Insurance Premium Tax Information 2020

What is the Florida Premium Tax Information?

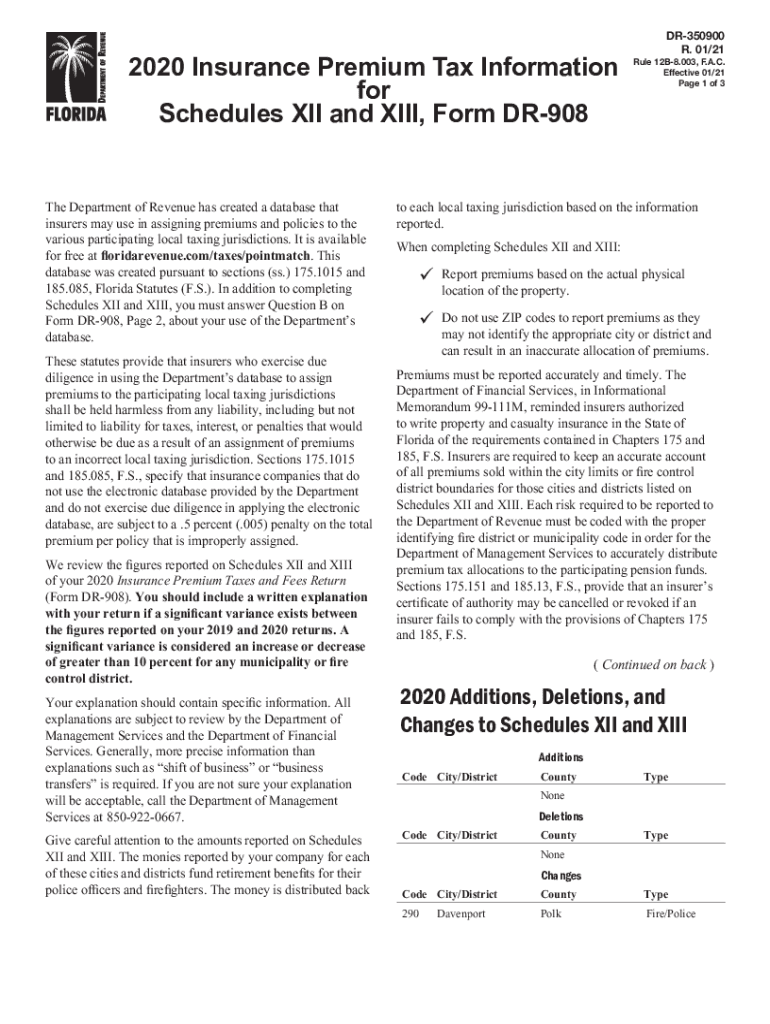

The Florida premium tax form is a document that businesses must complete to report and pay taxes on premiums written for insurance policies. This form is essential for ensuring compliance with state tax regulations. The tax is typically assessed on the gross premiums collected by insurance companies, and the revenue generated contributes to various state funds. Understanding the specifics of this form helps businesses maintain accurate records and adhere to legal obligations.

Steps to Complete the Florida Premium Tax Form

Completing the Florida premium tax form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial records, including premium statements and any relevant documentation. Next, accurately fill out the form, ensuring that all figures reflect the gross premiums collected. After completing the form, review it for any errors or omissions. Finally, submit the form by the specified deadline, either electronically or by mail, as per state guidelines.

Legal Use of the Florida Premium Tax Information

The Florida premium tax information is legally binding when completed and submitted according to state regulations. To ensure its validity, businesses must adhere to the requirements set forth by the Florida Department of Revenue. This includes accurate reporting of premium amounts and timely submission. Utilizing a reliable electronic signature solution can enhance the legal standing of the submitted documents, ensuring they meet compliance standards under laws such as ESIGN and UETA.

Filing Deadlines / Important Dates

Filing deadlines for the Florida premium tax form are critical to avoid penalties. Typically, the form must be submitted annually, with specific due dates established by the Florida Department of Revenue. Businesses should mark their calendars for these deadlines and ensure that all necessary documentation is prepared in advance. Staying informed about any changes in tax laws or deadlines is essential for maintaining compliance.

Required Documents

To complete the Florida premium tax form, several documents are required. These may include premium statements, financial records, and any prior year tax returns. Having these documents organized and readily available can streamline the completion process. Additionally, businesses should ensure that all figures reported are accurate and reflect the total gross premiums collected during the reporting period.

Form Submission Methods

The Florida premium tax form can be submitted through various methods, including online, by mail, or in person. Electronic submission is often preferred for its efficiency and speed. Businesses should follow the specific guidelines provided by the Florida Department of Revenue for each submission method to ensure compliance and avoid delays in processing.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the Florida premium tax form can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal repercussions. It is crucial for businesses to understand these penalties and take proactive steps to ensure timely and accurate filing to avoid any negative consequences.

Quick guide on how to complete 2020 insurance premium tax information

Access Insurance Premium Tax Information effortlessly on any device

Digital document management has become increasingly favored by both businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, alter, and eSign your documents quickly and efficiently. Handle Insurance Premium Tax Information on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Insurance Premium Tax Information with ease

- Obtain Insurance Premium Tax Information and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Insurance Premium Tax Information and guarantee excellent communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 insurance premium tax information

Create this form in 5 minutes!

How to create an eSignature for the 2020 insurance premium tax information

The way to make an electronic signature for a PDF file in the online mode

The way to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature straight from your smartphone

The way to generate an eSignature for a PDF file on iOS devices

How to generate an electronic signature for a PDF document on Android

People also ask

-

What is a Florida premium tax form?

A Florida premium tax form is a document that insurers must file with the Florida Department of Financial Services to report premium taxes owed. This form is essential for compliance with state regulations and ensures that businesses remain in good standing. Understanding how to properly fill out this form is crucial for any insurance provider operating in Florida.

-

How can airSlate SignNow help with the Florida premium tax form?

airSlate SignNow offers an easy-to-use platform to electronically sign and manage your Florida premium tax form. This streamlined process saves time and reduces the likelihood of errors compared to traditional paper methods. By utilizing our solution, businesses can ensure timely submission of their tax forms while enhancing compliance.

-

Is there a cost associated with using airSlate SignNow for the Florida premium tax form?

Yes, airSlate SignNow offers various pricing plans designed to cater to different business needs. These plans provide access to features that streamline the process of signing and managing the Florida premium tax form. The investment is affordable and aligns well with the cost-saving benefits of using our eSignature solution.

-

What features does airSlate SignNow offer for managing the Florida premium tax form?

Key features include customizable templates, secure electronic signatures, and document tracking capabilities. These tools ensure that your Florida premium tax form is completed accurately and submitted promptly. Additionally, our user-friendly interface makes it simple for teams to collaborate on important documents.

-

What are the benefits of using airSlate SignNow for the Florida premium tax form?

Using airSlate SignNow provides signNow benefits, including reduced processing time, enhanced security, and improved document accuracy for your Florida premium tax form. Businesses can easily track their submissions and receive instant notifications, ensuring that deadlines are met. This efficiency allows companies to focus more on their core operations rather than paperwork.

-

Can airSlate SignNow integrate with other software for filing the Florida premium tax form?

Yes, airSlate SignNow supports integration with various third-party applications, enhancing the overall efficiency of filing your Florida premium tax form. This capability allows you to connect with accounting software or other business tools, streamlining your workflow. Integrating systems helps maintain accuracy and saves valuable time during tax season.

-

Is airSlate SignNow secure for handling the Florida premium tax form?

Absolutely! airSlate SignNow prioritizes security, ensuring that all documents, including the Florida premium tax form, are encrypted and stored safely. We comply with industry standards for data protection, giving users peace of mind when handling sensitive information. Your trust in our platform is vital, and we strive to exceed your security expectations.

Get more for Insurance Premium Tax Information

Find out other Insurance Premium Tax Information

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors