Texas Franchise Tax Ez Computation Report Form 2018

What is the Texas Franchise Tax Ez Computation Report Form

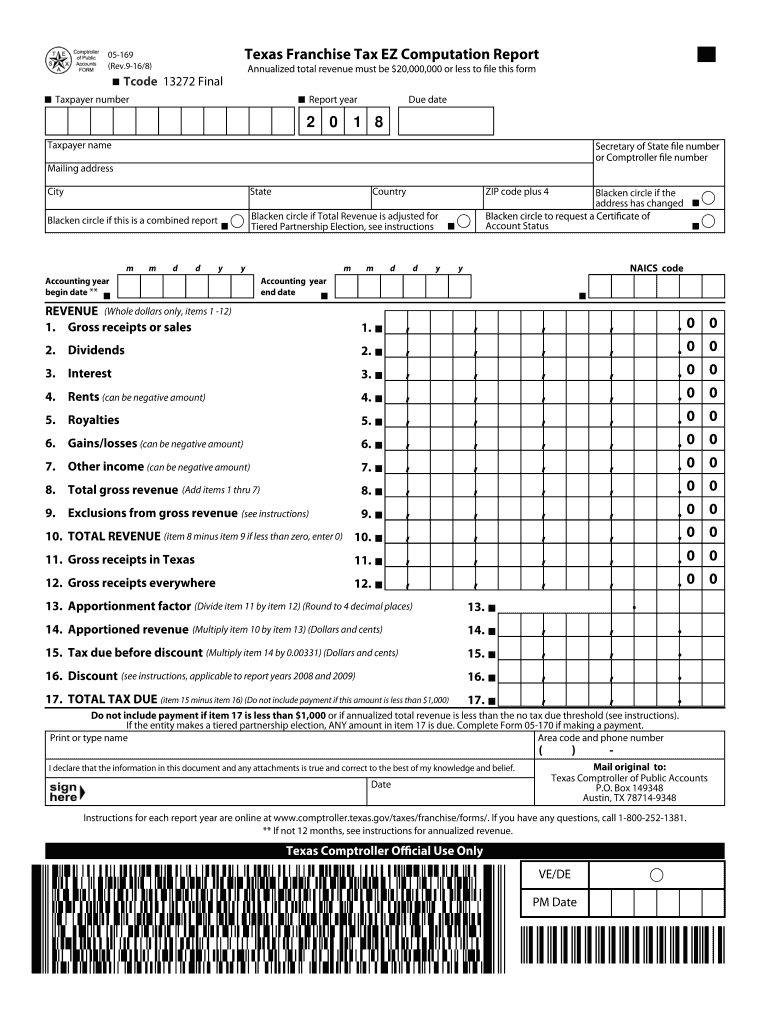

The Texas Franchise Tax Ez Computation Report Form is a simplified tax reporting document designed for certain small businesses operating in Texas. This form allows eligible entities to report their franchise tax liability with minimal complexity. It is specifically tailored for businesses that meet the criteria for the Ez Computation method, which typically includes those with lower revenue thresholds. By using this form, businesses can streamline their tax reporting process while ensuring compliance with state tax regulations.

Steps to complete the Texas Franchise Tax Ez Computation Report Form

Completing the Texas Franchise Tax Ez Computation Report Form involves several key steps:

- Gather necessary information: Collect financial data, including total revenue, deductions, and any other relevant financial records.

- Fill out the form: Enter the required information into the designated fields of the form, ensuring accuracy to avoid delays.

- Review the form: Double-check all entries for completeness and correctness before proceeding.

- Sign the form: Use a legally accepted eSignature method to sign the document, ensuring it meets all legal requirements.

- Submit the form: Choose your preferred submission method—online, by mail, or in person—and ensure it is sent before the deadline.

Legal use of the Texas Franchise Tax Ez Computation Report Form

The Texas Franchise Tax Ez Computation Report Form is legally recognized as a valid document for reporting franchise taxes in Texas. It must be completed accurately and submitted within the specified deadlines to avoid penalties. The form is designed to comply with state regulations, ensuring that businesses fulfill their tax obligations while benefiting from a simplified reporting process. Utilizing this form correctly can help businesses maintain good standing with the Texas Comptroller of Public Accounts.

Filing Deadlines / Important Dates

Filing deadlines for the Texas Franchise Tax Ez Computation Report Form are crucial for compliance. Typically, the report is due on May 15 of each year, but this date may vary based on specific circumstances or extensions. It is essential for businesses to stay informed about any changes to filing dates and to prepare their documentation well in advance to ensure timely submission. Missing the deadline can result in penalties and interest on unpaid taxes.

Form Submission Methods (Online / Mail / In-Person)

Businesses have several options for submitting the Texas Franchise Tax Ez Computation Report Form. The most efficient method is online submission through the Texas Comptroller's website, which allows for immediate processing. Alternatively, businesses can mail the completed form to the appropriate address listed on the form or deliver it in person to a local Comptroller office. Each method has its advantages, and businesses should choose the one that best fits their needs while ensuring compliance with submission guidelines.

Key elements of the Texas Franchise Tax Ez Computation Report Form

The Texas Franchise Tax Ez Computation Report Form includes several key elements that are essential for accurate reporting:

- Entity Information: Basic details about the business, including name, address, and taxpayer identification number.

- Revenue Information: Total revenue figures that determine the franchise tax liability.

- Deductions: Any applicable deductions that can reduce the taxable amount.

- Tax Calculation: A section for calculating the final tax due based on the reported revenue and deductions.

- Signature Section: A space for the authorized representative to sign and date the form, confirming its accuracy.

Quick guide on how to complete texas franchise tax ez computation report 2018 form

Your assistance manual on how to prepare your Texas Franchise Tax Ez Computation Report Form

If you’re wondering how to finalize and submit your Texas Franchise Tax Ez Computation Report Form, here are a few concise instructions on how to simplify tax reporting.

To get started, simply register your airSlate SignNow account to revolutionize your online document management. airSlate SignNow is an intuitive and robust document solution that enables you to edit, create, and complete your income tax forms seamlessly. With its editor, you can alternate between text, check boxes, and eSignatures and revisit to modify answers as needed. Streamline your tax processing with advanced PDF editing, eSigning, and easy sharing.

Follow these steps to complete your Texas Franchise Tax Ez Computation Report Form in no time:

- Create your account and start working on PDFs almost instantly.

- Utilize our directory to find any IRS tax form; browse different versions and schedules.

- Click Get form to open your Texas Franchise Tax Ez Computation Report Form in our editor.

- Provide the necessary fillable fields with your information (text, numbers, check marks).

- Use the Sign Tool to insert your legally-binding eSignature (if necessary).

- Review your document and fix any mistakes.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Refer to this manual to file your taxes electronically with airSlate SignNow. Be aware that submitting on paper may increase return mistakes and delay refunds. Certainly, before e-filing your taxes, verify the IRS website for filing guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct texas franchise tax ez computation report 2018 form

FAQs

-

What tax forms do I need to fill out for reporting bitcoin gains and loses?

IRS1040 and 1099 forms.“For instance, there is no long-term capital gains tax to pay if you are in the lower two tax brackets (less than $36,900 single income or less than $73,800 married income). The capital gains rate is only 15% for other tax brackets (less than $405,100 single income) with 20% for the final bracket.”Reference: Filing Bitcoin Taxes Capital Gains Losses 1040 Schedule DOther References:IRS Virtual Currency Guidance : Virtual Currency Is Treated as Property for U.S. Federal Tax Purposes; General Rules for Property Transactions ApplyHow do I report taxes?Filing Bitcoin Taxes Capital Gains Losses 1040 Schedule Dhttps://www.irs.gov/pub/irs-drop...

-

Do you have to fill out form 1099 (for tax reporting) if you send over $600 in bitcoin to company for a product?

Among the numerous tax forms, the IRS will be expecting you to fill out a 1099-MISC form in two cases:you made payments to freelancers or independent contractors for business-related services totaling at least $600 within the year;or you paid minimum $10 in royalties or broker payments in lieu of dividends or tax-exempt interest.However, if you made any payments for personal or household services, there is no need to submit a 1099-MISC form.This site has a lot of information about it - http://bit.ly/2Nkf48f

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

How should I fill out the preference form for the IBPS PO 2018 to get a posting in an urban city?

When you get selected as bank officer of psb you will have to serve across the country. Banks exist not just in urban areas but also in semi urban and rural areas also. Imagine every employee in a bank got posting in urban areas as their wish as a result bank have to shut down all rural and semi urban branches as there is no people to serve. People in other areas deprived of banking service. This makes no sense. Being an officer you will be posted across the country and transferred every three years. You have little say of your wish. Every three year urban posting followed by three years rural and vice versa. If you want your career to grow choose Canara bank followed by union bank . These banks have better growth potentials and better promotion scope

Create this form in 5 minutes!

How to create an eSignature for the texas franchise tax ez computation report 2018 form

How to generate an electronic signature for the Texas Franchise Tax Ez Computation Report 2018 Form in the online mode

How to make an electronic signature for your Texas Franchise Tax Ez Computation Report 2018 Form in Chrome

How to make an eSignature for signing the Texas Franchise Tax Ez Computation Report 2018 Form in Gmail

How to create an electronic signature for the Texas Franchise Tax Ez Computation Report 2018 Form from your smartphone

How to make an eSignature for the Texas Franchise Tax Ez Computation Report 2018 Form on iOS devices

How to create an eSignature for the Texas Franchise Tax Ez Computation Report 2018 Form on Android OS

People also ask

-

What is the Texas Franchise Tax Ez Computation Report Form?

The Texas Franchise Tax Ez Computation Report Form is a simplified document that businesses in Texas can use to report their franchise tax. This form is designed for businesses with less complex tax situations, making it easier and quicker to file. Using this form can save time and reduce the hassle associated with tax calculations.

-

Who is eligible to use the Texas Franchise Tax Ez Computation Report Form?

Eligibility for the Texas Franchise Tax Ez Computation Report Form typically includes businesses with total revenue less than a specified threshold. It is ideal for small businesses or partnerships that meet certain criteria set by the Texas comptroller's office. Checking your eligibility can help streamline your tax filing process.

-

How can airSlate SignNow assist with the Texas Franchise Tax Ez Computation Report Form?

airSlate SignNow provides an easy-to-use platform for creating, signing, and managing documents, including the Texas Franchise Tax Ez Computation Report Form. Our solution allows you to digitally fill out and eSign the form, ensuring compliance and accuracy. With our service, you can streamline your filing process without the worry of mailing or printing documents.

-

Are there any costs associated with using airSlate SignNow for the Texas Franchise Tax Ez Computation Report Form?

Yes, using airSlate SignNow involves subscription pricing based on the features you choose. However, many customers find it cost-effective compared to traditional paper filing methods. Our plans are designed to provide value while ensuring you can efficiently manage forms like the Texas Franchise Tax Ez Computation Report Form.

-

What features does airSlate SignNow offer for the Texas Franchise Tax Ez Computation Report Form?

airSlate SignNow offers a range of features tailored for document management, including eSigning, templates, and secure cloud storage. You can easily customize your Texas Franchise Tax Ez Computation Report Form with essential details, ensuring a smooth filing process. Additionally, our user-friendly interface allows for easy navigation and seamless document handling.

-

Can I integrate airSlate SignNow with other applications for managing the Texas Franchise Tax Ez Computation Report Form?

Yes, airSlate SignNow offers integrations with various business applications to enhance your document workflow. You can connect with tools like CRM systems or accounting software to automatically populate the Texas Franchise Tax Ez Computation Report Form with relevant data. This integration helps save time and reduces the chances of errors.

-

Is it possible to track the status of my Texas Franchise Tax Ez Computation Report Form using airSlate SignNow?

Absolutely! airSlate SignNow provides tracking features that allow you to monitor the status of your Texas Franchise Tax Ez Computation Report Form. You’ll receive notifications when the form is opened, signed, and completed, enabling you to stay informed throughout the signing process and ensuring timely submissions.

Get more for Texas Franchise Tax Ez Computation Report Form

- Application for entry visa to israel form

- Rcboe form

- Boating permit city of greeley form

- Bosch dishwasher installation rebate sears form

- South carolina form c 245

- Medical terminology study guide form

- Labour market trends and prospects for employment opportunities in jamaica form

- Scholarship scholarship agreement template form

Find out other Texas Franchise Tax Ez Computation Report Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document