DR 350900 R 0125 Insurance Premium Tax Info 2024-2026

What is the DR 350900 R 0125 Insurance Premium Tax Info

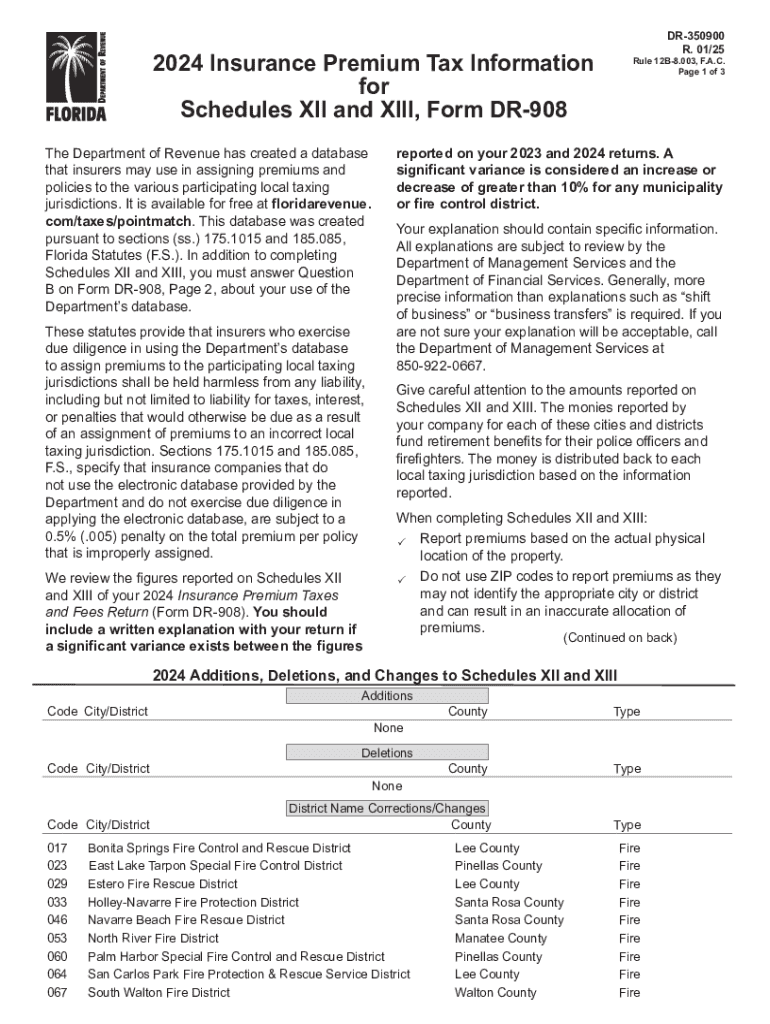

The DR 350900 R 0125 Insurance Premium Tax Info is a specific form used to report and remit insurance premium taxes in the United States. This form is essential for insurance companies and agents to ensure compliance with state tax regulations. It provides the necessary details about the premiums collected, the types of insurance policies issued, and the corresponding tax amounts owed to state authorities. Understanding this form is crucial for maintaining proper tax records and avoiding penalties.

How to use the DR 350900 R 0125 Insurance Premium Tax Info

To effectively use the DR 350900 R 0125 Insurance Premium Tax Info, one must first gather all relevant data regarding the insurance premiums collected during the reporting period. This includes details about the types of insurance sold, the total premiums, and any applicable exemptions. Once the data is compiled, it should be accurately entered into the form. After completing the form, it must be submitted to the appropriate state tax authority, either electronically or by mail, depending on state regulations.

Steps to complete the DR 350900 R 0125 Insurance Premium Tax Info

Completing the DR 350900 R 0125 Insurance Premium Tax Info involves several key steps:

- Gather all necessary documentation related to insurance premiums.

- Fill out the form with accurate information, ensuring all fields are completed.

- Calculate the total tax owed based on the premiums reported.

- Review the form for accuracy before submission.

- Submit the form to the relevant state tax authority by the specified deadline.

Key elements of the DR 350900 R 0125 Insurance Premium Tax Info

The key elements of the DR 350900 R 0125 Insurance Premium Tax Info include:

- Identification of the insurance provider or agent.

- Details of the premiums collected, categorized by type of insurance.

- Calculation of the total tax due based on the premiums.

- Signature of the authorized representative certifying the accuracy of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the DR 350900 R 0125 Insurance Premium Tax Info vary by state. It is essential to be aware of these deadlines to avoid penalties. Typically, forms must be submitted on a quarterly or annual basis, depending on the volume of premiums collected. Marking these important dates on a calendar can help ensure timely submissions and compliance with state tax laws.

Penalties for Non-Compliance

Failure to file the DR 350900 R 0125 Insurance Premium Tax Info on time can result in significant penalties. These penalties may include fines, interest on unpaid taxes, and potential legal action by state tax authorities. It is crucial for insurance providers to adhere to filing requirements to avoid these consequences and maintain good standing with regulatory bodies.

Create this form in 5 minutes or less

Find and fill out the correct dr 350900 r 0125 insurance premium tax info

Create this form in 5 minutes!

How to create an eSignature for the dr 350900 r 0125 insurance premium tax info

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is DR 350900 R 0125 Insurance Premium Tax Info?

DR 350900 R 0125 Insurance Premium Tax Info refers to specific documentation required for reporting insurance premium taxes. This information is crucial for businesses to ensure compliance with tax regulations. Understanding this info helps streamline the tax filing process and avoid potential penalties.

-

How can airSlate SignNow assist with DR 350900 R 0125 Insurance Premium Tax Info?

airSlate SignNow provides an efficient platform for managing and eSigning documents related to DR 350900 R 0125 Insurance Premium Tax Info. Our solution simplifies the process of collecting necessary signatures and ensures that all documents are securely stored. This helps businesses maintain compliance and manage their tax documentation effectively.

-

What are the pricing options for airSlate SignNow when handling DR 350900 R 0125 Insurance Premium Tax Info?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses dealing with DR 350900 R 0125 Insurance Premium Tax Info. Our plans are designed to be cost-effective, ensuring that you only pay for the features you need. You can choose from various subscription options to find the best fit for your organization.

-

What features does airSlate SignNow offer for managing insurance documents?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure eSigning capabilities specifically for managing insurance documents like DR 350900 R 0125 Insurance Premium Tax Info. These features enhance efficiency and reduce the time spent on document management. Additionally, our platform ensures that all documents are legally binding and compliant.

-

Can airSlate SignNow integrate with other software for handling DR 350900 R 0125 Insurance Premium Tax Info?

Yes, airSlate SignNow seamlessly integrates with various software applications to facilitate the management of DR 350900 R 0125 Insurance Premium Tax Info. This includes popular CRM and accounting systems, allowing for a streamlined workflow. Integrations help ensure that all relevant data is synchronized and accessible across platforms.

-

What are the benefits of using airSlate SignNow for DR 350900 R 0125 Insurance Premium Tax Info?

Using airSlate SignNow for DR 350900 R 0125 Insurance Premium Tax Info offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows for quick document turnaround times, which is essential for timely tax compliance. Additionally, the user-friendly interface makes it easy for teams to collaborate on documents.

-

Is airSlate SignNow secure for handling sensitive tax information?

Absolutely, airSlate SignNow prioritizes security when managing sensitive information like DR 350900 R 0125 Insurance Premium Tax Info. We implement advanced encryption and security protocols to protect your data. Our platform is designed to ensure that all documents are stored securely and accessed only by authorized users.

Get more for DR 350900 R 0125 Insurance Premium Tax Info

- Taxiowagovsitesdefaultia 123 iowa net operating loss nol schedule form

- 4797 form sales of business property omb nocheggcom

- Taxiowagovsitesdefaultia 2848 iowa power of attorney form 14101

- Taxiowagovsitesdefaultia nexus questionnaire state of iowa taxesiowa form

- Iowa sales tax exemption certificatesiowa sales and use tax guideiowa department of revenueiowa sales and use tax guideiowa form

- Cole 2106 form 2106 department of the treasury internal

- 2021 form 1098 e student loan interest statement

- Wwwirsgovpubirs pdf2021 schedule j form 1040 internal revenue service

Find out other DR 350900 R 0125 Insurance Premium Tax Info

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now