Schedule in 2058SP Form

What is the Schedule IN 2058SP

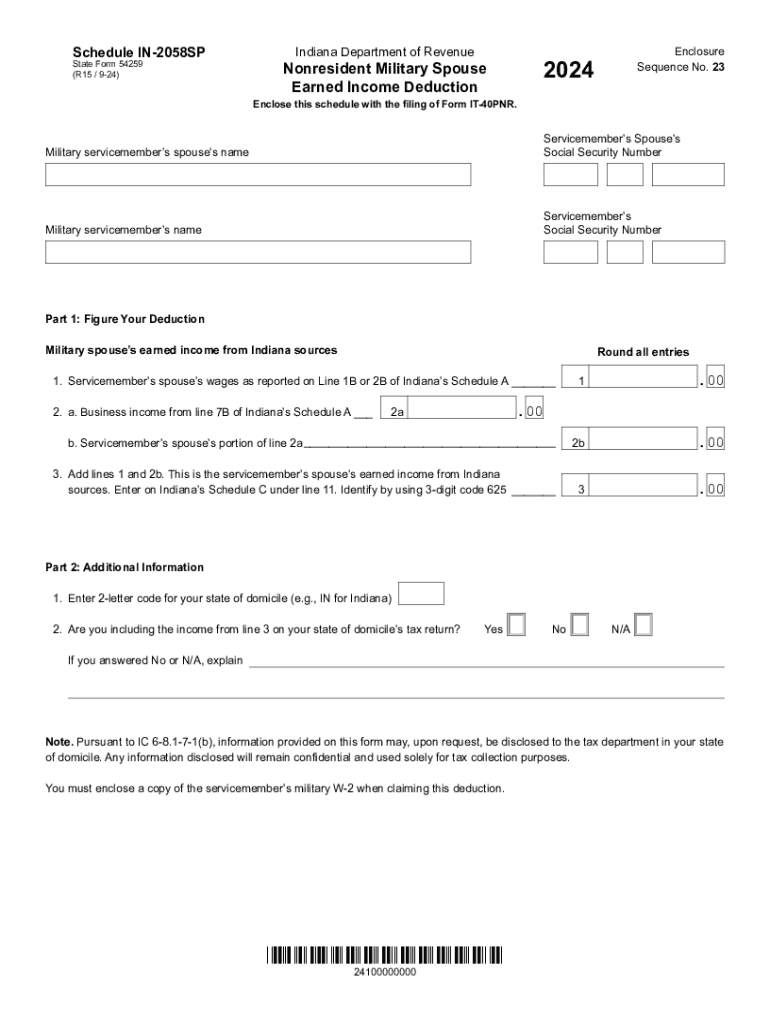

The Schedule IN 2058SP is a specific form used by taxpayers in Indiana to report certain types of income and claim deductions. This form is particularly relevant for individuals and businesses that need to provide detailed information about their income sources and tax liabilities. It is essential for ensuring compliance with state tax laws and for accurately calculating the amount owed or refunded.

How to use the Schedule IN 2058SP

Using the Schedule IN 2058SP involves several key steps. First, gather all necessary financial documents, including W-2s, 1099s, and any other relevant income statements. Next, carefully fill out the form, ensuring that all income sources are reported accurately. After completing the form, review it for any errors or omissions. Finally, submit the Schedule IN 2058SP along with your state tax return by the designated deadline to ensure compliance with Indiana tax regulations.

Steps to complete the Schedule IN 2058SP

Completing the Schedule IN 2058SP requires a systematic approach:

- Collect all relevant income documentation, including any forms that report earnings.

- Begin filling out the form by entering your personal information, including your name and Social Security number.

- Report all income sources, ensuring that you include any applicable deductions and credits.

- Double-check all entries for accuracy, particularly numerical values and calculations.

- Sign and date the form before submission.

Legal use of the Schedule IN 2058SP

The Schedule IN 2058SP is a legally mandated form for Indiana taxpayers. It must be used in accordance with state tax laws to report income accurately. Failure to use the form correctly can result in penalties or audits. Therefore, it is crucial to understand the legal implications of the information provided on the form and to ensure that all data is truthful and complete.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule IN 2058SP typically align with the general state tax return deadlines. For most taxpayers, this means the form must be submitted by April 15 each year. However, if you are unable to meet this deadline, it is important to check for any extensions that may apply. Staying informed about these dates helps avoid late fees and ensures timely processing of your tax return.

Required Documents

To complete the Schedule IN 2058SP, several documents are necessary:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of any deductions or credits being claimed

- Previous year’s tax return for reference

Having these documents on hand will facilitate a smoother and more accurate filing process.

Who Issues the Form

The Schedule IN 2058SP is issued by the Indiana Department of Revenue. This state agency is responsible for tax administration and compliance within Indiana. They provide the form and any necessary instructions to ensure taxpayers can fulfill their obligations accurately and efficiently.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule in 2058sp

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Schedule IN 2058SP?

Schedule IN 2058SP is a powerful feature within airSlate SignNow that allows users to efficiently manage and automate their document signing processes. This tool is designed to streamline workflows, ensuring that all parties can easily access and sign documents on time.

-

How does Schedule IN 2058SP improve document management?

With Schedule IN 2058SP, businesses can set specific timelines for document signing, reducing delays and enhancing productivity. This feature ensures that all stakeholders are notified and reminded about pending signatures, making document management seamless.

-

What are the pricing options for Schedule IN 2058SP?

airSlate SignNow offers competitive pricing for the Schedule IN 2058SP feature, with various plans tailored to meet different business needs. You can choose from monthly or annual subscriptions, ensuring you get the best value for your investment.

-

Can Schedule IN 2058SP integrate with other tools?

Yes, Schedule IN 2058SP integrates seamlessly with various third-party applications, enhancing your existing workflows. This integration capability allows businesses to connect with CRM systems, project management tools, and more, ensuring a cohesive experience.

-

What are the benefits of using Schedule IN 2058SP?

The primary benefits of using Schedule IN 2058SP include increased efficiency, reduced turnaround times, and improved collaboration among team members. By automating the scheduling of document signatures, businesses can focus on their core activities without the hassle of manual follow-ups.

-

Is Schedule IN 2058SP user-friendly?

Absolutely! Schedule IN 2058SP is designed with user experience in mind, making it easy for anyone to navigate and utilize its features. Whether you're tech-savvy or a beginner, you'll find the interface intuitive and straightforward.

-

How can I get support for Schedule IN 2058SP?

airSlate SignNow provides comprehensive support for Schedule IN 2058SP, including tutorials, FAQs, and customer service assistance. If you encounter any issues or have questions, our support team is ready to help you maximize the benefits of this feature.

Get more for Schedule IN 2058SP

- Ut doc f 70apa d1 form

- Ak ltc 01 form

- Suny morrisville ferpa authorization form to release student educational records

- Ca boe 267 l ap1 los angeles county form

- Canada western mustangs pre participation health questionnaire form

- Canada cancellation notice form

- Canada cf2951 form

- Au sat form medical report

Find out other Schedule IN 2058SP

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document