Ptax 329 Form 2009

What is the Ptax 329 Form

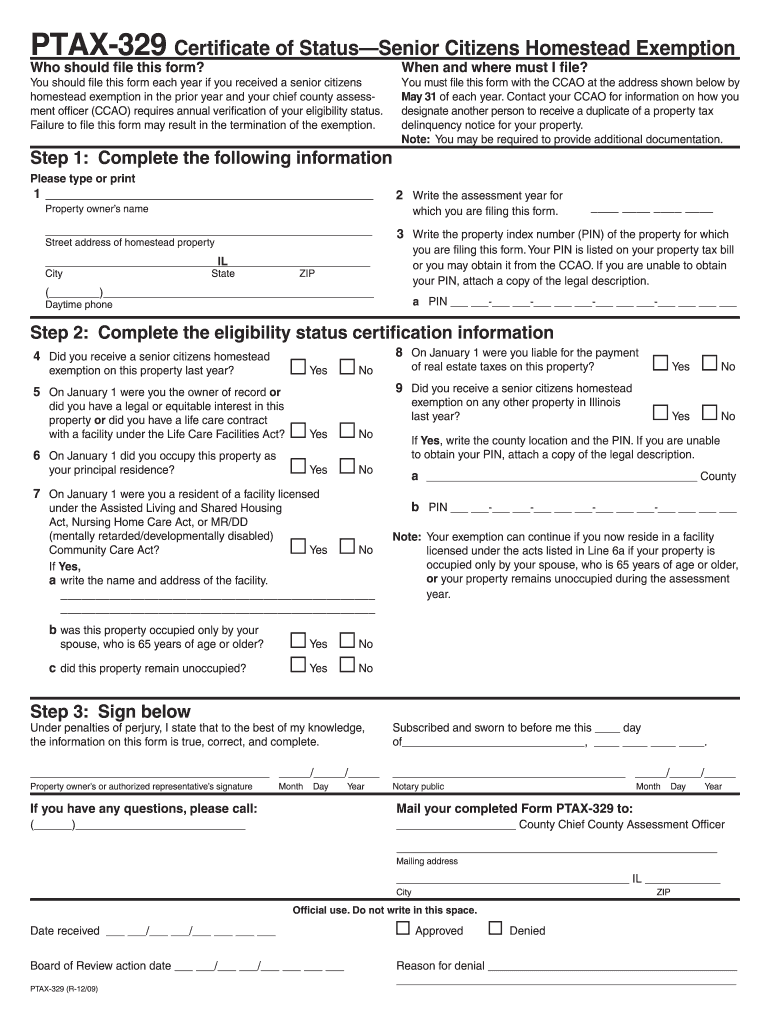

The Ptax 329 Form is a document used in the United States for property tax assessment purposes. It is typically required by local tax authorities to gather information about property ownership and valuation. This form plays a crucial role in determining the tax liability of property owners, ensuring that assessments are fair and accurate. Understanding the Ptax 329 Form is essential for homeowners and property investors alike, as it directly impacts their financial obligations related to property taxes.

How to use the Ptax 329 Form

Using the Ptax 329 Form involves several key steps that ensure accurate completion and submission. First, gather all necessary information about the property, including ownership details, location, and any relevant financial data. Next, carefully fill out each section of the form, ensuring that all information is accurate and complete. Once the form is filled out, review it for any errors before submitting it to the appropriate local tax authority. Proper use of the Ptax 329 Form can help avoid issues with property tax assessments and ensure compliance with local regulations.

Steps to complete the Ptax 329 Form

Completing the Ptax 329 Form requires attention to detail. Follow these steps for successful completion:

- Gather all relevant property information, including ownership documents and tax identification numbers.

- Access the Ptax 329 Form from your local tax authority's website or office.

- Fill out the form, ensuring that all sections are completed accurately, including property details and owner information.

- Review the completed form for any mistakes or omissions.

- Submit the form to your local tax authority by the specified deadline, either online, by mail, or in person.

Legal use of the Ptax 329 Form

The legal use of the Ptax 329 Form is essential for ensuring compliance with property tax laws. This form must be completed accurately and submitted within the designated time frame to avoid penalties. Local tax authorities rely on the information provided in the Ptax 329 Form to assess property values and calculate tax liabilities. Failure to use the form correctly can result in disputes over property assessments and potential legal consequences for property owners.

Form Submission Methods

The Ptax 329 Form can be submitted through various methods, depending on the local tax authority's regulations. Common submission methods include:

- Online submission via the local tax authority's website, which may offer a convenient way to file the form electronically.

- Mailing a printed copy of the completed form to the designated address provided by the tax authority.

- In-person submission at the local tax office, allowing for immediate feedback and assistance if needed.

Required Documents

When completing the Ptax 329 Form, certain documents may be required to support the information provided. These documents can include:

- Proof of property ownership, such as a deed or title.

- Previous tax assessments or statements related to the property.

- Any relevant financial documents that may affect property valuation, such as recent appraisals.

Quick guide on how to complete ptax 329 form

Conveniently Prepare Ptax 329 Form on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly and effortlessly. Manage Ptax 329 Form on any device with airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

How to Modify and Electronically Sign Ptax 329 Form with Ease

- Locate Ptax 329 Form and click on Get Form to initiate the process.

- Use the tools we offer to complete your document.

- Mark important sections of your documents or conceal sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method for sharing your form, whether via email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or disorganized files, tedious document searches, or mistakes that require reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Ptax 329 Form and ensure outstanding communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ptax 329 form

Create this form in 5 minutes!

How to create an eSignature for the ptax 329 form

How to make an eSignature for your PDF online

How to make an eSignature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The way to create an electronic signature from your smartphone

The best way to make an electronic signature for a PDF on iOS

The way to create an electronic signature for a PDF file on Android

People also ask

-

What is the Ptax 329 Form and why is it important?

The Ptax 329 Form is a crucial document used for property tax assessment in certain jurisdictions. It helps property owners report specific information related to their property, ensuring accurate tax calculations. Understanding the importance of the Ptax 329 Form is essential for homeowners to manage their tax obligations effectively.

-

How can airSlate SignNow help me with the Ptax 329 Form?

airSlate SignNow provides a user-friendly platform to easily eSign and send the Ptax 329 Form securely. Our solution simplifies the process, allowing you to complete and manage your property tax documents online without the hassle of printing or mailing. Experience a smooth and efficient way to handle your Ptax 329 Form.

-

What are the pricing options for using airSlate SignNow with the Ptax 329 Form?

airSlate SignNow offers several flexible pricing plans that cater to different business needs. Our cost-effective solutions ensure you get the best value whether you're an individual homeowner or a large organization handling multiple Ptax 329 Forms. Explore our pricing page for detailed information on each plan.

-

Can I integrate airSlate SignNow with other software for handling the Ptax 329 Form?

Yes, airSlate SignNow seamlessly integrates with a variety of popular software applications, enhancing your workflow for handling the Ptax 329 Form. Integrations with tools like Google Drive, Dropbox, and CRMs streamline document management, making it easier to access and organize your property tax documents.

-

Is it safe to use airSlate SignNow for the Ptax 329 Form?

Absolutely! airSlate SignNow prioritizes security and offers advanced encryption to protect your sensitive documents, including the Ptax 329 Form. Our platform complies with industry standards to ensure that your data remains confidential and secure throughout the signing process.

-

What features does airSlate SignNow offer for managing the Ptax 329 Form?

airSlate SignNow provides a suite of features designed for efficient document management. With capabilities like templating, customizable workflows, and real-time status tracking, you can manage your Ptax 329 Form effectively and ensure that all necessary steps are completed seamlessly.

-

How long does it take to complete the Ptax 329 Form with airSlate SignNow?

With airSlate SignNow, completing the Ptax 329 Form can take as little as a few minutes. The easy-to-use interface and streamlined signing process mean you can fill out, sign, and send your form quickly. This efficiency saves you time and allows you to focus on other important tasks.

Get more for Ptax 329 Form

Find out other Ptax 329 Form

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free