PIT RES Form

What is the PIT RES

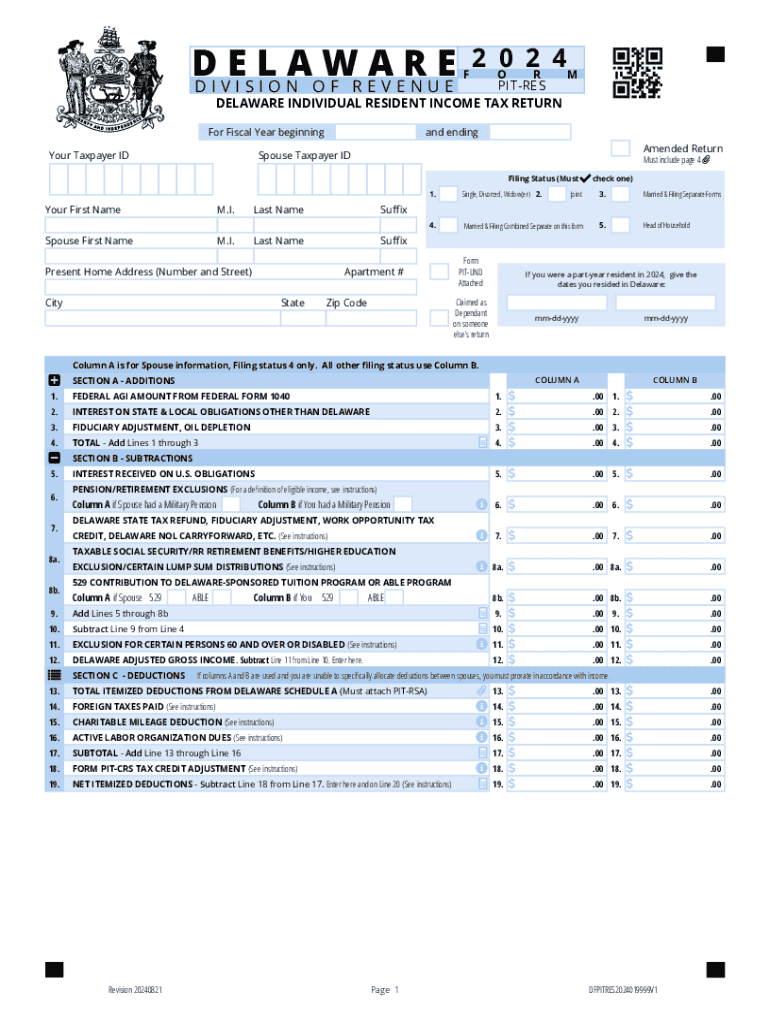

The PIT RES, or Personal Income Tax Resolution, is a form used by individuals in the United States to address specific issues related to their personal income tax obligations. This form is particularly relevant for taxpayers who may need to clarify their tax status, resolve discrepancies, or seek relief from certain tax liabilities. Understanding the purpose and function of the PIT RES is essential for ensuring compliance with tax regulations and for effectively managing one’s financial responsibilities.

How to use the PIT RES

Using the PIT RES involves several straightforward steps. First, individuals must gather all relevant financial documents, including income statements and previous tax returns. Next, they should accurately fill out the form, ensuring that all information is complete and truthful. After completing the form, it can be submitted either online or through traditional mail, depending on the specific requirements outlined by the IRS. It is crucial to keep a copy of the submitted form for personal records and future reference.

Steps to complete the PIT RES

Completing the PIT RES requires careful attention to detail. Here are the steps involved:

- Collect necessary documents, such as W-2s, 1099s, and any prior correspondence with the IRS.

- Fill out the PIT RES form, ensuring all fields are completed accurately.

- Review the form for any errors or omissions before submission.

- Submit the form through the appropriate channel, either online or by mail.

- Retain a copy of the submitted form and any confirmation received from the IRS.

Legal use of the PIT RES

The PIT RES is a legally recognized document that serves specific functions within the U.S. tax system. It is essential for taxpayers to use this form in accordance with IRS guidelines to avoid potential legal issues. Proper use of the PIT RES can help individuals resolve tax disputes, clarify their tax status, or seek relief from penalties. Understanding the legal implications of this form is vital for maintaining compliance with federal tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the PIT RES can vary based on individual circumstances. Generally, it is advisable to submit the form as soon as a tax issue arises to avoid penalties and interest. Taxpayers should be aware of specific dates related to their tax filings and ensure that the PIT RES is submitted within the appropriate timeframes. Keeping track of these deadlines is crucial for effective tax management.

Required Documents

To successfully complete the PIT RES, certain documents are required. These typically include:

- Proof of income, such as W-2 forms or 1099 statements.

- Previous tax returns for the last few years.

- Any correspondence received from the IRS regarding tax issues.

- Documentation supporting claims made on the PIT RES.

Having these documents readily available can streamline the process and ensure that the form is completed accurately.

Who Issues the Form

The PIT RES is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and enforcement in the United States. The IRS provides guidelines and resources to help taxpayers understand how to properly fill out and submit this form. It is important for individuals to refer to the IRS website or official publications for the most current information regarding the PIT RES.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pit res

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is PIT RES and how does it benefit my business?

PIT RES is a powerful tool within airSlate SignNow that streamlines the process of sending and eSigning documents. By utilizing PIT RES, businesses can enhance their workflow efficiency, reduce turnaround times, and ensure secure document handling. This feature is designed to simplify the signing process, making it accessible for all users.

-

How much does airSlate SignNow with PIT RES cost?

The pricing for airSlate SignNow with PIT RES is competitive and designed to fit various business needs. We offer flexible subscription plans that cater to different team sizes and usage levels. For detailed pricing information, you can visit our pricing page or contact our sales team for a personalized quote.

-

What features are included in the PIT RES solution?

PIT RES includes a range of features such as customizable templates, real-time tracking, and secure cloud storage. Additionally, it supports multiple file formats and integrates seamlessly with other applications. These features are designed to enhance user experience and improve document management.

-

Can PIT RES integrate with other software tools?

Yes, PIT RES is designed to integrate with various software tools, enhancing its functionality. Whether you use CRM systems, project management tools, or cloud storage solutions, airSlate SignNow can connect with them to streamline your workflow. This integration capability ensures that your document processes are efficient and cohesive.

-

Is PIT RES secure for sensitive documents?

Absolutely, PIT RES prioritizes security and compliance, ensuring that your sensitive documents are protected. We utilize advanced encryption methods and adhere to industry standards to safeguard your data. With PIT RES, you can confidently manage and eSign documents without compromising security.

-

How does PIT RES improve the document signing process?

PIT RES simplifies the document signing process by allowing users to eSign documents quickly and efficiently. With features like automated reminders and easy access to documents, PIT RES reduces delays and enhances productivity. This streamlined approach ensures that your business can operate smoothly and effectively.

-

What types of businesses can benefit from PIT RES?

PIT RES is versatile and can benefit a wide range of businesses, from small startups to large enterprises. Any organization that requires efficient document management and eSigning can leverage PIT RES to improve their operations. Its user-friendly interface makes it accessible for teams of all sizes.

Get more for PIT RES

- Forms ampampamp applicationsofi dhhs maine

- Individual identification card application instructions form

- Foc 13a complaint and notice for health care expense payment form

- Office of the registrar division of student affairs personal form

- Radon disclosure form

- Msba real property forms

- How to file a complaint with the missouri department of form

- Initial dental credentialing application sanford health plan form

Find out other PIT RES

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form