Form 6100

What is the Form 6100

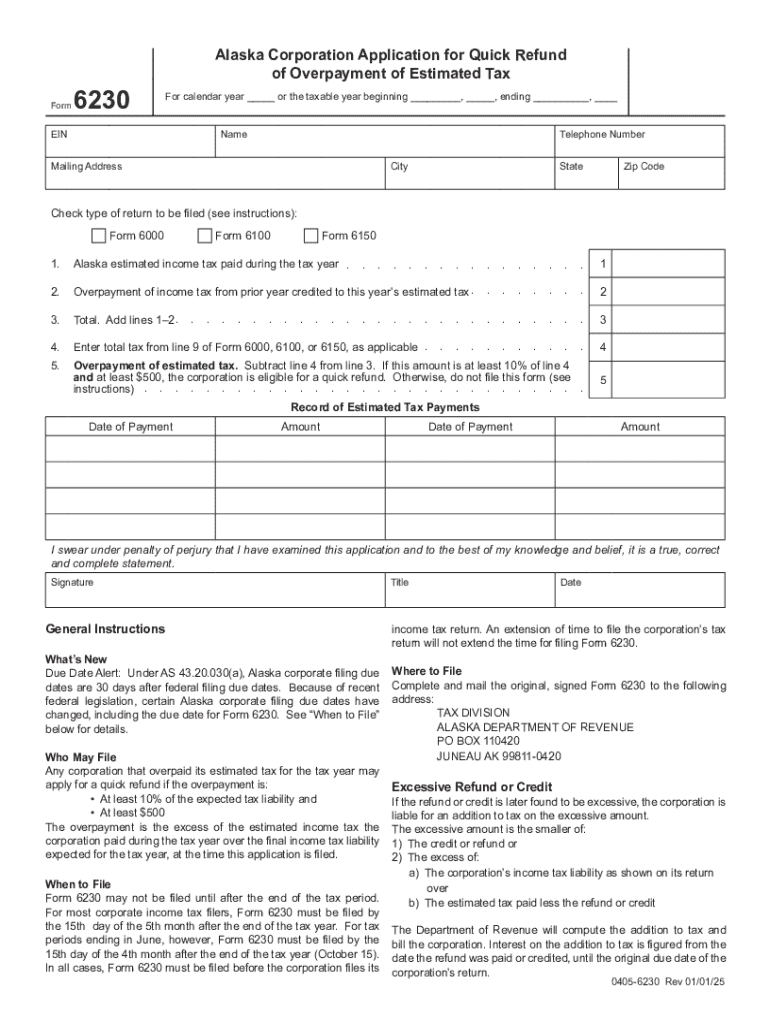

The Form 6100 is a document used primarily for tax purposes in the United States. It is often associated with specific reporting requirements that individuals or businesses must fulfill. This form is essential for ensuring compliance with federal regulations, and it helps the Internal Revenue Service (IRS) track certain financial activities. Understanding the purpose of Form 6100 is crucial for anyone required to submit it, as it plays a significant role in the overall tax process.

How to use the Form 6100

Using the Form 6100 involves several key steps. First, gather all necessary information and documentation related to the financial activities you need to report. This may include income statements, receipts, and any other relevant financial records. Next, carefully fill out the form, ensuring that all sections are completed accurately. It is important to follow the instructions provided with the form to avoid any errors that could lead to delays or penalties. After completing the form, review it for accuracy before submitting it to the appropriate IRS office.

Steps to complete the Form 6100

Completing the Form 6100 requires a systematic approach to ensure accuracy and compliance. Begin by obtaining the latest version of the form from the IRS website or other official sources. Next, follow these steps:

- Gather all necessary financial documents and information.

- Carefully read the instructions provided with the form.

- Fill out each section of the form, providing accurate and complete information.

- Double-check your entries for any mistakes or omissions.

- Sign and date the form as required.

- Submit the form via the appropriate method, whether online, by mail, or in person.

Legal use of the Form 6100

The legal use of Form 6100 is governed by IRS regulations. It is essential for individuals and businesses to understand the legal implications of submitting this form. Failure to comply with the reporting requirements can result in penalties, including fines or additional scrutiny from the IRS. It is advisable to consult with a tax professional if there are any uncertainties regarding the legal aspects of using this form.

Filing Deadlines / Important Dates

Filing deadlines for Form 6100 can vary based on the specific circumstances of the filer. Generally, it is important to submit the form by the due date to avoid penalties. The IRS typically provides specific dates for filing, which can be found in their official guidelines. Staying informed about these deadlines is crucial for maintaining compliance and avoiding unnecessary complications.

Required Documents

To complete the Form 6100, certain documents are typically required. These may include:

- Income statements or pay stubs.

- Receipts for expenses related to the reported income.

- Any previous tax returns that may be relevant.

- Identification documents, if necessary.

Having these documents ready will streamline the process of completing the form and ensure that all necessary information is accurately reported.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 6100

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 6100 and how can airSlate SignNow help with it?

Form 6100 is a specific document used for various administrative purposes. airSlate SignNow simplifies the process of completing and signing Form 6100 by providing an intuitive platform that allows users to fill out, eSign, and send the document securely.

-

Is there a cost associated with using airSlate SignNow for Form 6100?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost-effective solution ensures that you can manage Form 6100 efficiently without breaking the bank, making it accessible for businesses of all sizes.

-

What features does airSlate SignNow offer for managing Form 6100?

airSlate SignNow provides features such as customizable templates, real-time tracking, and secure cloud storage for Form 6100. These features enhance the user experience by streamlining the signing process and ensuring that documents are easily accessible.

-

Can I integrate airSlate SignNow with other applications for Form 6100?

Absolutely! airSlate SignNow offers seamless integrations with various applications, allowing you to manage Form 6100 alongside your existing tools. This integration capability enhances workflow efficiency and ensures that your document management is cohesive.

-

What are the benefits of using airSlate SignNow for Form 6100?

Using airSlate SignNow for Form 6100 provides numerous benefits, including increased efficiency, reduced turnaround time, and enhanced security. The platform's user-friendly interface makes it easy for anyone to complete and sign the document quickly.

-

Is airSlate SignNow compliant with legal standards for Form 6100?

Yes, airSlate SignNow is compliant with legal standards for electronic signatures, ensuring that your Form 6100 is legally binding. This compliance gives users peace of mind when sending and signing important documents.

-

How can I get started with airSlate SignNow for Form 6100?

Getting started with airSlate SignNow for Form 6100 is simple. You can sign up for a free trial on their website, explore the features, and begin creating and managing your Form 6100 documents right away.

Get more for Form 6100

Find out other Form 6100

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors