IL 8453, Illinois Individual Income Tax Electronic Filing Declaration 2020

What is the IL 8453, Illinois Individual Income Tax Electronic Filing Declaration

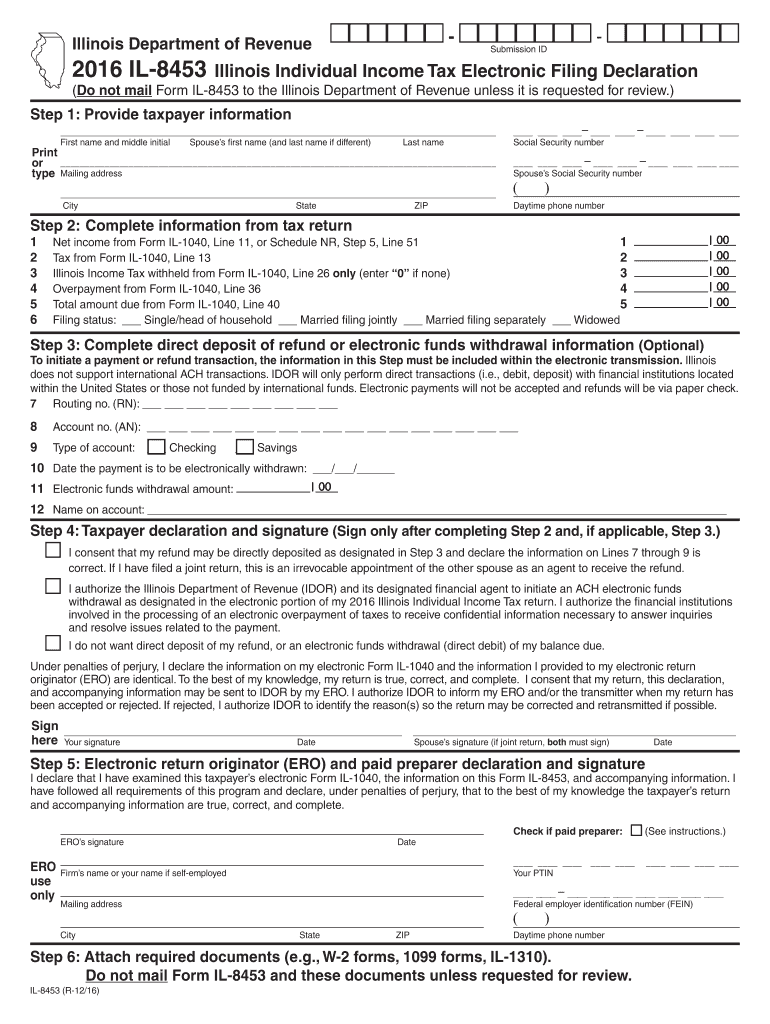

The IL 8453, Illinois Individual Income Tax Electronic Filing Declaration, is a crucial document for taxpayers in Illinois who file their income tax returns electronically. This form serves as a declaration that the taxpayer has completed their tax return and authorizes the electronic submission of their tax information to the Illinois Department of Revenue. It is an essential part of the e-filing process, ensuring that the taxpayer's identity is verified and that the return is submitted in compliance with state regulations.

How to use the IL 8453, Illinois Individual Income Tax Electronic Filing Declaration

To use the IL 8453, taxpayers must first complete their Illinois Individual Income Tax return using an approved e-filing software. Once the tax return is prepared, the IL 8453 form will be generated as part of the e-filing process. Taxpayers need to review the information on the form, sign it electronically, and submit it along with their tax return. This process ensures that the Illinois Department of Revenue receives both the tax return and the declaration in a secure manner.

Steps to complete the IL 8453, Illinois Individual Income Tax Electronic Filing Declaration

Completing the IL 8453 involves several key steps:

- Prepare your Illinois Individual Income Tax return using e-filing software.

- Review the generated IL 8453 form for accuracy.

- Electronically sign the form, which may involve entering your name and providing additional verification, depending on the software used.

- Submit the IL 8453 along with your tax return through the e-filing system.

- Keep a copy of the signed IL 8453 for your records.

Legal use of the IL 8453, Illinois Individual Income Tax Electronic Filing Declaration

The IL 8453 is legally binding when completed and signed electronically, provided that it meets the requirements set forth by the Illinois Department of Revenue. This includes compliance with eSignature laws, which ensure that electronic signatures are recognized as valid. The form must be filled out accurately, and the electronic signature must be executed in a manner that verifies the identity of the signer, ensuring the integrity of the tax filing process.

Key elements of the IL 8453, Illinois Individual Income Tax Electronic Filing Declaration

Several key elements are essential for the IL 8453 to be valid:

- The taxpayer's name and address must be clearly stated.

- The form must include the taxpayer's Social Security number or Individual Taxpayer Identification Number.

- It must contain the signature of the taxpayer, confirming the accuracy of the information provided.

- The date of signing is also required to establish the timeline of the filing.

- Any additional information required by the Illinois Department of Revenue must be included.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the IL 8453. Typically, the deadline for filing individual income tax returns in Illinois aligns with the federal tax filing deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important for taxpayers to stay informed about any changes to these dates to ensure timely filing and avoid penalties.

Quick guide on how to complete 2016 il 8453 illinois individual income tax electronic filing declaration

Effortlessly Prepare IL 8453, Illinois Individual Income Tax Electronic Filing Declaration on Any Device

The management of online documents has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to quickly create, modify, and eSign your documents without delays. Manage IL 8453, Illinois Individual Income Tax Electronic Filing Declaration on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to Modify and eSign IL 8453, Illinois Individual Income Tax Electronic Filing Declaration with Ease

- Obtain IL 8453, Illinois Individual Income Tax Electronic Filing Declaration and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your updates.

- Choose your preferred method for submitting your form—via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to misplaced or lost documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow manages your document management needs in just a few clicks from any device you select. Edit and eSign IL 8453, Illinois Individual Income Tax Electronic Filing Declaration while ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 il 8453 illinois individual income tax electronic filing declaration

Create this form in 5 minutes!

How to create an eSignature for the 2016 il 8453 illinois individual income tax electronic filing declaration

How to make an eSignature for your PDF in the online mode

How to make an eSignature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature from your smart phone

The best way to make an electronic signature for a PDF on iOS devices

The way to create an electronic signature for a PDF file on Android OS

People also ask

-

What is the IL 8453, Illinois Individual Income Tax Electronic Filing Declaration?

The IL 8453 is a crucial form for Illinois taxpayers that acts as an electronic filing declaration for your individual income tax return. By using this declaration, you confirm the authenticity of your electronic filing and support your submission through a secure process.

-

How does airSlate SignNow facilitate the process of submitting the IL 8453?

airSlate SignNow simplifies the process of submitting the IL 8453, Illinois Individual Income Tax Electronic Filing Declaration, by allowing users to eSign and send necessary documents quickly. Our platform ensures that the document is securely signed and submitted, enhancing your filing experience.

-

What features does airSlate SignNow offer for electronic filing?

airSlate SignNow offers a comprehensive set of features including electronic signatures, customizable templates, and tracking options to ensure that your IL 8453, Illinois Individual Income Tax Electronic Filing Declaration is handled efficiently. These features streamline the filing process and reduce the likelihood of errors.

-

Is airSlate SignNow cost-effective for filing the IL 8453?

Yes, airSlate SignNow is designed to be a cost-effective solution for individuals and businesses needing to file the IL 8453, Illinois Individual Income Tax Electronic Filing Declaration. Our competitive pricing ensures that you can manage your tax filings without breaking the bank.

-

Can I integrate airSlate SignNow with other tax software for filing the IL 8453?

Absolutely! airSlate SignNow can be integrated with various tax software applications, making it easier to manage your IL 8453, Illinois Individual Income Tax Electronic Filing Declaration alongside other tax-related processes. This integration helps streamline your workflow and enhances productivity.

-

What benefits does airSlate SignNow provide for tax professionals filing the IL 8453?

For tax professionals, airSlate SignNow offers enhanced collaboration features that allow for easy communication and document management when filing the IL 8453, Illinois Individual Income Tax Electronic Filing Declaration. This means you can handle multiple clients efficiently while retaining accuracy and security.

-

How secure is the electronic signing process for the IL 8453?

The electronic signing process for the IL 8453, Illinois Individual Income Tax Electronic Filing Declaration, is secured through advanced encryption and authentication methods implemented by airSlate SignNow. We prioritize your data security, ensuring that all electronic signatures are legally binding and protected.

Get more for IL 8453, Illinois Individual Income Tax Electronic Filing Declaration

Find out other IL 8453, Illinois Individual Income Tax Electronic Filing Declaration

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form