for the Year January 1, , through December 31, , or Fiscal Year Beginning Tax Ny 2017

What is the For The Year January 1, , Through December 31, , Or Fiscal Year Beginning Tax Ny

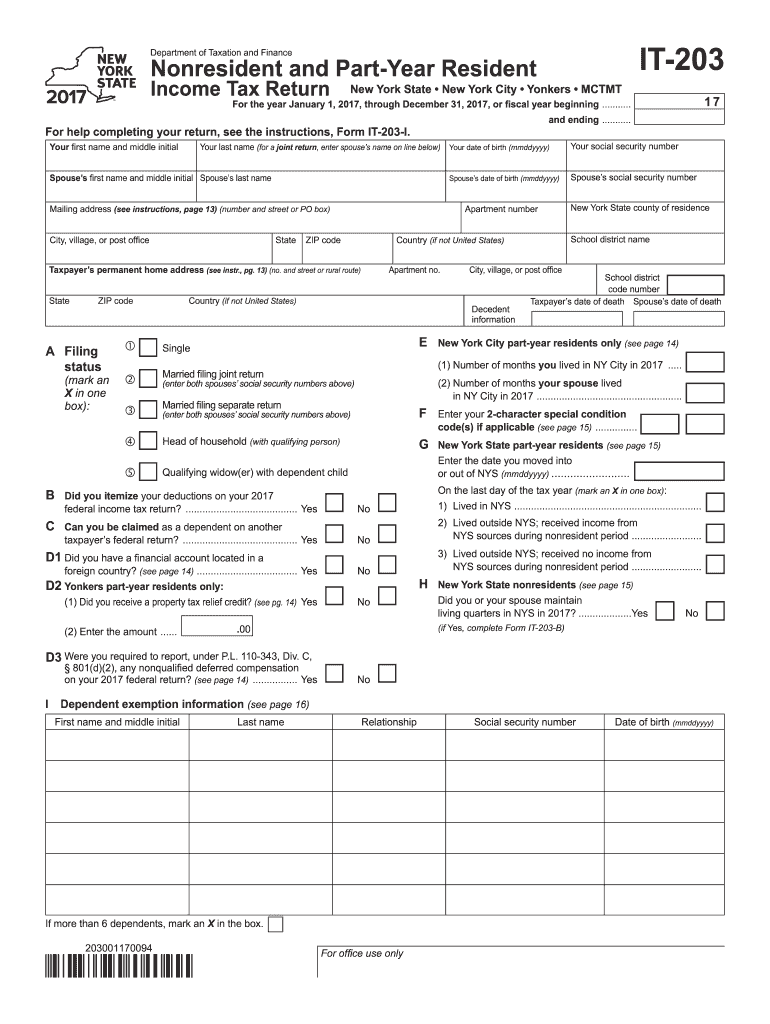

The For The Year January 1, , Through December 31, , Or Fiscal Year Beginning Tax Ny form is a crucial document for individuals and businesses in New York State to report their income and calculate tax liabilities. This form is designed to capture financial information for a specific tax year, allowing taxpayers to comply with state tax regulations. It is essential for accurate tax reporting and helps ensure that taxpayers fulfill their obligations under New York tax law.

Steps to Complete the For The Year January 1, , Through December 31, , Or Fiscal Year Beginning Tax Ny

Completing the For The Year January 1, , Through December 31, , Or Fiscal Year Beginning Tax Ny form involves several important steps:

- Gather all necessary financial documents, including W-2s, 1099s, and any other income statements.

- Review the form instructions carefully to understand the specific requirements and sections.

- Fill in your personal information, including your name, address, and Social Security number.

- Report all sources of income accurately, ensuring that you include any deductions or credits applicable to your situation.

- Double-check all entries for accuracy and completeness before signing the form.

How to Obtain the For The Year January 1, , Through December 31, , Or Fiscal Year Beginning Tax Ny

To obtain the For The Year January 1, , Through December 31, , Or Fiscal Year Beginning Tax Ny form, taxpayers can visit the official New York State Department of Taxation and Finance website. The form is typically available for download in PDF format, allowing users to print it for completion. Additionally, some tax preparation software may include this form, streamlining the process for users who prefer digital filing.

Legal Use of the For The Year January 1, , Through December 31, , Or Fiscal Year Beginning Tax Ny

The legal use of the For The Year January 1, , Through December 31, , Or Fiscal Year Beginning Tax Ny form is governed by New York State tax laws. It is essential for taxpayers to ensure that the form is filled out accurately and submitted by the designated deadlines to avoid penalties. The form serves as a legal declaration of income and tax obligations, making it vital for compliance with state regulations.

IRS Guidelines

While the For The Year January 1, , Through December 31, , Or Fiscal Year Beginning Tax Ny form is specific to New York State, it is important to align it with IRS guidelines. Taxpayers should ensure that they are aware of any federal tax implications that may arise from their state filings. This includes understanding how state income interacts with federal tax obligations and ensuring that all income is reported consistently across both state and federal forms.

Filing Deadlines / Important Dates

Filing deadlines for the For The Year January 1, , Through December 31, , Or Fiscal Year Beginning Tax Ny form typically align with the federal tax deadlines. Generally, individual taxpayers must file by April 15 of the following year. However, if the deadline falls on a weekend or holiday, it may be extended. It is crucial for taxpayers to stay informed about any changes to deadlines or extensions offered by the New York State Department of Taxation and Finance.

Quick guide on how to complete for the year january 1 2017 through december 31 2017 or fiscal year beginning tax ny

Your assistance manual on how to prepare your For The Year January 1, , Through December 31, , Or Fiscal Year Beginning Tax Ny

If you’re wondering how to finalize and submit your For The Year January 1, , Through December 31, , Or Fiscal Year Beginning Tax Ny, here are some succinct guidelines on how to simplify tax filing.

To begin, you only need to create your airSlate SignNow account to revolutionize how you handle documents online. airSlate SignNow is an extremely intuitive and efficient document solution that allows you to modify, generate, and complete your tax files with ease. With its editing tool, you can toggle between text, checkboxes, and eSignatures and return to adjust details as necessary. Streamline your tax administration with advanced PDF editing, eSigning, and convenient sharing options.

Follow these steps to finish your For The Year January 1, , Through December 31, , Or Fiscal Year Beginning Tax Ny in just a few minutes:

- Create your account and start editing PDFs within minutes.

- Utilize our directory to locate any IRS tax form; browse through versions and schedules.

- Click Get form to access your For The Year January 1, , Through December 31, , Or Fiscal Year Beginning Tax Ny in our editor.

- Complete the necessary fillable fields with your information (text, numbers, checkmarks).

- Employ the Sign Tool to add your legally valid eSignature (if required).

- Examine your document and rectify any inaccuracies.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Be aware that submitting in paper form can increase mistakes and delay refunds. Of course, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct for the year january 1 2017 through december 31 2017 or fiscal year beginning tax ny

Create this form in 5 minutes!

How to create an eSignature for the for the year january 1 2017 through december 31 2017 or fiscal year beginning tax ny

How to make an eSignature for your For The Year January 1 2017 Through December 31 2017 Or Fiscal Year Beginning Tax Ny in the online mode

How to make an electronic signature for the For The Year January 1 2017 Through December 31 2017 Or Fiscal Year Beginning Tax Ny in Chrome

How to generate an eSignature for signing the For The Year January 1 2017 Through December 31 2017 Or Fiscal Year Beginning Tax Ny in Gmail

How to create an eSignature for the For The Year January 1 2017 Through December 31 2017 Or Fiscal Year Beginning Tax Ny right from your smart phone

How to create an electronic signature for the For The Year January 1 2017 Through December 31 2017 Or Fiscal Year Beginning Tax Ny on iOS

How to generate an electronic signature for the For The Year January 1 2017 Through December 31 2017 Or Fiscal Year Beginning Tax Ny on Android devices

People also ask

-

What is the pricing structure for airSlate SignNow for the year January 1, 2023, through December 31, 2023, or fiscal year beginning tax NY?

airSlate SignNow offers a flexible pricing structure tailored to meet your business needs. For the year January 1, 2023, through December 31, 2023, or fiscal year beginning tax NY, you can choose from various plans that cater to different user requirements, ensuring you only pay for what you need.

-

How can airSlate SignNow help with compliance for the year January 1, 2023, through December 31, 2023, or fiscal year beginning tax NY?

airSlate SignNow is designed to help businesses maintain compliance with industry regulations. For the year January 1, 2023, through December 31, 2023, or fiscal year beginning tax NY, our platform ensures that all eSigned documents are legally binding and securely stored, providing peace of mind during tax season.

-

What features does airSlate SignNow offer for the year January 1, 2023, through December 31, 2023, or fiscal year beginning tax NY?

For the year January 1, 2023, through December 31, 2023, or fiscal year beginning tax NY, airSlate SignNow provides a comprehensive suite of features including document templates, bulk sending capabilities, and real-time tracking. These tools streamline your workflow and enhance productivity, making document signing effortless.

-

Can airSlate SignNow integrate with other software for the year January 1, 2023, through December 31, 2023, or fiscal year beginning tax NY?

Yes, airSlate SignNow integrates seamlessly with numerous third-party applications. For the year January 1, 2023, through December 31, 2023, or fiscal year beginning tax NY, you can connect with popular platforms like Salesforce, Google Drive, and Zapier, enhancing your document management processes.

-

What are the benefits of using airSlate SignNow during the year January 1, 2023, through December 31, 2023, or fiscal year beginning tax NY?

Using airSlate SignNow during the year January 1, 2023, through December 31, 2023, or fiscal year beginning tax NY allows businesses to save time and reduce costs associated with traditional document signing methods. Our user-friendly interface and cloud-based solution enable faster transactions, helping you meet your fiscal deadlines efficiently.

-

Is airSlate SignNow secure for document signing in the year January 1, 2023, through December 31, 2023, or fiscal year beginning tax NY?

Absolutely! airSlate SignNow prioritizes security, employing industry-standard encryption and authentication measures. For the year January 1, 2023, through December 31, 2023, or fiscal year beginning tax NY, your documents are protected against unauthorized access, ensuring your sensitive information remains confidential.

-

What support options are available for airSlate SignNow users for the year January 1, 2023, through December 31, 2023, or fiscal year beginning tax NY?

For the year January 1, 2023, through December 31, 2023, or fiscal year beginning tax NY, airSlate SignNow offers robust customer support options including live chat, email support, and an extensive knowledge base. We are committed to helping you navigate any challenges you may face while using our platform.

Get more for For The Year January 1, , Through December 31, , Or Fiscal Year Beginning Tax Ny

Find out other For The Year January 1, , Through December 31, , Or Fiscal Year Beginning Tax Ny

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online