Please Print Your Numbers Like This in Black or Bl 2024-2026

Understanding the GA 500 Tax Form

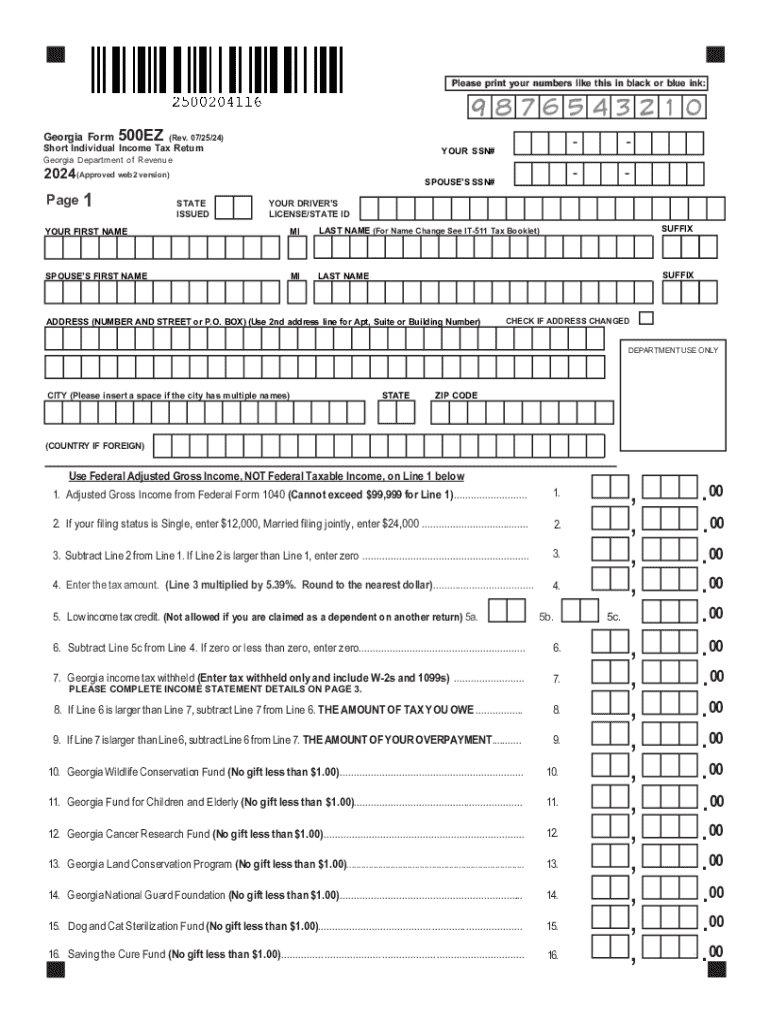

The GA 500 tax form is a crucial document for individuals and businesses in Georgia who are required to report their income and calculate their tax liabilities. This form is primarily used for filing individual income tax returns, allowing taxpayers to report their earnings, claim deductions, and determine their tax obligations. It is essential to understand the specific requirements and components of the GA 500 to ensure accurate filing and compliance with state tax laws.

Key Elements of the GA 500 Tax Form

The GA 500 tax form includes several key sections that taxpayers must complete. These sections typically cover personal information, income details, tax credits, and deductions. Taxpayers need to provide their Social Security number, filing status, and income sources, including wages, self-employment income, and interest. Additionally, the form allows for the inclusion of various deductions, such as standard deductions or itemized deductions, which can significantly affect the final tax calculation.

Steps to Complete the GA 500 Tax Form

Completing the GA 500 tax form involves several steps to ensure accuracy and compliance. First, gather all necessary documents, including W-2s, 1099s, and records of any deductions. Next, fill out the personal information section, followed by reporting all sources of income. After that, calculate any applicable deductions and credits. Finally, review the form for accuracy before submitting it to the Georgia Department of Revenue. It is advisable to keep a copy of the completed form for personal records.

Filing Deadlines for the GA 500 Tax Form

Timely submission of the GA 500 tax form is essential to avoid penalties. The filing deadline for individual income tax returns in Georgia typically aligns with the federal tax deadline, which is usually April 15. If the deadline falls on a weekend or holiday, it may be extended to the next business day. Taxpayers should also be aware of any extensions that may apply, as well as specific deadlines for estimated tax payments if applicable.

Form Submission Methods for the GA 500 Tax Form

Taxpayers have multiple options for submitting the GA 500 tax form. The form can be filed electronically through the Georgia Department of Revenue’s online portal, which is a convenient and efficient method. Alternatively, taxpayers may choose to mail a paper copy of the form to the appropriate state address. In-person submissions are also possible at designated state offices. Regardless of the method chosen, ensuring that the form is submitted by the deadline is crucial for compliance.

Penalties for Non-Compliance with the GA 500 Tax Form

Failure to file the GA 500 tax form on time or inaccuracies in the submitted information can result in penalties. The Georgia Department of Revenue may impose fines for late filings, which can accumulate over time. Additionally, underreporting income or failing to pay the owed taxes can lead to interest charges and further penalties. It is essential for taxpayers to understand these consequences to maintain compliance and avoid unnecessary financial burdens.

Create this form in 5 minutes or less

Find and fill out the correct please print your numbers like this in black or bl 771910761

Create this form in 5 minutes!

How to create an eSignature for the please print your numbers like this in black or bl 771910761

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the GA 500 tax form?

The GA 500 tax form is a state tax form used in Georgia for various tax purposes, including reporting and paying certain taxes. Understanding this form is crucial for businesses and individuals to ensure compliance with state tax regulations.

-

How can airSlate SignNow help with the GA 500 tax form?

airSlate SignNow provides an efficient platform for businesses to electronically sign and send the GA 500 tax form. This streamlines the process, ensuring that your tax documents are completed accurately and submitted on time.

-

Is there a cost associated with using airSlate SignNow for the GA 500 tax form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. These plans provide access to features that simplify the completion and submission of the GA 500 tax form, making it a cost-effective solution.

-

What features does airSlate SignNow offer for managing the GA 500 tax form?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking. These tools enhance the management of the GA 500 tax form, ensuring that users can handle their tax documents efficiently.

-

Can I integrate airSlate SignNow with other software for the GA 500 tax form?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to streamline your workflow when handling the GA 500 tax form. This ensures that your tax processes are seamless and efficient.

-

What are the benefits of using airSlate SignNow for the GA 500 tax form?

Using airSlate SignNow for the GA 500 tax form provides numerous benefits, including time savings, enhanced accuracy, and improved compliance. The platform's user-friendly interface makes it easy for anyone to manage their tax documents effectively.

-

Is airSlate SignNow secure for submitting the GA 500 tax form?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your GA 500 tax form and other documents are protected. The platform uses advanced encryption and security measures to safeguard your sensitive information.

Get more for Please Print Your Numbers Like This In Black Or Bl

- Oxervate patient enrollment form

- Urgent care centermedical aid unit mau ampamp retail clinic application form

- Skin pen consent form

- Client intake application form ballard spahr

- Please save and send this completed application to form

- Medic form

- Medic complaint form

- Investigations medic complaint form

Find out other Please Print Your Numbers Like This In Black Or Bl

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template