PLANILLA INDIVIDUOS FORMA UNICA 16 Nov 16 PLANILLA INDIVIDUOS FORMA UNICA 16 Nov 16

Understanding the Puerto Rico 482 Form

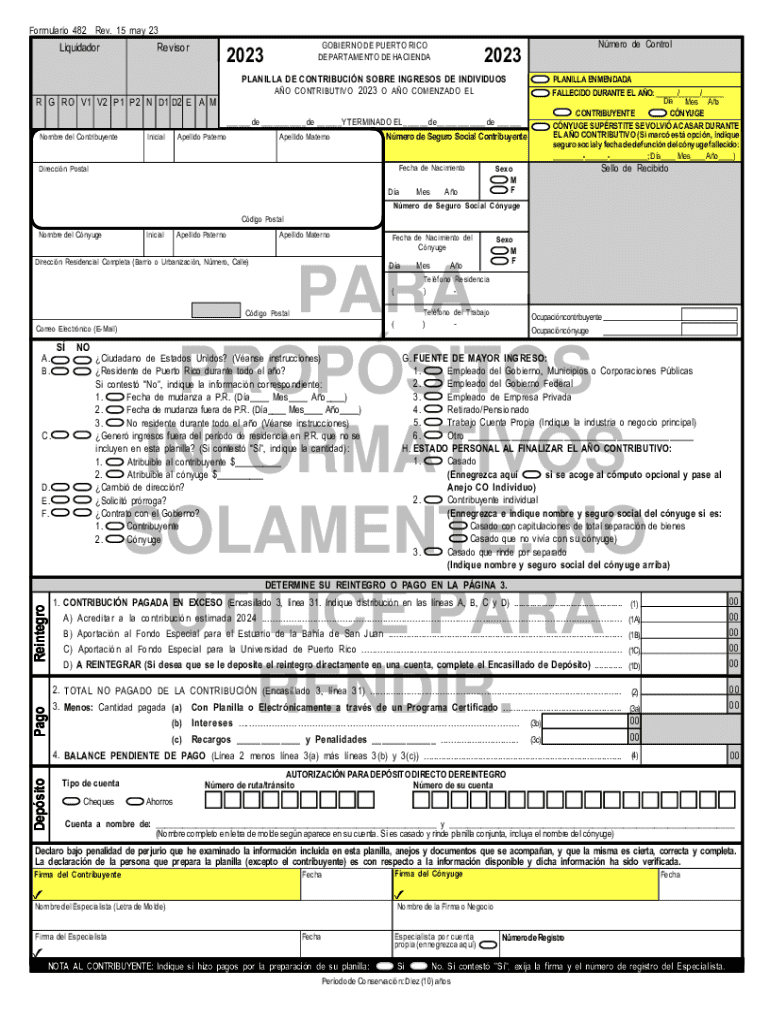

The Puerto Rico 482 form, also known as the Formulario 482 Planilla, is a crucial document for individuals and businesses in Puerto Rico. This form is primarily used for income tax purposes, allowing taxpayers to report their income and calculate their tax liability. It is essential for ensuring compliance with local tax laws and regulations, and it serves as a foundational element of the tax filing process in Puerto Rico.

Steps to Complete the Puerto Rico 482 Form

Completing the Puerto Rico 482 form involves several key steps:

- Gather necessary documentation, including income statements, deductions, and credits.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income accurately, including wages, dividends, and business income.

- Calculate deductions and credits to determine your taxable income.

- Complete the tax calculation section to determine your total tax liability.

- Review the form for accuracy before submission.

Required Documents for the Puerto Rico 482 Form

To successfully complete the Puerto Rico 482 form, you will need to gather specific documents, including:

- W-2 forms from employers

- 1099 forms for other income sources

- Receipts for deductible expenses

- Proof of any tax credits you are claiming

- Previous year’s tax return for reference

Filing Deadlines for the Puerto Rico 482 Form

It is important to be aware of the filing deadlines for the Puerto Rico 482 form. Typically, the deadline aligns with the federal tax filing deadline, which is usually April 15 each year. However, taxpayers should verify any specific dates or extensions that may apply to Puerto Rico residents, as local regulations can differ.

Legal Use of the Puerto Rico 482 Form

The Puerto Rico 482 form has legal significance, as it is a formal declaration of income and tax obligations. Filing this form accurately and on time is essential to avoid penalties and ensure compliance with Puerto Rican tax laws. Failure to submit the form can result in fines, interest on unpaid taxes, and potential legal action by tax authorities.

Examples of Using the Puerto Rico 482 Form

The Puerto Rico 482 form can be utilized in various scenarios, such as:

- Individuals reporting income from employment and investments.

- Self-employed individuals calculating their business income and expenses.

- Retirees declaring pension income and other retirement benefits.

Digital vs. Paper Version of the Puerto Rico 482 Form

Taxpayers have the option to file the Puerto Rico 482 form either digitally or via paper submission. The digital version is often more efficient, allowing for faster processing and easier corrections. However, some individuals may prefer the traditional paper format for various reasons, including familiarity or lack of access to technology. Regardless of the method chosen, it is crucial to ensure that all information is accurate and complete.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the planilla individuos forma unica 16 nov 16 planilla individuos forma unica 16 nov 16

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of puerto rico 482 in document signing?

Puerto rico 482 refers to a specific regulation that governs electronic signatures in Puerto Rico. Understanding this regulation is crucial for businesses operating in the region, as it ensures compliance when using eSignature solutions like airSlate SignNow.

-

How does airSlate SignNow comply with puerto rico 482?

AirSlate SignNow is designed to meet the requirements of puerto rico 482 by providing legally binding electronic signatures. Our platform ensures that all signed documents are secure and compliant with local regulations, giving businesses peace of mind.

-

What are the pricing options for airSlate SignNow in relation to puerto rico 482?

AirSlate SignNow offers flexible pricing plans that cater to businesses of all sizes in Puerto Rico. Our pricing is competitive and designed to provide value while ensuring compliance with puerto rico 482, making it an affordable choice for eSigning needs.

-

What features does airSlate SignNow offer for puerto rico 482 compliance?

AirSlate SignNow includes features such as secure document storage, audit trails, and customizable workflows that align with puerto rico 482. These features help businesses manage their eSigning processes efficiently while adhering to local regulations.

-

Can airSlate SignNow integrate with other tools for puerto rico 482 compliance?

Yes, airSlate SignNow offers integrations with various business tools and applications that can enhance compliance with puerto rico 482. This allows businesses to streamline their workflows and ensure that all documents are signed and stored securely.

-

What are the benefits of using airSlate SignNow for puerto rico 482?

Using airSlate SignNow for puerto rico 482 compliance provides numerous benefits, including increased efficiency, reduced paper usage, and enhanced security. Our platform simplifies the signing process, allowing businesses to focus on their core operations while ensuring compliance.

-

Is airSlate SignNow user-friendly for businesses in Puerto Rico?

Absolutely! AirSlate SignNow is designed with user experience in mind, making it easy for businesses in Puerto Rico to navigate and utilize its features. This user-friendly interface ensures that even those unfamiliar with eSigning can quickly adapt and comply with puerto rico 482.

Get more for PLANILLA INDIVIDUOS FORMA UNICA 16 Nov 16 PLANILLA INDIVIDUOS FORMA UNICA 16 Nov 16

- Fuel supply proposal pdf form

- Peppis hoagie order form bnhipab nhipa

- Employee direct bdeposit authorizationb solex payroll form

- Op msj 201pdf municipio aut nomo de san juan form

- Funeral request form for initial call saintbenedicts

- Quicklet application form

- Hipaa privacy form ste genevieve county memorial hospital stegenevievehospital

- Account application credit form

Find out other PLANILLA INDIVIDUOS FORMA UNICA 16 Nov 16 PLANILLA INDIVIDUOS FORMA UNICA 16 Nov 16

- Can I eSignature West Virginia Affidavit of Domicile

- eSignature Wyoming Affidavit of Domicile Online

- eSign Montana Safety Contract Safe

- How To eSign Arizona Course Evaluation Form

- How To eSign California Course Evaluation Form

- How To eSign Florida Course Evaluation Form

- How To eSign Hawaii Course Evaluation Form

- How To eSign Illinois Course Evaluation Form

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure