Insurance Premium Tax Information 2022

What is the Insurance Premium Tax Information

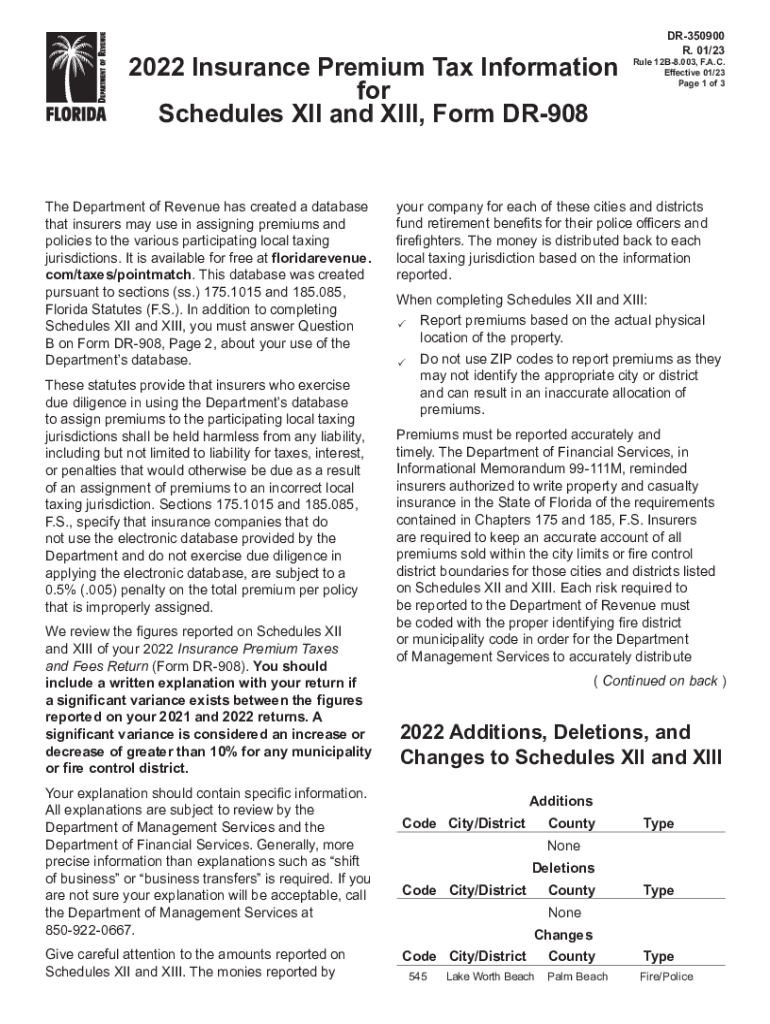

The Insurance Premium Tax Information refers to the details and requirements associated with the Florida premium tax, specifically outlined in the Florida form DR-908. This form is essential for insurance companies operating within the state to report and remit the appropriate taxes on premiums collected. Understanding this tax information is crucial for compliance and financial planning, as it impacts the overall tax obligations of insurance providers.

Steps to complete the Insurance Premium Tax Information

Completing the Florida premium tax form involves several key steps:

- Gather necessary documentation, including records of premiums collected and any applicable deductions.

- Access the Florida form DR-908 online, ensuring you have the latest version to avoid any compliance issues.

- Fill out the form accurately, providing all required information such as policy numbers, premium amounts, and company details.

- Review the completed form for accuracy and completeness before submission.

- Submit the form electronically or via mail, depending on your preference and compliance requirements.

Legal use of the Insurance Premium Tax Information

The legal use of the Insurance Premium Tax Information is governed by state laws and regulations. It is imperative that insurance companies adhere to the guidelines set forth by the Florida Department of Revenue to ensure compliance. This includes accurately reporting premium amounts and remitting the correct tax payments. Failure to comply with these regulations can result in penalties, including fines and interest on unpaid taxes.

Filing Deadlines / Important Dates

Filing deadlines for the Florida premium tax form are critical for compliance. Typically, insurance companies must submit the form DR-908 by a specified date each year, often aligned with the end of the fiscal year. It is important to stay informed about these deadlines to avoid late fees and potential legal issues. Marking these dates on your calendar can help ensure timely submissions.

Required Documents

To complete the Florida premium tax form, certain documents are required. These may include:

- Records of premiums collected during the reporting period.

- Documentation of any deductions or exemptions claimed.

- Company identification details, such as the Florida tax identification number.

- Previous year’s tax filings for reference.

Who Issues the Form

The Florida form DR-908 is issued by the Florida Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among insurance providers. It is essential for businesses to stay updated on any changes to the form or related tax regulations issued by this department.

Quick guide on how to complete 2022 insurance premium tax information

Effortlessly Prepare Insurance Premium Tax Information on Any Device

The management of documents online has become increasingly popular among organizations and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly and efficiently. Handle Insurance Premium Tax Information on any platform using airSlate SignNow's Android or iOS applications and simplify any document-based workflow today.

How to Edit and Electronically Sign Insurance Premium Tax Information with Ease

- Obtain Insurance Premium Tax Information and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your document administration needs in just a few clicks from a device of your choosing. Modify and electronically sign Insurance Premium Tax Information to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 insurance premium tax information

Create this form in 5 minutes!

How to create an eSignature for the 2022 insurance premium tax information

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Florida XIII and how does it relate to airSlate SignNow?

Florida XIII refers to the comprehensive document management solution offered by airSlate SignNow, designed specifically to enhance the eSigning experience. It integrates seamless features that cater to users in Florida and beyond, making it easier to manage documents efficiently.

-

How much does Florida XIII cost with airSlate SignNow?

Pricing for Florida XIII with airSlate SignNow varies based on the plan you choose. We offer different tiers to accommodate all business sizes, ensuring that you get the best value for the features you need, including unlimited eSigning options and document templates.

-

What features does Florida XIII provide?

Florida XIII through airSlate SignNow includes a variety of essential features such as customizable templates, bulk sending, and secure eSignature options. These features are designed to streamline your document workflow and enhance productivity in your business processes.

-

How can Florida XIII benefit my business?

Implementing Florida XIII can signNowly improve your business operations by reducing the time spent on paperwork and enhancing document security. With airSlate SignNow, you can manage and eSign documents quickly, allowing your team to focus on more important tasks.

-

Is Florida XIII compatible with other software?

Yes, Florida XIII is designed to integrate seamlessly with various third-party applications such as CRMs, cloud storage services, and more. This ensures that you can easily incorporate airSlate SignNow into your existing workflows without any disruptions.

-

What security measures does Florida XIII include?

Florida XIII prioritizes security with features like advanced encryption, secure storage, and comprehensive audit trails. airSlate SignNow ensures that all your documents are protected throughout the signing process, so you can have peace of mind when managing sensitive information.

-

Can I try Florida XIII before purchasing?

Absolutely! airSlate SignNow offers a free trial of Florida XIII that allows you to explore all the features and benefits without any commitment. This way, you can assess how it fits your needs before making a final decision.

Get more for Insurance Premium Tax Information

- Notice of intent not to renew at end of specified term from landlord to tenant for nonresidential or commercial property rhode form

- Agreed written termination of lease by landlord and tenant rhode island form

- Notice of breach of written lease for violating specific provisions of lease with right to cure for residential property from 497325168 form

- Rhode island lease 497325169 form

- Rhode island violating form

- Ri provisions form

- Business credit application rhode island form

- Individual credit application rhode island form

Find out other Insurance Premium Tax Information

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free