MICHIGAN Adjustments of Capital Gains and Losses MI 1041D Form

Understanding the Michigan Adjustments of Capital Gains and Losses MI 1041D

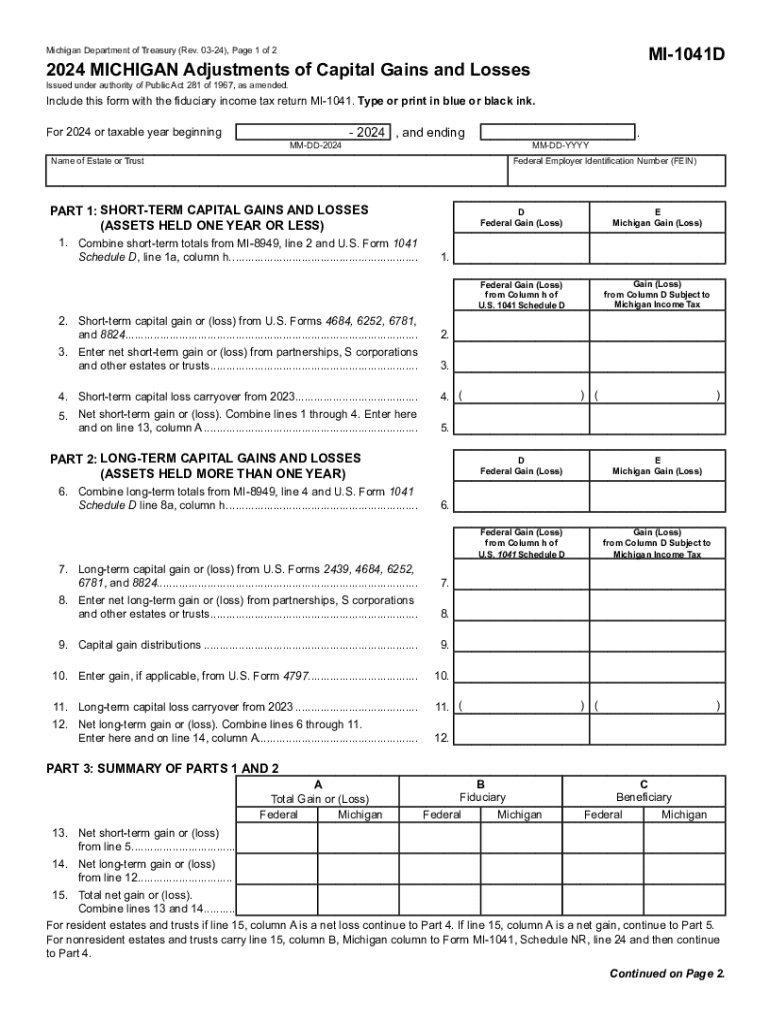

The Michigan Adjustments of Capital Gains and Losses MI 1041D is a tax form specifically designed for reporting capital gains and losses for estates and trusts in Michigan. This form allows taxpayers to adjust their federal capital gains and losses to align with Michigan tax regulations. Understanding this form is crucial for accurate tax reporting and compliance with state laws.

Taxpayers must consider the specific adjustments allowed by Michigan law, which may differ from federal guidelines. This form is essential for ensuring that any gains or losses are reported correctly, potentially affecting the overall tax liability for the estate or trust.

Steps to Complete the Michigan Adjustments of Capital Gains and Losses MI 1041D

Completing the Michigan 1041D form involves several key steps:

- Gather Required Information: Collect all necessary documentation regarding capital gains and losses, including sales records and any relevant federal forms.

- Fill Out the Form: Input the required information accurately, ensuring that all figures reflect the actual gains and losses incurred.

- Make Adjustments: Apply any state-specific adjustments as outlined in the instructions for the MI 1041D.

- Review for Accuracy: Double-check all entries for correctness to avoid errors that could lead to penalties.

- Submit the Form: Follow the submission guidelines for filing the form, either electronically or by mail.

Legal Use of the Michigan Adjustments of Capital Gains and Losses MI 1041D

The MI 1041D form is legally required for estates and trusts that have capital gains or losses to report under Michigan tax law. Proper use of this form ensures compliance with state regulations and helps prevent potential legal issues. Taxpayers should be aware of the legal ramifications of failing to report accurately, which can include fines or additional taxes owed.

Understanding the legal context of this form is essential for fiduciaries managing estates or trusts, as they are responsible for ensuring that all tax obligations are met in accordance with Michigan law.

Examples of Using the Michigan Adjustments of Capital Gains and Losses MI 1041D

Examples can clarify how to apply the MI 1041D in real scenarios:

For instance, if an estate sold a property for $300,000, having originally purchased it for $200,000, the capital gain would be $100,000. The fiduciary would report this gain on the MI 1041D, adjusting for any applicable Michigan-specific deductions or credits.

Another example involves a trust that incurred a capital loss from the sale of stocks. If the stocks were sold for $50,000, having been purchased for $70,000, the fiduciary would report a $20,000 loss, which could be adjusted according to Michigan tax laws.

Filing Deadlines for the Michigan Adjustments of Capital Gains and Losses MI 1041D

Timely filing of the MI 1041D is crucial to avoid penalties. The deadline for submitting this form typically aligns with the federal tax return due date, which is usually April 15 for most taxpayers. However, if the estate or trust operates on a fiscal year, the deadline may differ.

Taxpayers should also be aware of any extensions that may apply, allowing for additional time to file without incurring penalties. It is advisable to check the Michigan Department of Treasury's guidelines for any updates or changes to filing deadlines.

Required Documents for the Michigan Adjustments of Capital Gains and Losses MI 1041D

To complete the MI 1041D, several documents are necessary:

- Federal tax returns related to the estate or trust.

- Records of all capital transactions, including purchase and sale documents.

- Any supporting documentation for adjustments claimed, such as receipts for improvements or expenses related to the property sold.

- Previous years' tax returns, if applicable, to assist in determining carryover losses.

Having these documents organized and accessible will facilitate a smoother filing process and help ensure compliance with Michigan tax laws.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the michigan adjustments of capital gains and losses mi 1041d 771949259

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to Michigan capital?

airSlate SignNow is a powerful eSignature solution that enables businesses in Michigan capital to send and sign documents electronically. It streamlines the signing process, making it faster and more efficient for organizations in the region. With its user-friendly interface, airSlate SignNow is designed to meet the needs of businesses in Michigan capital.

-

What are the pricing options for airSlate SignNow in Michigan capital?

airSlate SignNow offers flexible pricing plans tailored for businesses in Michigan capital. Whether you're a small startup or a large enterprise, you can find a plan that fits your budget and needs. Our competitive pricing ensures that businesses in Michigan capital can access top-notch eSignature services without breaking the bank.

-

What features does airSlate SignNow offer for users in Michigan capital?

airSlate SignNow provides a range of features designed to enhance document management for users in Michigan capital. Key features include customizable templates, real-time tracking, and secure cloud storage. These tools help businesses in Michigan capital streamline their workflows and improve productivity.

-

How can airSlate SignNow benefit businesses in Michigan capital?

Businesses in Michigan capital can benefit from airSlate SignNow by reducing the time and costs associated with traditional document signing. The platform allows for quick turnaround times and eliminates the need for physical paperwork. This efficiency can lead to improved customer satisfaction and faster business operations in Michigan capital.

-

Does airSlate SignNow integrate with other software commonly used in Michigan capital?

Yes, airSlate SignNow integrates seamlessly with various software applications that businesses in Michigan capital may already be using. This includes popular CRM systems, cloud storage solutions, and productivity tools. These integrations help streamline processes and enhance overall efficiency for users in Michigan capital.

-

Is airSlate SignNow secure for businesses in Michigan capital?

Absolutely! airSlate SignNow prioritizes security, ensuring that all documents signed in Michigan capital are protected with advanced encryption and compliance with industry standards. Businesses can trust that their sensitive information remains confidential and secure while using our platform.

-

Can airSlate SignNow help with compliance in Michigan capital?

Yes, airSlate SignNow is designed to help businesses in Michigan capital maintain compliance with legal and regulatory requirements. Our eSignature solution adheres to the ESIGN Act and UETA, ensuring that all electronic signatures are legally binding. This compliance support is crucial for businesses operating in Michigan capital.

Get more for MICHIGAN Adjustments Of Capital Gains And Losses MI 1041D

- Legal problem we suggest that you consult an attorney form

- Wisconsin will instructions married with adult form

- Property 15 form

- Where you and your partner are making wills you would only include this paragraph in one form

- Probate without other evidence of execution form

- Wisconsin last will and testamentlegal will formsus

- Wisconsin being of legal age and of sound and disposing mind and memory and not acting form

- Under duress menace fraud or undue influence of any person do make declare and form

Find out other MICHIGAN Adjustments Of Capital Gains And Losses MI 1041D

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors