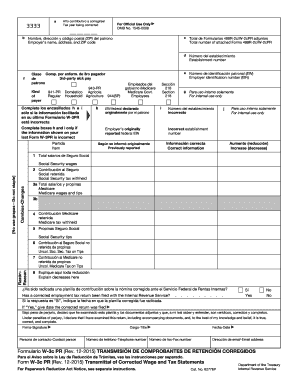

Form W 3c PR Rev December Transmittal of Corrected Wage and Tax Statements Puerto Rican Version 2024

What is the Form W-3c PR Rev December Transmittal Of Corrected Wage And Tax Statements Puerto Rican Version

The Form W-3c PR Rev December is a crucial document used for transmitting corrected wage and tax statements specifically for Puerto Rico. This form is essential for employers who need to rectify errors in previously submitted wage and tax statements, such as Forms W-2c, which report employee wages and withholding. The W-3c PR serves as a summary of the corrected information being submitted to the Internal Revenue Service (IRS) and the Puerto Rico Department of Treasury. It ensures that discrepancies are addressed, maintaining accurate records for both the employer and employee.

How to use the Form W-3c PR Rev December Transmittal Of Corrected Wage And Tax Statements Puerto Rican Version

Using the Form W-3c PR involves several steps to ensure that the corrections are properly reported. First, employers must gather all relevant information from the original wage and tax statements that require correction. Once the necessary data is collected, the employer should fill out the W-3c PR, ensuring that all corrected amounts are accurately reflected. After completing the form, it should be submitted along with the corrected Forms W-2c to the IRS and the Puerto Rico Department of Treasury. This process helps maintain compliance with tax regulations and ensures that employees' tax records are accurate.

Steps to complete the Form W-3c PR Rev December Transmittal Of Corrected Wage And Tax Statements Puerto Rican Version

Completing the Form W-3c PR requires careful attention to detail. Follow these steps:

- Gather all original wage and tax statements that need correction.

- Obtain the Form W-3c PR from the IRS or the Puerto Rico Department of Treasury.

- Fill in the employer's information, including name, address, and Employer Identification Number (EIN).

- Enter the corrected amounts for each employee's wages and withholding as necessary.

- Double-check all entries for accuracy to avoid further discrepancies.

- Sign and date the form to certify that the information is correct.

- Submit the completed W-3c PR along with the corresponding W-2c forms.

Key elements of the Form W-3c PR Rev December Transmittal Of Corrected Wage And Tax Statements Puerto Rican Version

The Form W-3c PR includes several key elements that are essential for accurate reporting. These elements include:

- Employer Information: Name, address, and EIN must be clearly stated.

- Employee Information: Details for each employee whose information is being corrected.

- Corrected Amounts: Accurate figures for wages, tips, and any withheld taxes.

- Certification: The employer's signature and date affirming the correctness of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the Form W-3c PR are crucial to ensure compliance with tax regulations. Generally, corrected forms must be submitted by the end of February following the tax year in which the corrections are being made. It is important for employers to stay informed about any changes to these deadlines, as timely submission helps avoid penalties and ensures that employees' tax records are updated accurately.

Penalties for Non-Compliance

Failure to submit the Form W-3c PR or to correct wage and tax statement errors can result in significant penalties. The IRS may impose fines for late submissions, and employers may also face additional charges for inaccuracies in reporting. It is essential for employers to ensure that all corrections are made promptly and accurately to avoid these financial repercussions and maintain compliance with tax laws.

Create this form in 5 minutes or less

Find and fill out the correct form w 3c pr rev december transmittal of corrected wage and tax statements puerto rican version

Create this form in 5 minutes!

How to create an eSignature for the form w 3c pr rev december transmittal of corrected wage and tax statements puerto rican version

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form W 3c PR Rev December Transmittal Of Corrected Wage And Tax Statements Puerto Rican Version?

The Form W 3c PR Rev December Transmittal Of Corrected Wage And Tax Statements Puerto Rican Version is a document used to report corrected wage and tax information for employees in Puerto Rico. It is essential for employers to ensure accurate tax reporting and compliance with local regulations.

-

How can airSlate SignNow help with the Form W 3c PR Rev December Transmittal Of Corrected Wage And Tax Statements Puerto Rican Version?

airSlate SignNow provides a streamlined platform for businesses to easily create, send, and eSign the Form W 3c PR Rev December Transmittal Of Corrected Wage And Tax Statements Puerto Rican Version. Our solution simplifies the process, ensuring that all necessary corrections are made efficiently and accurately.

-

What are the pricing options for using airSlate SignNow for the Form W 3c PR Rev December Transmittal Of Corrected Wage And Tax Statements Puerto Rican Version?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. You can choose a plan that fits your needs, whether you require basic features or advanced functionalities for handling the Form W 3c PR Rev December Transmittal Of Corrected Wage And Tax Statements Puerto Rican Version.

-

Are there any features specifically designed for the Form W 3c PR Rev December Transmittal Of Corrected Wage And Tax Statements Puerto Rican Version?

Yes, airSlate SignNow includes features tailored for the Form W 3c PR Rev December Transmittal Of Corrected Wage And Tax Statements Puerto Rican Version, such as customizable templates, automated workflows, and secure eSigning. These features enhance accuracy and efficiency in managing tax documents.

-

What benefits does airSlate SignNow provide for managing the Form W 3c PR Rev December Transmittal Of Corrected Wage And Tax Statements Puerto Rican Version?

Using airSlate SignNow for the Form W 3c PR Rev December Transmittal Of Corrected Wage And Tax Statements Puerto Rican Version offers numerous benefits, including time savings, reduced errors, and improved compliance. Our platform ensures that your documents are processed quickly and securely.

-

Can airSlate SignNow integrate with other software for handling the Form W 3c PR Rev December Transmittal Of Corrected Wage And Tax Statements Puerto Rican Version?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and HR software, making it easier to manage the Form W 3c PR Rev December Transmittal Of Corrected Wage And Tax Statements Puerto Rican Version alongside your existing systems. This integration enhances workflow efficiency and data accuracy.

-

Is airSlate SignNow secure for handling sensitive documents like the Form W 3c PR Rev December Transmittal Of Corrected Wage And Tax Statements Puerto Rican Version?

Yes, airSlate SignNow prioritizes security and compliance. We use advanced encryption and security protocols to protect sensitive documents, including the Form W 3c PR Rev December Transmittal Of Corrected Wage And Tax Statements Puerto Rican Version, ensuring that your data remains confidential and secure.

Get more for Form W 3c PR Rev December Transmittal Of Corrected Wage And Tax Statements Puerto Rican Version

- Petition for exception form california state university bakersfield csub

- Risk assessment for eyewash station form

- Change uaf form

- Georgia health form 3231

- Annual tuberculosis questionnaire form

- Perceived stress scale form

- B 1c clinical notes mini mental status exam 1 what is med illinois form

- Toledo hospital doctors note form

Find out other Form W 3c PR Rev December Transmittal Of Corrected Wage And Tax Statements Puerto Rican Version

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online