Nonresident Claim for Release from Withholding Tax Form

What is the Nonresident Claim For Release From Withholding Tax

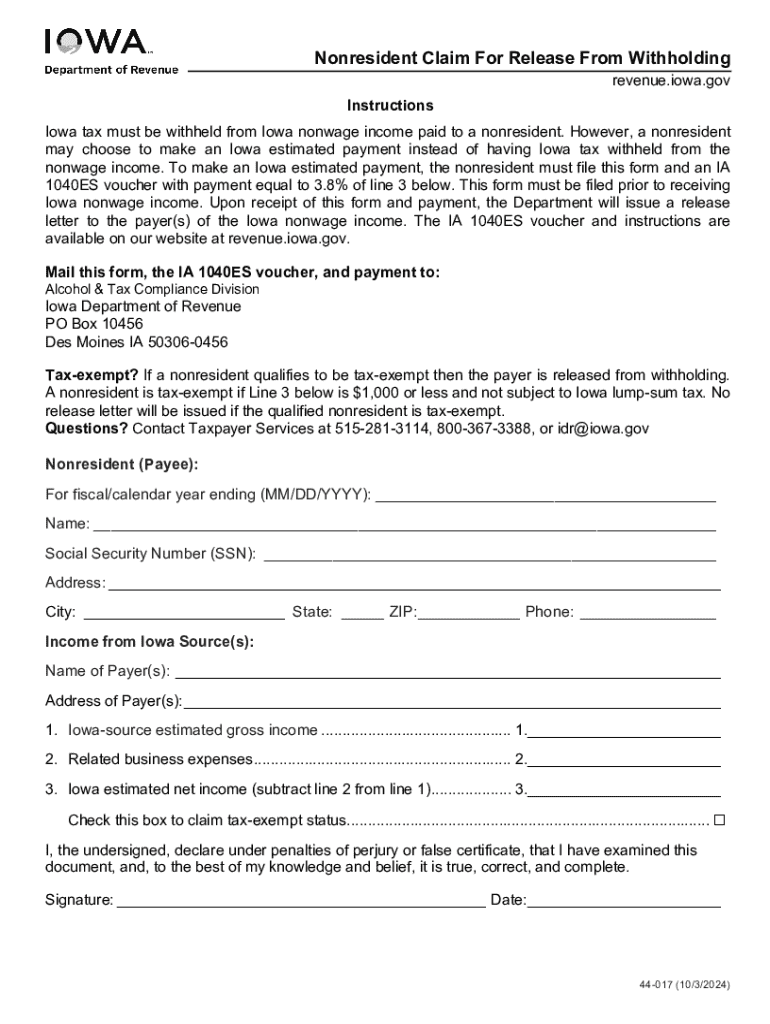

The Nonresident Claim For Release From Withholding Tax is a form used by individuals who are nonresidents of Iowa to request a release from state income tax withholding. This form is particularly relevant for those who earn income in Iowa but do not reside there. By submitting this claim, nonresidents can potentially avoid unnecessary withholding on their earnings, ensuring that they are only taxed on income that is subject to Iowa tax laws.

How to use the Nonresident Claim For Release From Withholding Tax

To effectively use the Nonresident Claim For Release From Withholding Tax, individuals must first determine their eligibility based on their residency status and the nature of their income. After confirming eligibility, the form should be completed with accurate information, including details about the income earned in Iowa and the reasons for requesting the release. It is essential to submit the form to the appropriate Iowa tax authority to ensure proper processing.

Steps to complete the Nonresident Claim For Release From Withholding Tax

Completing the Nonresident Claim For Release From Withholding Tax involves several key steps:

- Gather necessary documentation, including proof of nonresidency and income details.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the Iowa Department of Revenue, either online or via mail.

Eligibility Criteria

Eligibility for the Nonresident Claim For Release From Withholding Tax typically requires that the individual is a nonresident of Iowa and has earned income from Iowa sources. Additionally, the individual must not be subject to Iowa income tax on that income due to specific exemptions or treaties. It is important to verify your status and ensure compliance with Iowa tax regulations before applying.

Required Documents

When submitting the Nonresident Claim For Release From Withholding Tax, individuals may need to provide supporting documents to validate their claim. Commonly required documents include:

- Proof of nonresidency, such as a driver's license or utility bill from another state.

- Documentation of income earned in Iowa, such as W-2 forms or 1099 statements.

- Any relevant tax treaties or agreements that may apply to the individual's situation.

Filing Deadlines / Important Dates

Filing deadlines for the Nonresident Claim For Release From Withholding Tax can vary based on the tax year and specific circumstances. Generally, it is advisable to submit the form as early as possible to avoid delays in processing. Keeping track of important dates related to Iowa tax filings can help ensure compliance and timely submission of all necessary forms.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nonresident claim for release from withholding tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow's pricing structure for Iowa payment information?

airSlate SignNow offers a flexible pricing structure that caters to businesses of all sizes. For Iowa payment information, you can choose from various plans that provide essential features at competitive rates. Each plan is designed to ensure you get the best value for your eSigning needs.

-

How does airSlate SignNow ensure the security of Iowa payment information?

Security is a top priority at airSlate SignNow. We utilize advanced encryption methods to protect Iowa payment information during transmission and storage. Additionally, our platform complies with industry standards to ensure that your sensitive data remains safe and secure.

-

What features does airSlate SignNow offer for managing Iowa payment information?

airSlate SignNow provides a range of features to help you manage Iowa payment information effectively. You can easily create, send, and track documents, ensuring that all payment details are accurately captured and securely stored. Our user-friendly interface simplifies the entire process.

-

Can I integrate airSlate SignNow with other tools for Iowa payment information?

Yes, airSlate SignNow offers seamless integrations with various applications to streamline your workflow. This includes popular accounting and payment processing tools, making it easier to manage Iowa payment information alongside your other business operations. Integration enhances efficiency and reduces manual data entry.

-

What are the benefits of using airSlate SignNow for Iowa payment information?

Using airSlate SignNow for Iowa payment information provides numerous benefits, including increased efficiency and reduced turnaround times for document signing. Our platform is designed to simplify the eSigning process, allowing you to focus on your core business activities while ensuring that payment information is handled promptly and securely.

-

Is there a mobile app for managing Iowa payment information with airSlate SignNow?

Yes, airSlate SignNow offers a mobile app that allows you to manage Iowa payment information on the go. With the app, you can send, sign, and track documents from your mobile device, ensuring that you never miss an important payment or document, no matter where you are.

-

How can I get support for issues related to Iowa payment information?

airSlate SignNow provides comprehensive customer support to assist you with any issues related to Iowa payment information. You can signNow our support team via email, chat, or phone, and we also offer a robust knowledge base with articles and tutorials to help you resolve common queries.

Get more for Nonresident Claim For Release From Withholding Tax

- 213 cv 00610 nmk doc government publishing office form

- V 5 aggregate verification group form

- Case 112 cv 00219 rhb doc 73 filed 081913 page 1 of 29 page id form

- Zoning permit use verification form

- Utah pain relief institute your pain solution centerhome form

- Drug testing laboratoriesus department of transportation form

- 44386 federal register vol 80 no 143monday july 27 form

- Appeal 08 2391 form

Find out other Nonresident Claim For Release From Withholding Tax

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement