1040 Tax Table 2017

What is the 1040 Tax Table

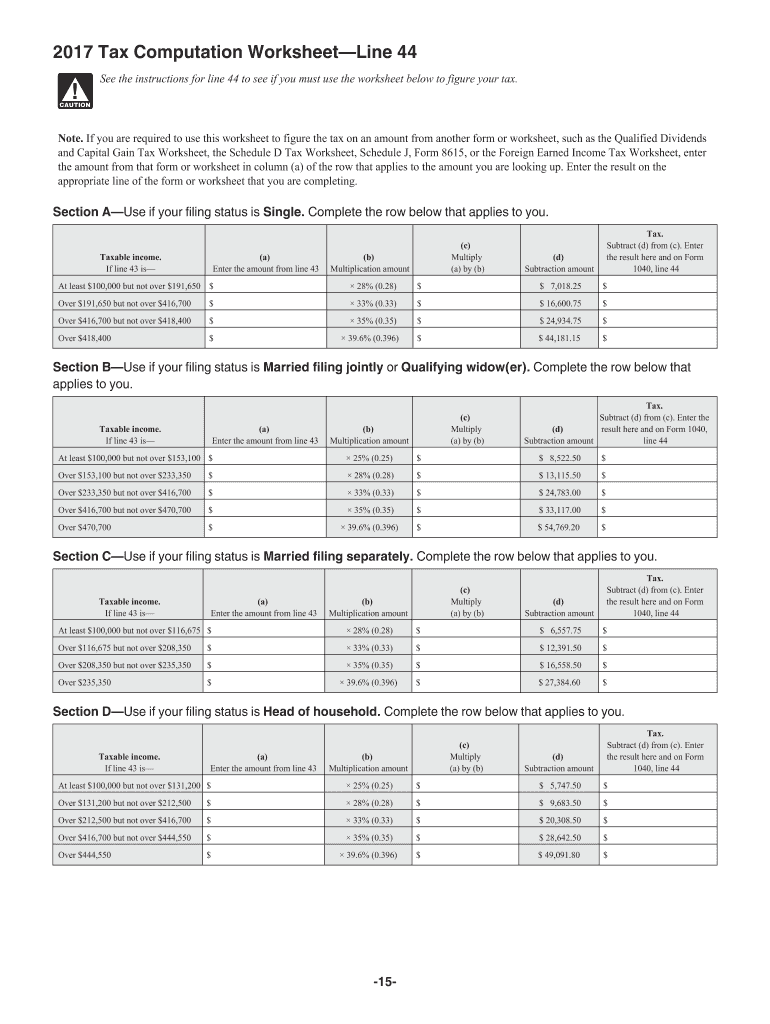

The 1040 Tax Table is a crucial resource used by taxpayers in the United States to determine their federal income tax liability based on taxable income. This table outlines the tax rates applicable to various income brackets, allowing individuals to calculate the amount of tax owed. The 1040 Tax Table is typically included in the IRS Form 1040 instructions, which provides guidance on how to use it effectively. Understanding this table is essential for accurate tax filing and compliance with IRS regulations.

How to use the 1040 Tax Table

To use the 1040 Tax Table, first locate your filing status, which can be single, married filing jointly, married filing separately, or head of household. Next, find your taxable income within the appropriate section of the table. The corresponding tax amount will be listed next to your income level. If your income falls between two amounts, you will need to calculate your tax based on the applicable rates for your specific income level. This process ensures that you are accurately reporting your tax obligations to the IRS.

Steps to complete the 1040 Tax Table

Completing the 1040 Tax Table involves several key steps:

- Gather your financial documents, including W-2s and 1099s, to determine your total income.

- Calculate your adjusted gross income (AGI) by subtracting any deductions from your total income.

- Determine your taxable income by subtracting standard or itemized deductions from your AGI.

- Refer to the 1040 Tax Table to find the tax amount corresponding to your taxable income.

- Record the calculated tax amount on your Form 1040.

IRS Guidelines

The IRS provides specific guidelines for using the 1040 Tax Table effectively. It is important to ensure that you are referencing the correct tax year’s table, as tax rates and brackets can change annually. Additionally, the IRS offers detailed instructions on how to fill out Form 1040, including information on various credits and deductions that may apply to your situation. Staying informed about these guidelines helps taxpayers avoid errors and ensures compliance with federal tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the 1040 Tax Table are critical for taxpayers to keep in mind. Typically, the deadline for filing individual tax returns is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions available, which may allow for additional time to file but not to pay any taxes owed. Staying aware of these important dates helps avoid penalties and interest on late payments.

Required Documents

To accurately complete the 1040 Tax Table, certain documents are essential. These include:

- W-2 forms from employers, detailing wages and withheld taxes.

- 1099 forms for any additional income, such as freelance work or interest earned.

- Documentation for deductions, such as mortgage interest statements or medical expenses.

- Any other relevant financial records that support your income and deductions.

Having these documents organized and accessible will streamline the tax preparation process and ensure accurate reporting.

Quick guide on how to complete form 1040 tax 2017 2018

Discover the simplest method to complete and sign your 1040 Tax Table

Are you still spending time creating your official documents on paper instead of completing them online? airSlate SignNow offers a superior approach to fill out and sign your 1040 Tax Table and comparable forms for governmental services. Our intelligent eSignature solution equips you with everything necessary to handle documents swiftly and in accordance with formal standards - comprehensive PDF editing, managing, securing, signing, and sharing tools all available within a user-friendly interface.

There are just a few steps needed to complete and sign your 1040 Tax Table:

- Upload the editable template to the editor using the Get Form button.

- Verify what information you need to include in your 1040 Tax Table.

- Move between the fields using the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to complete the fields with your information.

- Modify the content with Text boxes or Images from the upper toolbar.

- Emphasize what is important or Redact fields that are no longer relevant.

- Click on Sign to generate a legally valid eSignature using your preferred option.

- Add the Date next to your signature and conclude your work with the Done button.

Store your finalized 1040 Tax Table in the Documents section of your profile, download it, or transfer it to your preferred cloud storage. Our service also offers versatile file sharing. There’s no need to print out your documents when you need to submit them to the relevant public office - do it via email, fax, or by requesting USPS “snail mail” delivery from your account. Give it a try today!

Create this form in 5 minutes or less

Find and fill out the correct form 1040 tax 2017 2018

FAQs

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

How do you fill out line 5 on a 1040EZ tax form?

I suspect the question is related to knowing whether someone can claim you as a dependent, because otherwise line 5 itself is pretty clear.General answer: if you are under 19, or a full-time student under the age of 24, your parents can probably claim you as a dependent. If you are living with someone to whom you are not married and who is providing you with more than half of your support, that person can probably claim you as a dependent. If you are married and filing jointly, your spouse needs to answer the same questions.Note that whether those individuals actually do claim you as a dependent doesn't matter; the question is whether they can. It is not a choice.

-

How can I fill up my own 1040 tax forms?

The 1040 Instructions will provide step-by-step instructions on how to prepare the 1040. IRS Publication 17 is also an important resource to use while preparing your 1040 return. You can prepare it online through the IRS website or through a software program. You can also prepare it by hand and mail it in, or you can see a professional tax preparer to assist you with preparing and filing your return.

-

How do I fill out the NTSE form 2017- 2018 Jharkhand online?

You cannot gove NTSE online or at your own level you have to belong to a school which is conducting ntse. Then download the form online from the page of ntse, fill it and submit it to your school along with fee. If your school is not conducting ntse, sorry to say but you cannot give ntse. It can only be given through, no institutions are allowed to conduct thos exam.

-

How do I understand the 1040 U.S. tax form in terms of an equation instead of a ton of boxes to fill in and instructions to read?

First the 1040 is an exercise in sets:Gross Income - A collection and summation of all your income types.Adjustments - A collection of deductions the tax law allow you to deduct before signNowing AGI. (AGI is used as a threshold for another set of deductions).ExemptionsDeductions - A collection of allowed deductions.Taxes - A Collection of Different collected along with Income TaxesCredits - A collection of allowed reductions in tax owed.Net Tax Owed or Refundable - Hopefully Self Explanatory.Now the formulas:[math]Gross Income - Adjustments = Adjusted Gross Income (AGI)[/math][math]AGI - Exemptions - Deductions = Taxable Income[/math][math]Tax Function (Taxable Income ) = Income Tax[/math][math]Taxes - Credits = Net Tax Owed or Refundable[/math]Please Note each set of lines is meant as a means to make collecting and summing the subsidiary information easier.It would probably be much easier to figure out if everyone wanted to pay more taxes instead of less.

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

Create this form in 5 minutes!

How to create an eSignature for the form 1040 tax 2017 2018

How to create an electronic signature for your Form 1040 Tax 2017 2018 in the online mode

How to generate an eSignature for your Form 1040 Tax 2017 2018 in Chrome

How to create an electronic signature for signing the Form 1040 Tax 2017 2018 in Gmail

How to generate an eSignature for the Form 1040 Tax 2017 2018 from your smartphone

How to make an electronic signature for the Form 1040 Tax 2017 2018 on iOS

How to generate an eSignature for the Form 1040 Tax 2017 2018 on Android devices

People also ask

-

What is the 1040 Tax Table and how does it relate to airSlate SignNow?

The 1040 Tax Table is a resource that helps individuals determine their tax obligations based on their income level. At airSlate SignNow, we provide a seamless way to manage and eSign tax-related documents, including those that reference the 1040 Tax Table, ensuring you stay compliant and organized.

-

How can airSlate SignNow assist me with my 1040 Tax Table calculations?

While airSlate SignNow does not calculate taxes, it allows you to easily create, send, and eSign tax documents that include the 1040 Tax Table. This means you can quickly prepare your forms and ensure all necessary information is included, streamlining your tax filing process.

-

Is airSlate SignNow a cost-effective solution for managing 1040 Tax Table documents?

Yes, airSlate SignNow offers a cost-effective solution for managing all your tax documents, including those that utilize the 1040 Tax Table. With flexible pricing plans, you can choose a package that fits your needs and budget, making it easier to handle your tax documentation efficiently.

-

What features does airSlate SignNow offer for 1040 Tax Table eSigning?

airSlate SignNow includes features specifically designed for eSigning tax documents, such as customizable templates, secure storage, and real-time tracking. These features make it easy to manage the signing process for documents that reference the 1040 Tax Table, saving you time and reducing errors.

-

Can I integrate airSlate SignNow with other software for 1040 Tax Table document management?

Absolutely! airSlate SignNow offers integrations with various software solutions that can help you manage your 1040 Tax Table documents more effectively. This includes accounting software and document management systems, streamlining your workflow and enhancing your productivity.

-

What are the benefits of using airSlate SignNow for my 1040 Tax Table forms?

Using airSlate SignNow for your 1040 Tax Table forms offers several benefits, including increased efficiency, reduced paperwork, and enhanced security for sensitive information. With easy eSignature capabilities, you can expedite the signing process and ensure that your tax documents are always compliant.

-

Is there a mobile app for airSlate SignNow to manage 1040 Tax Table documents on the go?

Yes, airSlate SignNow offers a mobile app that allows you to manage your 1040 Tax Table documents from anywhere. This means you can easily send, sign, and track your tax forms even when you're away from your desk, ensuring you stay on top of your tax obligations.

Get more for 1040 Tax Table

Find out other 1040 Tax Table

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim