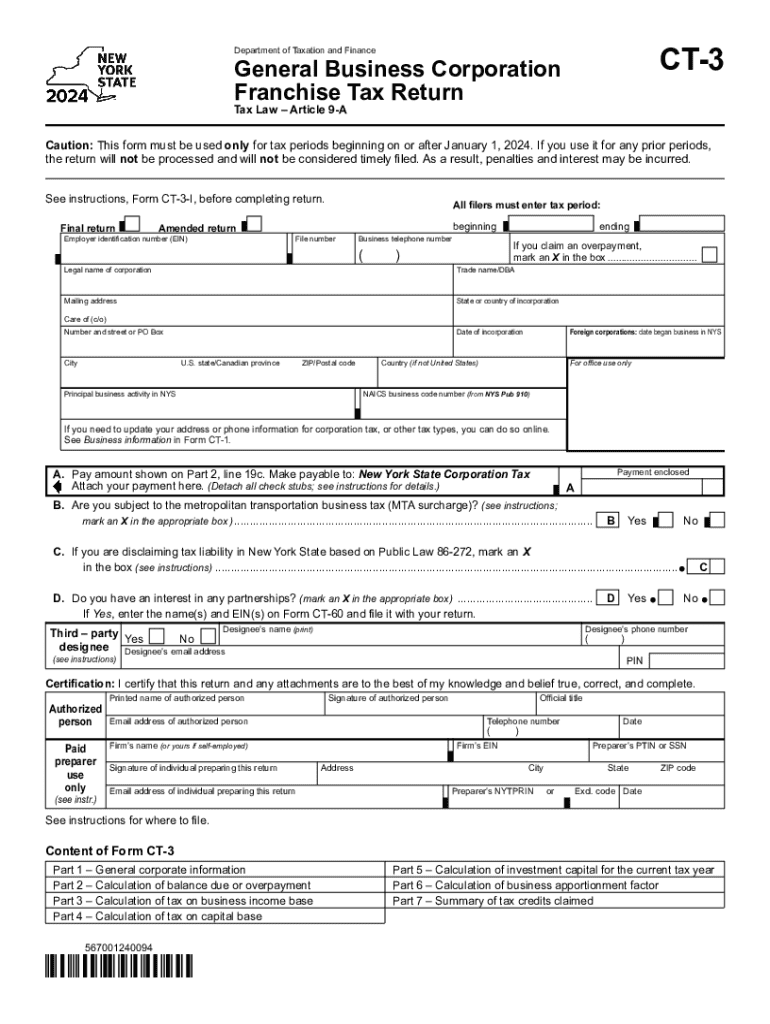

The 2024 NY CT 3 is a crucial form for businesses operating in New York State. It serves as the General Business Corporation Franchise Tax Return, which corporations must file to report their income and calculate their franchise tax liability. This form is essential for ensuring compliance with state tax laws and maintaining good standing with the New York State Department of Taxation and Finance.

Steps to Complete the 2024 NY CT 3 Form

Completing the 2024 NY CT 3 involves several key steps:

- Gather necessary financial documents, including income statements and balance sheets.

- Determine your corporation's tax year and ensure it aligns with the reporting period.

- Fill out the form accurately, providing detailed information about your business income, deductions, and credits.

- Review the completed form for any errors or omissions.

- Submit the form by the designated filing deadline to avoid penalties.

Key Elements of the 2024 NY CT 3 Form

The 2024 NY CT 3 form includes several critical sections:

- Identification Information: This section requires basic details about the corporation, including its name, address, and employer identification number (EIN).

- Income Reporting: Corporations must report total income, including gross receipts and other sources of income.

- Deductions and Credits: This section allows businesses to claim eligible deductions and credits that can reduce their taxable income.

- Franchise Tax Calculation: The form provides a method for calculating the franchise tax based on the reported income and applicable rates.

Filing Deadlines for the 2024 NY CT 3

Corporations must adhere to specific filing deadlines for the 2024 NY CT 3. Generally, the form is due on the fifteenth day of the third month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by March 15, 2024. It is essential to file on time to avoid late fees and penalties.

Obtaining the 2024 NY CT 3 Form

The 2024 NY CT 3 form can be obtained through the New York State Department of Taxation and Finance website. It is available as a downloadable PDF, which can be printed and filled out manually. Additionally, businesses can access fillable versions of the form for easier completion. Ensuring you have the correct and most current version of the form is vital for accurate filing.

Legal Use of the 2024 NY CT 3 Form

The 2024 NY CT 3 form is legally required for corporations operating in New York State. Filing this form is not only a matter of compliance but also crucial for maintaining the corporation's legal status. Failure to file or inaccuracies can lead to penalties, including fines and potential loss of good standing with the state.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ct 3 general business corporation franchise tax return tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2024 ny ct 3 form and why is it important?

The 2024 ny ct 3 form is a crucial document for businesses operating in New York and Connecticut, as it helps in reporting income and calculating taxes. Understanding this form is essential for compliance and ensuring accurate tax filings. Using airSlate SignNow can simplify the process of eSigning and submitting this form.

-

How can airSlate SignNow help with the 2024 ny ct 3 form?

airSlate SignNow provides an easy-to-use platform for businesses to eSign and manage the 2024 ny ct 3 form efficiently. With its intuitive interface, users can quickly fill out, sign, and send the form, reducing the time spent on paperwork. This streamlines the tax filing process and enhances productivity.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, starting from a basic plan to more advanced options. Each plan includes features that support the eSigning of documents like the 2024 ny ct 3 form. You can choose a plan that best fits your budget and requirements.

-

Are there any integrations available with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing its functionality. You can connect it with popular tools like Google Drive, Salesforce, and more to streamline your workflow. This is particularly beneficial when managing documents like the 2024 ny ct 3 form.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure cloud storage. These features make it easier to manage documents, including the 2024 ny ct 3 form, ensuring that you have everything organized and accessible. This enhances efficiency and reduces the risk of errors.

-

Is airSlate SignNow secure for signing sensitive documents?

Absolutely, airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. This ensures that your documents, including the 2024 ny ct 3 form, are protected during the signing process. You can trust that your sensitive information remains confidential and secure.

-

Can I use airSlate SignNow on mobile devices?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to eSign documents like the 2024 ny ct 3 form on the go. The mobile app provides the same features as the desktop version, ensuring you can manage your documents anytime, anywhere. This flexibility is ideal for busy professionals.

Get more for Form CT 3 General Business Corporation Franchise Tax Return Tax Year

- Form 1040 tax 2017 2018

- For the year january 1 2017 through december 31 2017 or fiscal year beginning tax ny form

- Download california form 540a taxhownet taxhow

- 2017 schedule r 2018 form

- Form 1040n v 2017 nebraska individual income tax payment

- 2017 rental 2018 form

- Form 8962 2018

- Commonwealth of puerto rico form

Find out other Form CT 3 General Business Corporation Franchise Tax Return Tax Year

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online