Form 05 169, Texas Franchise Tax E Z Computation Final 2025-2026

What is the Texas Form 05 169?

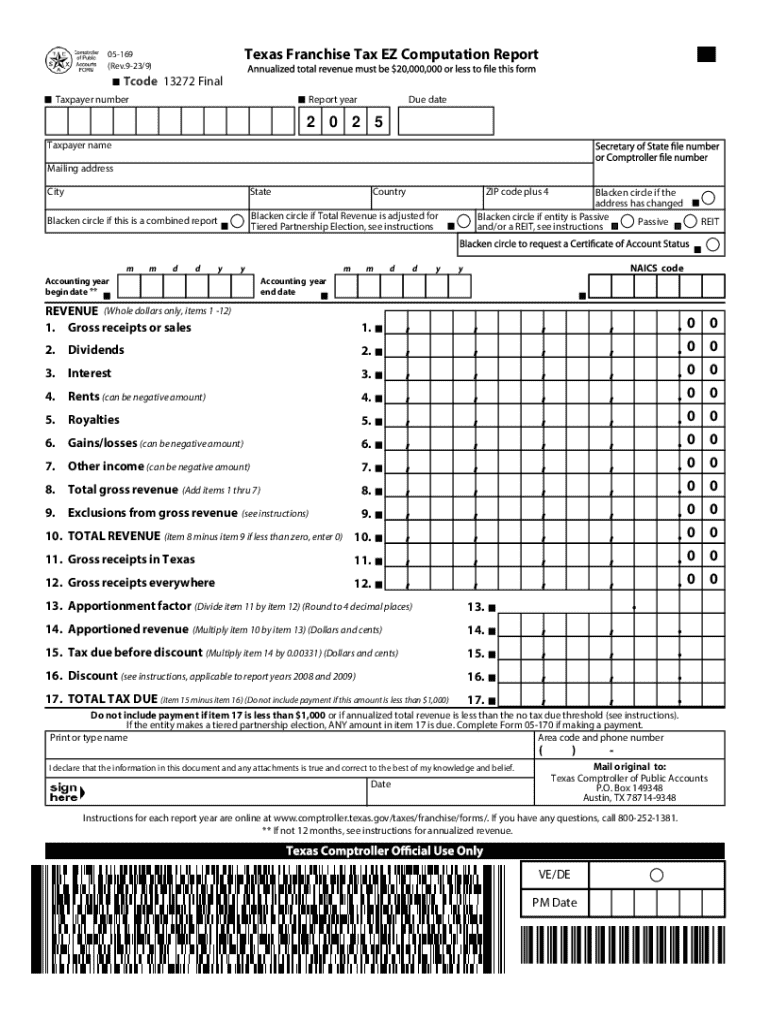

The Texas Form 05 169, known as the Franchise Tax E-Z Computation Final, is a simplified tax form designed for certain business entities in Texas. This form is primarily used by businesses that qualify for the E-Z computation method, allowing them to report their franchise tax in a streamlined manner. The form is beneficial for small businesses and those with a limited revenue threshold, as it reduces the complexity involved in filing franchise taxes.

How to Use the Texas Form 05 169

Using the Texas Form 05 169 involves several key steps. First, ensure that your business qualifies for the E-Z computation method. Then, gather the necessary financial information, including total revenue and any applicable deductions. Next, complete the form by entering the required data accurately. Finally, submit the form to the appropriate Texas tax authority by the specified deadline. Proper usage of this form can help ensure compliance with state tax regulations while minimizing the administrative burden.

Steps to Complete the Texas Form 05 169

Completing the Texas Form 05 169 involves a series of straightforward steps:

- Verify eligibility for the E-Z computation method based on revenue limits.

- Gather necessary financial documents, including revenue statements and expense reports.

- Fill out the form, ensuring all sections are completed accurately.

- Review the completed form for any errors or omissions.

- Submit the form by the designated deadline, either online or via mail.

Following these steps will help ensure that your franchise tax filing is accurate and timely.

Key Elements of the Texas Form 05 169

The Texas Form 05 169 includes several key elements that are essential for accurate completion. These elements typically consist of:

- Business identification information, including name and address.

- Total revenue for the reporting period.

- Applicable deductions and credits.

- The calculated franchise tax amount owed.

- Signature and date from an authorized representative of the business.

Understanding these elements is crucial for ensuring compliance and accuracy in tax reporting.

Filing Deadlines for the Texas Form 05 169

Filing deadlines for the Texas Form 05 169 are critical to avoid penalties. Typically, the form must be submitted by May 15 of each year for most businesses. However, if May 15 falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to stay informed about specific deadlines each tax year to ensure timely submission and compliance with Texas tax laws.

Legal Use of the Texas Form 05 169

The Texas Form 05 169 is legally recognized for reporting franchise taxes in the state of Texas. Businesses that meet the eligibility criteria for the E-Z computation method are required to use this form to report their tax obligations. Failure to use the correct form can result in penalties or additional scrutiny from tax authorities. Therefore, understanding the legal implications of using this form is essential for compliance and maintaining good standing with state regulations.

Handy tips for filling out Form 05 169, Texas Franchise Tax E Z Computation Final online

Quick steps to complete and e-sign Form 05 169, Texas Franchise Tax E Z Computation Final online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing documents can be. Get access to a GDPR and HIPAA compliant service for optimum straightforwardness. Use signNow to electronically sign and send out Form 05 169, Texas Franchise Tax E Z Computation Final for e-signing.

Create this form in 5 minutes or less

Find and fill out the correct form 05 169 texas franchise tax e z computation final

Create this form in 5 minutes!

How to create an eSignature for the form 05 169 texas franchise tax e z computation final

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Texas Form 05 169?

The Texas Form 05 169 is a specific document used for various administrative purposes in Texas. It is essential for businesses and individuals who need to comply with state regulations. Understanding how to properly fill out and submit this form can streamline your processes.

-

How can airSlate SignNow help with Texas Form 05 169?

airSlate SignNow provides an efficient platform for sending and eSigning the Texas Form 05 169. With its user-friendly interface, you can easily manage your documents and ensure they are signed promptly. This saves time and reduces the hassle of traditional paperwork.

-

What are the pricing options for using airSlate SignNow for Texas Form 05 169?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including those who frequently handle the Texas Form 05 169. You can choose from monthly or annual subscriptions, ensuring you only pay for what you need. This cost-effective solution helps businesses manage their document workflows efficiently.

-

Are there any features specifically designed for Texas Form 05 169?

Yes, airSlate SignNow includes features that enhance the handling of the Texas Form 05 169, such as customizable templates and automated workflows. These features allow users to create, send, and track their forms seamlessly. This ensures compliance and reduces errors in document management.

-

Can I integrate airSlate SignNow with other tools for Texas Form 05 169?

Absolutely! airSlate SignNow integrates with various applications, making it easy to manage the Texas Form 05 169 alongside your existing tools. Whether you use CRM systems or cloud storage solutions, these integrations enhance your workflow and improve efficiency.

-

What are the benefits of using airSlate SignNow for Texas Form 05 169?

Using airSlate SignNow for the Texas Form 05 169 offers numerous benefits, including faster processing times and improved accuracy. The platform's eSigning capabilities ensure that your documents are signed securely and legally. Additionally, it helps reduce paper usage, contributing to a more sustainable business practice.

-

Is airSlate SignNow secure for handling Texas Form 05 169?

Yes, airSlate SignNow prioritizes security, ensuring that your Texas Form 05 169 and other documents are protected. The platform uses advanced encryption and complies with industry standards to safeguard your data. You can confidently manage sensitive information without worrying about bsignNowes.

Get more for Form 05 169, Texas Franchise Tax E Z Computation Final

Find out other Form 05 169, Texas Franchise Tax E Z Computation Final

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement