T4 Statement of Remuneration Paid Slip Canada Ca Form

Understanding the T4 Statement of Remuneration Paid

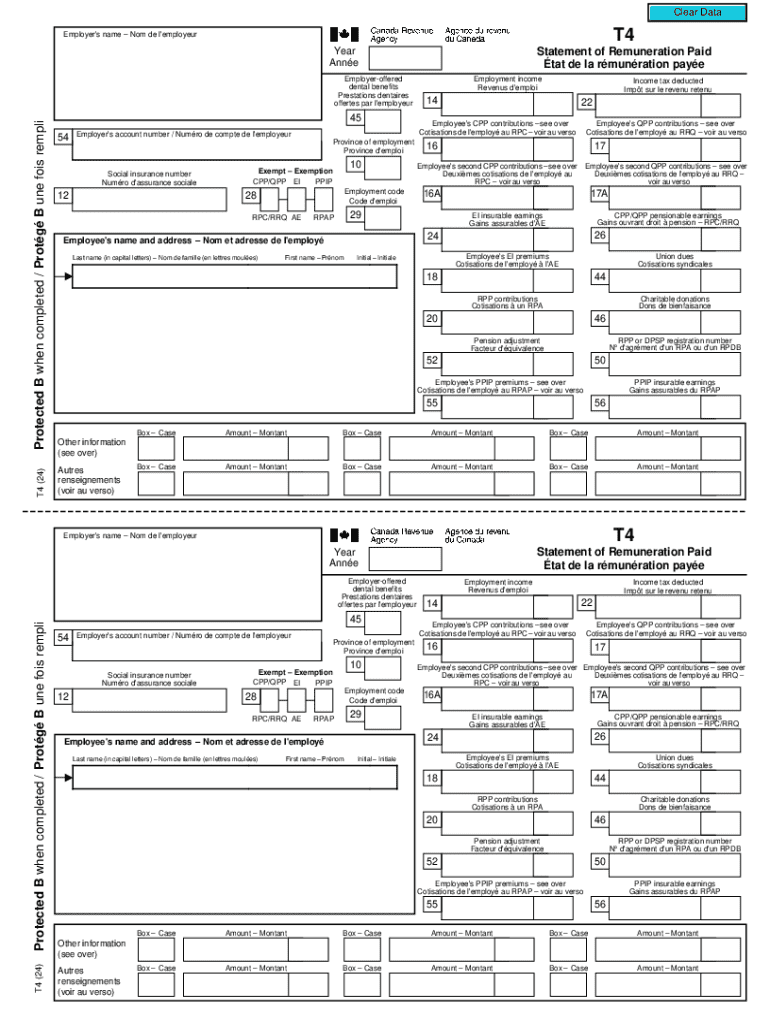

The T4 Statement of Remuneration Paid is an essential document used in Canada for reporting employment income. It summarizes the total earnings of an employee, including wages, bonuses, and other forms of compensation received during the tax year. This form is crucial for both employers and employees, as it ensures accurate tax reporting and compliance with Canadian tax laws.

The T4 form is issued by employers to their employees and is required to be filed with the Canada Revenue Agency (CRA). It serves as a record of the remuneration paid and the taxes withheld, making it easier for employees to complete their income tax returns. Understanding the details included in the T4 form is vital for ensuring that all income is reported accurately.

How to Complete the T4 Statement of Remuneration Paid

Completing the T4 Statement of Remuneration Paid involves several key steps. First, gather all necessary information, including the employee's name, address, and Social Insurance Number (SIN). Next, calculate the total earnings for the year, which may include regular wages, overtime, and bonuses.

It's important to accurately report any deductions, such as income tax, Canada Pension Plan (CPP) contributions, and Employment Insurance (EI) premiums. Each of these amounts should be clearly outlined in the appropriate boxes on the form. Once all information is compiled, review it for accuracy before submitting it to the CRA.

Key Elements of the T4 Statement of Remuneration Paid

The T4 form contains several critical components that must be filled out correctly. Key elements include:

- Employee Information: Name, address, and SIN.

- Employer Information: Name, address, and business number.

- Total Remuneration: Total income earned during the tax year.

- Deductions: Amounts withheld for taxes, CPP, and EI.

- Taxable Benefits: Any additional benefits provided to the employee.

Each of these elements plays a significant role in ensuring the accuracy of the information reported to the CRA and helps employees in their tax filing process.

Obtaining the T4 Statement of Remuneration Paid

Employers are responsible for issuing the T4 Statement of Remuneration Paid to their employees. Typically, this form is provided to employees by the end of February each year for the previous tax year. Employers can generate the T4 forms using accounting software or by accessing templates available through the CRA.

Employees can also request a copy of their T4 from their employer if they do not receive it by the deadline. It is essential to keep this document safe, as it is required for filing personal income tax returns.

Legal Use of the T4 Statement of Remuneration Paid

The T4 Statement of Remuneration Paid is not only a reporting tool but also a legal document. It must be completed accurately and submitted to the CRA as part of an employer's legal obligations. Failure to issue T4 forms on time or providing incorrect information can lead to penalties for employers.

Employees rely on the accuracy of the T4 form when filing their taxes. Therefore, it is crucial for both parties to understand their responsibilities regarding this document to avoid any legal complications.

Examples of Using the T4 Statement of Remuneration Paid

There are various scenarios where the T4 Statement of Remuneration Paid is utilized. For instance, when employees file their annual tax returns, they reference the information provided on their T4 to report their income accurately. Additionally, self-employed individuals may need to compare their T4 information against other income sources to ensure complete reporting.

Employers may also use the T4 form to verify employee income when assessing loan applications or during background checks. The T4 serves as a reliable source of income verification for various financial and legal purposes.

Handy tips for filling out T4 Statement Of Remuneration Paid slip Canada ca online

Quick steps to complete and e-sign T4 Statement Of Remuneration Paid slip Canada ca online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms can be. Get access to a HIPAA and GDPR compliant platform for optimum simpleness. Use signNow to electronically sign and send T4 Statement Of Remuneration Paid slip Canada ca for e-signing.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the t4 statement of remuneration paid slip canada ca

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are t4 fillable forms and how can they benefit my business?

T4 fillable forms are electronic documents that allow users to input data directly into designated fields. By using airSlate SignNow, businesses can streamline their processes, reduce paperwork, and ensure accuracy in tax reporting. This efficiency can lead to signNow time savings and improved compliance.

-

How does airSlate SignNow support t4 fillable forms?

airSlate SignNow provides a user-friendly platform for creating, sending, and signing t4 fillable forms. With customizable templates and easy integration options, businesses can manage their forms seamlessly. This ensures that all necessary information is captured accurately and securely.

-

Are there any costs associated with using t4 fillable forms on airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan includes access to t4 fillable forms along with other features like eSigning and document management. You can choose a plan that fits your budget and requirements.

-

Can I integrate t4 fillable forms with other software using airSlate SignNow?

Absolutely! airSlate SignNow supports integrations with various software applications, allowing you to connect your t4 fillable forms with tools you already use. This integration enhances workflow efficiency and ensures that all your data is synchronized across platforms.

-

What features does airSlate SignNow offer for managing t4 fillable forms?

airSlate SignNow offers a range of features for managing t4 fillable forms, including customizable templates, automated workflows, and secure eSigning. These features help businesses streamline their document processes and improve overall productivity. Additionally, you can track the status of your forms in real-time.

-

Is it easy to create t4 fillable forms with airSlate SignNow?

Yes, creating t4 fillable forms with airSlate SignNow is straightforward and user-friendly. The platform provides intuitive tools that allow you to design forms quickly without any technical expertise. This ease of use ensures that you can focus on your business rather than getting bogged down by form creation.

-

What security measures does airSlate SignNow have for t4 fillable forms?

airSlate SignNow prioritizes security for all documents, including t4 fillable forms. The platform employs advanced encryption and secure access controls to protect sensitive information. This commitment to security helps businesses maintain compliance and safeguard their data.

Get more for T4 Statement Of Remuneration Paid slip Canada ca

Find out other T4 Statement Of Remuneration Paid slip Canada ca

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word