Clear Print 700 SOV Maine Estate Tax Statem Form

Understanding the Clear Print 700 SOV Maine Estate Tax Statement

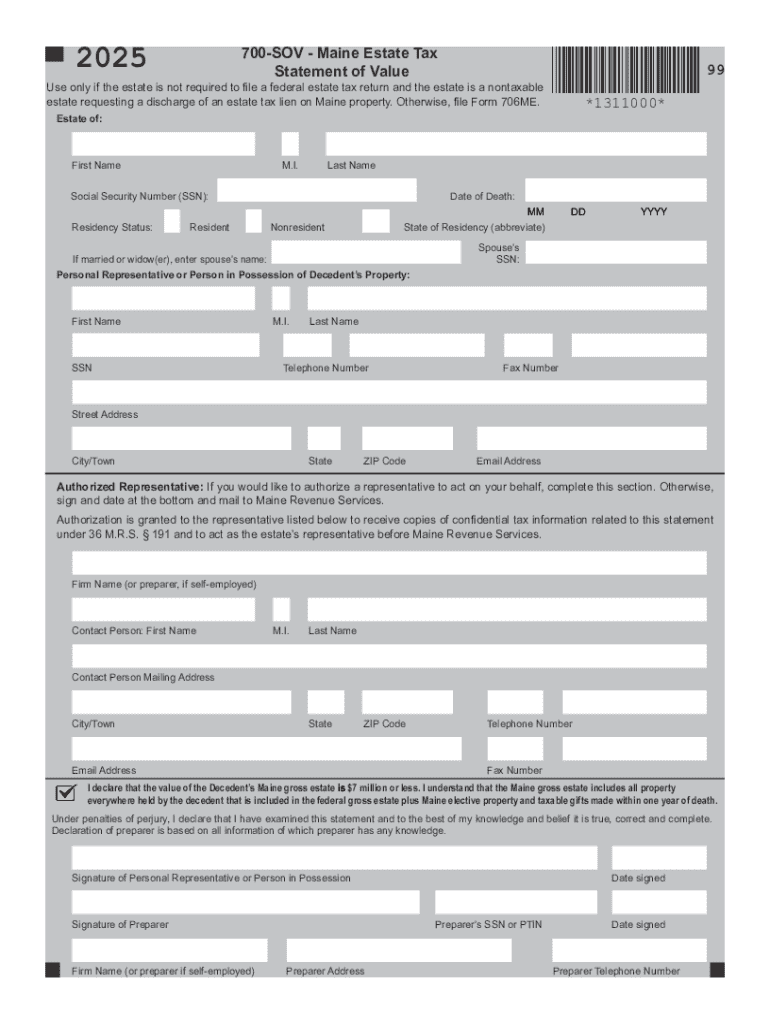

The Clear Print 700 SOV is a crucial document used in Maine for estate tax purposes. It serves as a declaration of the value of an estate and helps determine the tax liability. This form is essential for the executor or administrator of an estate to report the value of assets, liabilities, and any deductions that may apply. Understanding the specific requirements and details of this form is vital for compliance with Maine's estate tax laws.

Steps to Complete the Clear Print 700 SOV Maine Estate Tax Statement

Completing the Clear Print 700 SOV requires careful attention to detail. Here are the steps to follow:

- Gather necessary documentation, including property appraisals, financial statements, and any relevant legal documents.

- Fill out the form accurately, ensuring all sections are completed, including the estate's total value and any deductions.

- Review the form for accuracy and completeness before submission.

- Submit the completed form by the specified deadline to the appropriate state agency.

Required Documents for the Clear Print 700 SOV Maine Estate Tax Statement

When preparing to file the Clear Print 700 SOV, certain documents are essential. These include:

- Death certificate of the deceased.

- Will or trust documents, if applicable.

- Inventory of the estate's assets, including real estate, bank accounts, and personal property.

- Documentation of any debts or liabilities that may affect the estate's value.

Legal Use of the Clear Print 700 SOV Maine Estate Tax Statement

The Clear Print 700 SOV is legally required for estates that exceed Maine's estate tax exemption threshold. Filing this form is not only a legal obligation but also ensures that the estate is in compliance with state tax laws. Failure to file or inaccuracies in reporting can result in penalties or legal complications for the executor or administrator of the estate.

Filing Deadlines for the Clear Print 700 SOV Maine Estate Tax Statement

It is important to be aware of the deadlines associated with the Clear Print 700 SOV. Generally, the form must be filed within nine months of the date of death of the individual whose estate is being reported. Extensions may be available under certain circumstances, but it is advisable to file on time to avoid penalties.

Examples of Using the Clear Print 700 SOV Maine Estate Tax Statement

Understanding practical applications of the Clear Print 700 SOV can help clarify its importance. For instance, if an individual passes away leaving behind a home, bank accounts, and investments, the executor must use the form to report these assets' values. This ensures that the estate tax is calculated correctly and that the estate fulfills its tax obligations.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the clear print 700 sov maine estate tax statem

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 700 sov 2025 and how does it relate to airSlate SignNow?

The 700 sov 2025 refers to a specific document format that airSlate SignNow supports for electronic signatures. This format ensures compliance with legal standards, making it ideal for businesses looking to streamline their document signing process. By using airSlate SignNow, you can easily manage and eSign 700 sov 2025 documents efficiently.

-

What are the pricing options for using airSlate SignNow for 700 sov 2025 documents?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including those focused on 700 sov 2025 documents. You can choose from monthly or annual subscriptions, with options that provide access to essential features for document management and eSigning. This cost-effective solution ensures you get the best value for your investment.

-

What features does airSlate SignNow offer for managing 700 sov 2025 documents?

airSlate SignNow provides a range of features tailored for 700 sov 2025 documents, including customizable templates, secure storage, and real-time tracking of document status. These features enhance the efficiency of your workflow, allowing you to send, sign, and manage documents seamlessly. Additionally, the platform is user-friendly, making it accessible for all team members.

-

How can airSlate SignNow benefit my business when handling 700 sov 2025 documents?

Using airSlate SignNow for 700 sov 2025 documents can signNowly improve your business's efficiency and reduce turnaround times. The platform allows for quick eSigning, which accelerates the approval process and enhances productivity. Furthermore, it minimizes paper usage, contributing to a more sustainable business model.

-

Does airSlate SignNow integrate with other tools for managing 700 sov 2025 documents?

Yes, airSlate SignNow offers integrations with various tools and platforms, making it easy to manage 700 sov 2025 documents alongside your existing workflows. Whether you use CRM systems, cloud storage solutions, or project management tools, airSlate SignNow can seamlessly connect to enhance your document management process. This flexibility allows for a more streamlined operation.

-

Is airSlate SignNow secure for signing 700 sov 2025 documents?

Absolutely, airSlate SignNow prioritizes security, ensuring that all 700 sov 2025 documents are protected with advanced encryption and compliance with industry standards. The platform provides audit trails and authentication options to verify the identity of signers, giving you peace of mind when handling sensitive documents. Your data's security is our top priority.

-

Can I customize my 700 sov 2025 documents using airSlate SignNow?

Yes, airSlate SignNow allows you to customize your 700 sov 2025 documents easily. You can create templates that fit your specific needs, adding fields for signatures, dates, and other necessary information. This customization ensures that your documents are tailored to your business requirements, enhancing the overall signing experience.

Get more for Clear Print 700 SOV Maine Estate Tax Statem

- License agreement by and between wrangler apparel corp and form

- Form s 3 for the trizetto group inc sec

- Settlement agreement and mutual release ampampamp amendment to form

- Amendment no 1 to stock purchase agreement form

- Sf holdings group inc law insider form

- Metro sales inc v core consulting group llc et al no form

- Consolidated master deed for empire hills homeowners form

- Stock and asset purchase agreement sa louis dreyfus et form

Find out other Clear Print 700 SOV Maine Estate Tax Statem

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed