K 40svr Form

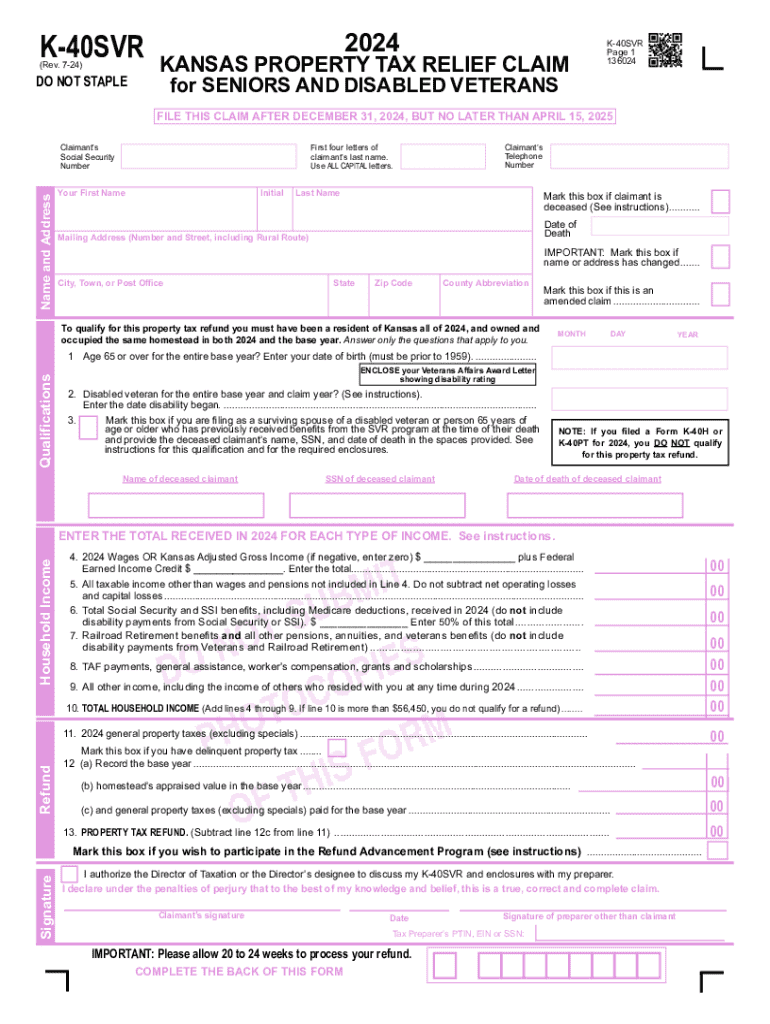

What is the K-40SVR?

The K-40SVR is a specific form used in Kansas for filing a property tax relief claim. This form allows eligible homeowners to apply for various property tax relief programs offered by the state. It is essential for individuals seeking to reduce their property tax burden, particularly for seniors and disabled citizens. Understanding the purpose of the K-40SVR is crucial for anyone looking to benefit from property tax relief options available in Kansas.

Eligibility Criteria

To qualify for a property tax relief claim using the K-40SVR, applicants must meet specific eligibility requirements. Generally, these criteria include:

- Being a resident of Kansas.

- Owning and occupying the property as your primary residence.

- Meeting income thresholds set by the state.

- Being a senior citizen or disabled individual may provide additional eligibility for certain relief programs.

It is important to review the latest guidelines to ensure compliance with the eligibility criteria before submitting the K-40SVR form.

Steps to Complete the K-40SVR

Completing the K-40SVR involves several key steps to ensure accurate submission. Begin by gathering necessary documentation, including proof of income and property ownership. Follow these steps:

- Obtain the K-40SVR form from the Kansas Department of Revenue website or a local office.

- Fill out the form with accurate personal information, including your name, address, and social security number.

- Provide details about your property, including its assessed value and property tax information.

- Document your income and any other required financial information.

- Review the completed form for accuracy before submission.

These steps will help ensure that your property tax relief claim is processed smoothly.

Required Documents

When filing a property tax relief claim using the K-40SVR, certain documents are necessary to support your application. Required documents typically include:

- Proof of income, such as tax returns or pay stubs.

- Documentation of property ownership, like a deed or mortgage statement.

- Identification, such as a driver's license or state ID.

Having these documents ready can expedite the review process and increase the likelihood of a successful claim.

Form Submission Methods

The K-40SVR can be submitted through various methods, providing flexibility for applicants. The submission options include:

- Online submission through the Kansas Department of Revenue website.

- Mailing the completed form to the appropriate local office.

- In-person submission at designated state or county offices.

Choosing the right submission method can depend on personal preference and accessibility to online services.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the K-40SVR to ensure your claim is submitted on time. Typically, the deadline for submitting the K-40SVR for property tax relief is set annually, often aligning with the tax filing season. Checking the Kansas Department of Revenue's official announcements for specific dates is advisable to avoid missing the deadline.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the k 40svr

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a property tax relief claim?

A property tax relief claim is a request made by property owners to reduce their property tax burden. This claim can be based on various factors, including financial hardship or eligibility for specific exemptions. Understanding how to file a property tax relief claim can help you save money on your taxes.

-

How can airSlate SignNow assist with my property tax relief claim?

airSlate SignNow provides a streamlined platform for sending and eSigning documents related to your property tax relief claim. Our easy-to-use solution ensures that all necessary paperwork is completed accurately and submitted on time. This can signNowly enhance your chances of a successful claim.

-

What features does airSlate SignNow offer for property tax relief claims?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, all of which are essential for managing your property tax relief claim. These tools simplify the process, making it easier to gather signatures and ensure compliance with local regulations.

-

Is there a cost associated with using airSlate SignNow for property tax relief claims?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs, including those specifically for managing property tax relief claims. Our cost-effective solution ensures that you can efficiently handle your claims without breaking the bank. Check our website for detailed pricing information.

-

Can I integrate airSlate SignNow with other software for my property tax relief claim?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing you to manage your property tax relief claim alongside your existing tools. This integration enhances workflow efficiency and ensures that all relevant data is easily accessible.

-

What are the benefits of using airSlate SignNow for property tax relief claims?

Using airSlate SignNow for your property tax relief claim offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform simplifies the entire process, allowing you to focus on what matters most—getting the relief you deserve.

-

How secure is airSlate SignNow when handling property tax relief claims?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure storage to protect your documents and personal information related to your property tax relief claim. You can trust that your data is safe with us.

Get more for K 40svr

- Orders or other papers as required by law or supreme court rule form

- Juvenile ejj dys releasereview hearing disposition sheet form

- Disposition sheet probation revocation or aftercare violation form

- Juvenile delinquencyejj cover sheet instructions arkansas form

- The intent of this form is to provide a degree of privacy to the parties and to help deter and

- Criminal cover sheet arkansas download fillable pdf form

- Before me form

- In the probate court of sebastian county arkansas form

Find out other K 40svr

- How Do I Sign Oregon Bank Loan Proposal Template

- Help Me With Sign Oregon Bank Loan Proposal Template

- Sign Michigan Gift Affidavit Mobile

- How To Sign North Carolina Gift Affidavit

- How Do I Sign Oregon Financial Affidavit

- Sign Maine Revocation of Power of Attorney Online

- Sign Louisiana Mechanic's Lien Online

- How To Sign New Mexico Revocation of Power of Attorney

- How Can I Sign Ohio Revocation of Power of Attorney

- Sign Michigan Mechanic's Lien Easy

- How To Sign Texas Revocation of Power of Attorney

- Sign Virginia Revocation of Power of Attorney Easy

- Can I Sign North Carolina Mechanic's Lien

- Sign Maine Payment Guaranty Myself

- Help Me With Sign Oklahoma Mechanic's Lien

- Sign Oregon Mechanic's Lien Simple

- How To Sign Utah Mechanic's Lien

- How To Sign Washington Mechanic's Lien

- Help Me With Sign Washington Mechanic's Lien

- Sign Arizona Notice of Rescission Safe