1040 Tax Table 2017

What is the 1040 Tax Table

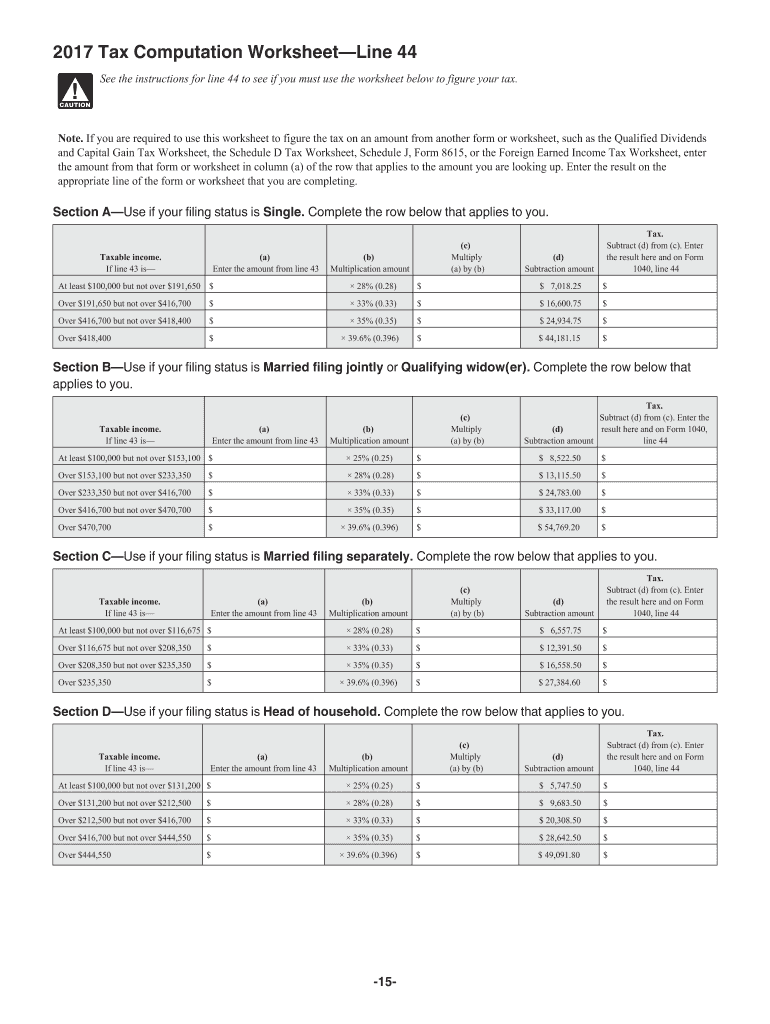

The 1040 Tax Table is a crucial resource used by taxpayers in the United States to determine their federal income tax liability based on taxable income. This table outlines the tax rates applicable to various income brackets, allowing individuals to calculate the amount of tax owed. The 1040 Tax Table is typically included in the IRS Form 1040 instructions, which provides guidance on how to use it effectively. Understanding this table is essential for accurate tax filing and compliance with IRS regulations.

How to use the 1040 Tax Table

To use the 1040 Tax Table, first locate your filing status, which can be single, married filing jointly, married filing separately, or head of household. Next, find your taxable income within the appropriate section of the table. The corresponding tax amount will be listed next to your income level. If your income falls between two amounts, you will need to calculate your tax based on the applicable rates for your specific income level. This process ensures that you are accurately reporting your tax obligations to the IRS.

Steps to complete the 1040 Tax Table

Completing the 1040 Tax Table involves several key steps:

- Gather your financial documents, including W-2s and 1099s, to determine your total income.

- Calculate your adjusted gross income (AGI) by subtracting any deductions from your total income.

- Determine your taxable income by subtracting standard or itemized deductions from your AGI.

- Refer to the 1040 Tax Table to find the tax amount corresponding to your taxable income.

- Record the calculated tax amount on your Form 1040.

IRS Guidelines

The IRS provides specific guidelines for using the 1040 Tax Table effectively. It is important to ensure that you are referencing the correct tax year’s table, as tax rates and brackets can change annually. Additionally, the IRS offers detailed instructions on how to fill out Form 1040, including information on various credits and deductions that may apply to your situation. Staying informed about these guidelines helps taxpayers avoid errors and ensures compliance with federal tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the 1040 Tax Table are critical for taxpayers to keep in mind. Typically, the deadline for filing individual tax returns is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions available, which may allow for additional time to file but not to pay any taxes owed. Staying aware of these important dates helps avoid penalties and interest on late payments.

Required Documents

To accurately complete the 1040 Tax Table, certain documents are essential. These include:

- W-2 forms from employers, detailing wages and withheld taxes.

- 1099 forms for any additional income, such as freelance work or interest earned.

- Documentation for deductions, such as mortgage interest statements or medical expenses.

- Any other relevant financial records that support your income and deductions.

Having these documents organized and accessible will streamline the tax preparation process and ensure accurate reporting.

Quick guide on how to complete form 1040 tax 2017 2018

Discover the simplest method to complete and sign your 1040 Tax Table

Are you still spending time creating your official documents on paper instead of completing them online? airSlate SignNow offers a superior approach to fill out and sign your 1040 Tax Table and comparable forms for governmental services. Our intelligent eSignature solution equips you with everything necessary to handle documents swiftly and in accordance with formal standards - comprehensive PDF editing, managing, securing, signing, and sharing tools all available within a user-friendly interface.

There are just a few steps needed to complete and sign your 1040 Tax Table:

- Upload the editable template to the editor using the Get Form button.

- Verify what information you need to include in your 1040 Tax Table.

- Move between the fields using the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to complete the fields with your information.

- Modify the content with Text boxes or Images from the upper toolbar.

- Emphasize what is important or Redact fields that are no longer relevant.

- Click on Sign to generate a legally valid eSignature using your preferred option.

- Add the Date next to your signature and conclude your work with the Done button.

Store your finalized 1040 Tax Table in the Documents section of your profile, download it, or transfer it to your preferred cloud storage. Our service also offers versatile file sharing. There’s no need to print out your documents when you need to submit them to the relevant public office - do it via email, fax, or by requesting USPS “snail mail” delivery from your account. Give it a try today!

Create this form in 5 minutes or less

Find and fill out the correct form 1040 tax 2017 2018

FAQs

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

How do you fill out line 5 on a 1040EZ tax form?

I suspect the question is related to knowing whether someone can claim you as a dependent, because otherwise line 5 itself is pretty clear.General answer: if you are under 19, or a full-time student under the age of 24, your parents can probably claim you as a dependent. If you are living with someone to whom you are not married and who is providing you with more than half of your support, that person can probably claim you as a dependent. If you are married and filing jointly, your spouse needs to answer the same questions.Note that whether those individuals actually do claim you as a dependent doesn't matter; the question is whether they can. It is not a choice.

-

How can I fill up my own 1040 tax forms?

The 1040 Instructions will provide step-by-step instructions on how to prepare the 1040. IRS Publication 17 is also an important resource to use while preparing your 1040 return. You can prepare it online through the IRS website or through a software program. You can also prepare it by hand and mail it in, or you can see a professional tax preparer to assist you with preparing and filing your return.

-

How do I fill out the NTSE form 2017- 2018 Jharkhand online?

You cannot gove NTSE online or at your own level you have to belong to a school which is conducting ntse. Then download the form online from the page of ntse, fill it and submit it to your school along with fee. If your school is not conducting ntse, sorry to say but you cannot give ntse. It can only be given through, no institutions are allowed to conduct thos exam.

-

How do I understand the 1040 U.S. tax form in terms of an equation instead of a ton of boxes to fill in and instructions to read?

First the 1040 is an exercise in sets:Gross Income - A collection and summation of all your income types.Adjustments - A collection of deductions the tax law allow you to deduct before signNowing AGI. (AGI is used as a threshold for another set of deductions).ExemptionsDeductions - A collection of allowed deductions.Taxes - A Collection of Different collected along with Income TaxesCredits - A collection of allowed reductions in tax owed.Net Tax Owed or Refundable - Hopefully Self Explanatory.Now the formulas:[math]Gross Income - Adjustments = Adjusted Gross Income (AGI)[/math][math]AGI - Exemptions - Deductions = Taxable Income[/math][math]Tax Function (Taxable Income ) = Income Tax[/math][math]Taxes - Credits = Net Tax Owed or Refundable[/math]Please Note each set of lines is meant as a means to make collecting and summing the subsidiary information easier.It would probably be much easier to figure out if everyone wanted to pay more taxes instead of less.

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

Create this form in 5 minutes!

How to create an eSignature for the form 1040 tax 2017 2018

How to create an electronic signature for your Form 1040 Tax 2017 2018 in the online mode

How to generate an eSignature for your Form 1040 Tax 2017 2018 in Chrome

How to create an electronic signature for signing the Form 1040 Tax 2017 2018 in Gmail

How to generate an eSignature for the Form 1040 Tax 2017 2018 from your smartphone

How to make an electronic signature for the Form 1040 Tax 2017 2018 on iOS

How to generate an eSignature for the Form 1040 Tax 2017 2018 on Android devices

People also ask

-

What features does airSlate SignNow offer for managing the 2013 IRS documents?

airSlate SignNow provides a range of features to help you manage your 2013 IRS documents efficiently. You can easily upload, eSign, and store documents securely in one place. The platform also offers templates specifically designed for IRS forms, making it simple to comply with tax requirements.

-

How does airSlate SignNow ensure the security of 2013 IRS documents?

Security is a priority for airSlate SignNow, especially for sensitive documents like the 2013 IRS forms. The platform uses advanced encryption techniques and secure cloud storage to safeguard your data. Additionally, you can implement customizable access controls to ensure only authorized users can view or modify your IRS documents.

-

Is there a free trial available for airSlate SignNow to handle 2013 IRS eSigning?

Yes, airSlate SignNow offers a free trial that allows you to explore its features for managing 2013 IRS eSigning. This trial is perfect for evaluating the platform's capabilities without commitment. You can send and sign documents, making it easier to decide if it's the right fit for your business needs.

-

What is the pricing structure for airSlate SignNow for 2013 IRS document management?

airSlate SignNow provides flexible pricing plans to accommodate different needs when managing 2013 IRS documents. Plans range from individual to business solutions, ensuring that you only pay for what you use. Each plan includes essential features like unlimited signing and document templates tailored to IRS requirements.

-

Can airSlate SignNow integrate with other tools for processing 2013 IRS documents?

Yes, airSlate SignNow offers seamless integrations with a variety of tools to streamline the processing of 2013 IRS documents. Popular integrations include Google Drive, Dropbox, and CRM systems, which enhance your workflow. This flexibility allows you to manage your document processes more efficiently.

-

What are the benefits of using airSlate SignNow for 2013 IRS forms?

Using airSlate SignNow for your 2013 IRS forms brings signNow benefits, including time savings and improved accuracy. The platform's user-friendly interface simplifies the eSigning process, allowing for quick document turnaround. Additionally, automatic reminders help ensure you never miss a filing deadline.

-

What types of documents can I sign related to the 2013 IRS with airSlate SignNow?

airSlate SignNow allows you to sign various document types related to the 2013 IRS, including tax returns, W-2 forms, and other essential tax documents. With the ability to create and customize templates, you can ensure all necessary information is included. This versatility helps streamline your tax filing process.

Get more for 1040 Tax Table

Find out other 1040 Tax Table

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself