Ct Income Withholding Form 2018

What is the Ct Income Withholding Form

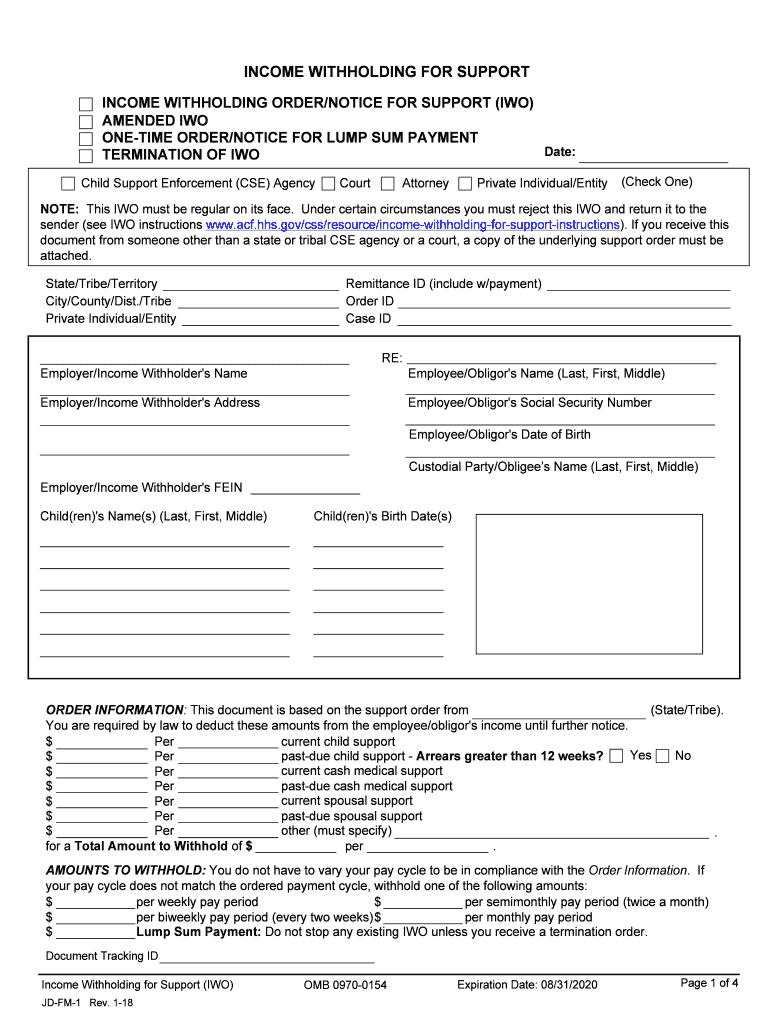

The Connecticut Income Withholding Form, commonly referred to as the CT withholding order form, is a legal document used to facilitate the collection of child support or alimony payments directly from an individual's wages. This form is essential for ensuring that payments are made consistently and on time, helping to support the financial needs of dependents. The form is typically issued by the court or a support enforcement agency and serves as an official directive to the employer to withhold a specified amount from the employee's paycheck.

How to use the Ct Income Withholding Form

Using the CT income withholding form involves several steps to ensure compliance with legal requirements. First, the form must be completed accurately, detailing the necessary information about the employee, the employer, and the payment amounts. Once filled out, it should be submitted to the employer, who is then responsible for implementing the withholding from the employee's wages. Employers must adhere to the instructions outlined in the form to ensure that the correct amounts are withheld and sent to the appropriate state agency or individual.

Steps to complete the Ct Income Withholding Form

Completing the CT income withholding form involves a few key steps:

- Gather necessary information, including the employee's name, address, Social Security number, and details about the support order.

- Fill out the form with accurate payment amounts and frequency of withholding.

- Sign and date the form to validate it.

- Submit the completed form to the employer, ensuring they have all required copies.

It is important to review the form for accuracy before submission to avoid delays in processing.

Legal use of the Ct Income Withholding Form

The legal use of the CT income withholding form is governed by state laws that outline the obligations of both employers and employees. This form is legally binding and must be treated as such by all parties involved. Employers are required to comply with the withholding order as stipulated in the form, while employees have the right to receive notice of the withholding and any changes made. Failure to comply with the terms of the withholding order can result in legal penalties for employers.

Key elements of the Ct Income Withholding Form

Several key elements must be included in the CT income withholding form to ensure its validity:

- Identification of the employee and employer, including names and addresses.

- Details of the support order, including the case number and payment amounts.

- Instructions for the employer on how to process the withholding.

- Signature of the issuing authority, such as a judge or support enforcement officer.

Each of these elements plays a crucial role in the enforcement of the withholding order and must be completed accurately.

Form Submission Methods (Online / Mail / In-Person)

The CT income withholding form can be submitted through various methods to ensure it reaches the appropriate parties effectively. Common submission methods include:

- Online submission through the state’s child support enforcement portal, if available.

- Mailing the completed form to the employer or the designated state agency.

- Delivering the form in person to the employer’s payroll department or the relevant agency office.

Choosing the right submission method can help streamline the process and ensure timely processing of the withholding order.

Quick guide on how to complete ct income withholding form

Complete Ct Income Withholding Form effortlessly on any device

Online document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly and easily. Handle Ct Income Withholding Form on any device with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to alter and eSign Ct Income Withholding Form without hassle

- Obtain Ct Income Withholding Form and click on Get Form to begin.

- Utilize the instruments we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow caters to all your document management needs in a few clicks from any device of your choice. Modify and eSign Ct Income Withholding Form and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct income withholding form

Create this form in 5 minutes!

How to create an eSignature for the ct income withholding form

The best way to make an eSignature for a PDF document online

The best way to make an eSignature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The way to generate an electronic signature right from your smart phone

How to make an eSignature for a PDF document on iOS

The way to generate an electronic signature for a PDF on Android OS

People also ask

-

What is a CT withholding order form and why is it important?

The CT withholding order form is a legal document used by employers to comply with state tax withholding requirements. It's essential for ensuring that the correct amount of taxes is withheld from an employee's paycheck, thus avoiding potential penalties. Understanding this form can help businesses maintain compliance and avoid costly issues.

-

How can airSlate SignNow help me manage CT withholding order forms?

airSlate SignNow provides a user-friendly platform for businesses to create, send, and eSign CT withholding order forms efficiently. With our electronic document management solution, you can streamline the process, reduce paperwork, and ensure secure storage of important documents. This means you can manage your CT withholding order forms with ease and confidence.

-

Is there a cost associated with using airSlate SignNow for CT withholding order forms?

airSlate SignNow offers a range of pricing plans that cater to different business needs, making it a cost-effective solution for managing CT withholding order forms. Our plans are structured to ensure that you only pay for the features you use, allowing you to scale as your business grows. Visit our pricing page for detailed information on our subscription options.

-

Can airSlate SignNow integrate with other software I use for payroll and tax purposes?

Yes, airSlate SignNow seamlessly integrates with a variety of payroll and accounting software to enhance your document management process, including managing CT withholding order forms. This integration allows you to keep all your important documents connected, streamlining workflows and ensuring that your tax compliance is always up to date.

-

What features does airSlate SignNow offer for completing CT withholding order forms?

airSlate SignNow is equipped with various features that make completing CT withholding order forms quick and simple. You can customize templates, add signature fields, and set reminders for important deadlines. These features not only enhance efficiency but also ensure that your documents are completed accurately and in compliance with state regulations.

-

How secure is the airSlate SignNow platform for handling CT withholding order forms?

The security of your documents, including CT withholding order forms, is a top priority for airSlate SignNow. We employ industry-standard encryption and secure cloud storage to protect your data. Additionally, our platform adheres to compliance regulations to ensure that all sensitive information remains confidential and secure.

-

Can I track the status of my CT withholding order forms with airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your CT withholding order forms in real-time. You will receive notifications when documents are viewed, signed, or completed, ensuring you stay informed throughout the entire process. This transparency helps you manage your documentation duties more effectively.

Get more for Ct Income Withholding Form

Find out other Ct Income Withholding Form

- Sign Arkansas Application for University Free

- Sign Arkansas Nanny Contract Template Fast

- How To Sign California Nanny Contract Template

- How Do I Sign Colorado Medical Power of Attorney Template

- How To Sign Louisiana Medical Power of Attorney Template

- How Do I Sign Louisiana Medical Power of Attorney Template

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online