State of Oklahoma Application for Property Valuati Form

Understanding the OTC 994 Form

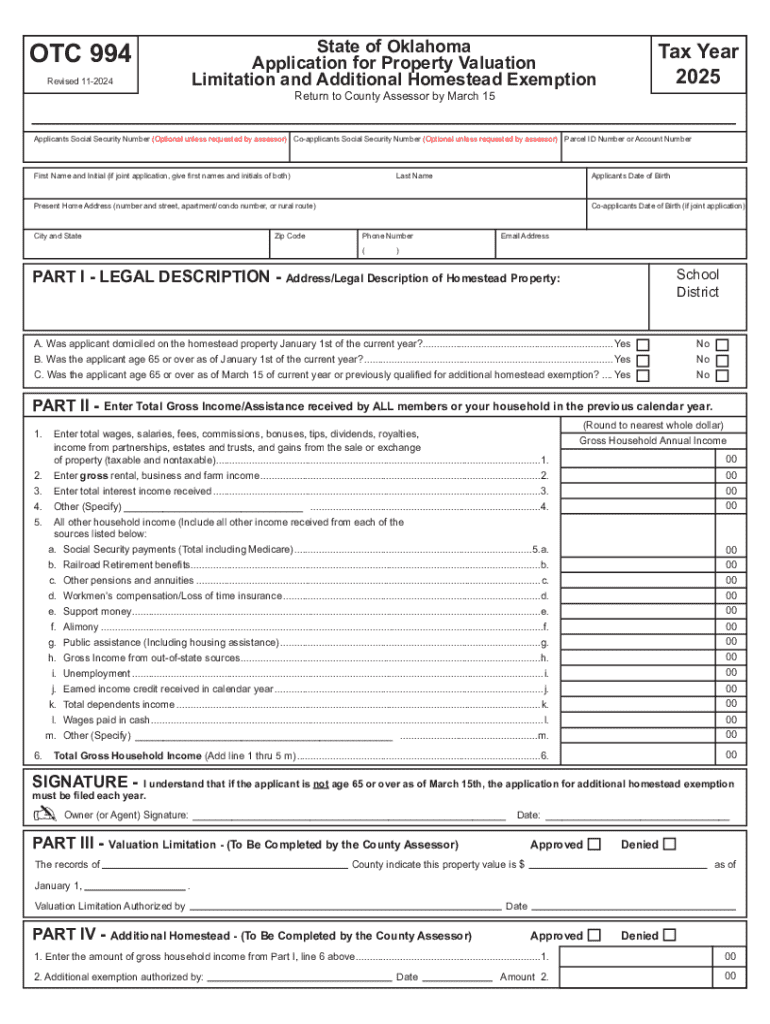

The OTC 994 form, officially known as the State of Oklahoma Application for Property Valuation, is a crucial document for property owners seeking to apply for property valuation adjustments. This form is primarily used to assess the value of properties for tax purposes, ensuring that property taxes are fair and accurate. Understanding the purpose and function of the OTC 994 is essential for property owners in Oklahoma who wish to manage their tax liabilities effectively.

Steps to Complete the OTC 994 Form

Filling out the OTC 994 form involves several key steps to ensure accurate submission:

- Gather Required Information: Collect all necessary documentation, including property details, ownership information, and any previous valuation notices.

- Complete the Form: Fill in the required fields on the OTC 994 form, ensuring that all information is accurate and up-to-date.

- Review Your Submission: Double-check all entries for accuracy. Mistakes can lead to delays or rejections.

- Submit the Form: Choose your preferred submission method, whether online, by mail, or in person.

Legal Use of the OTC 994 Form

The OTC 994 form is legally recognized in Oklahoma for property valuation applications. Proper use of this form ensures compliance with state regulations regarding property taxes. It is essential for property owners to understand their rights and responsibilities when submitting this form to avoid potential legal issues.

Eligibility Criteria for the OTC 994 Form

To qualify for submitting the OTC 994 form, applicants must meet specific eligibility criteria. Generally, property owners must demonstrate ownership of the property in question and provide evidence of its current market value. Additionally, properties must be located within Oklahoma, and applicants should be aware of any local regulations that may apply.

Form Submission Methods

There are several methods available for submitting the OTC 994 form:

- Online Submission: Many applicants prefer to submit the form electronically through the Oklahoma Tax Commission's website.

- Mail Submission: Property owners can also print the completed form and mail it to the appropriate county assessor's office.

- In-Person Submission: For those who prefer face-to-face interactions, submitting the form in person at the local assessor's office is an option.

Key Elements of the OTC 994 Form

The OTC 994 form includes several critical sections that must be completed accurately:

- Property Identification: This section requires details about the property, including its address and parcel number.

- Owner Information: Applicants must provide their name, contact information, and relationship to the property.

- Valuation Information: This section includes questions related to the property's current market value and any relevant appraisal data.

Important Dates and Filing Deadlines

Staying informed about important dates is crucial for successful submission of the OTC 994 form. Typically, property owners should be aware of the filing deadlines set by the Oklahoma Tax Commission, which may vary based on the type of property and local regulations. Missing these deadlines can result in the denial of the application or additional penalties.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the state of oklahoma application for property valuati

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the OTC 994 form and how is it used?

The OTC 994 form is a document used for submitting claims for over-the-counter medications and supplies. It allows individuals to request reimbursement from their health savings accounts or flexible spending accounts. Understanding how to properly fill out the OTC 994 form can streamline the reimbursement process.

-

How can airSlate SignNow help with the OTC 994 form?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending the OTC 994 form. With our solution, you can quickly complete and submit the form without the hassle of printing or scanning. This enhances efficiency and ensures your claims are processed faster.

-

Is there a cost associated with using airSlate SignNow for the OTC 994 form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solution allows you to manage documents like the OTC 994 form efficiently. You can choose a plan that fits your budget while enjoying all the features we offer.

-

What features does airSlate SignNow offer for managing the OTC 994 form?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking for the OTC 994 form. These tools simplify the process of completing and submitting your forms. Additionally, you can collaborate with team members in real-time to ensure accuracy.

-

Can I integrate airSlate SignNow with other software for the OTC 994 form?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enhancing your workflow for the OTC 994 form. Whether you use CRM systems or accounting software, our integrations help streamline the document management process.

-

What are the benefits of using airSlate SignNow for the OTC 994 form?

Using airSlate SignNow for the OTC 994 form offers numerous benefits, including increased efficiency, reduced paperwork, and faster processing times. Our platform ensures that your documents are securely stored and easily accessible. This allows you to focus on your business rather than administrative tasks.

-

Is airSlate SignNow secure for handling the OTC 994 form?

Yes, airSlate SignNow prioritizes security and compliance when handling documents like the OTC 994 form. We utilize advanced encryption and secure storage solutions to protect your sensitive information. You can trust that your data is safe with us.

Get more for State Of Oklahoma Application For Property Valuati

- Disabled persons plates placards form

- Grande vegas form

- Eagle mountain vial of life form form fillablepdf

- Amenity form

- Ignition interlock program non owned vehicle installation approval created 312 washington state patrol impaired driving section form

- Oklahoma insurance department state of oklahoma surplus lines insurance broker form sl3c quarter ampamp ok

- Cleveland clinic discharge papers form

- Charles p allen form

Find out other State Of Oklahoma Application For Property Valuati

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast