13 TOTAL RI TAX and CHECKOFF CONTRIBUTIONS 2019

What is the 13 TOTAL RI TAX AND CHECKOFF CONTRIBUTIONS

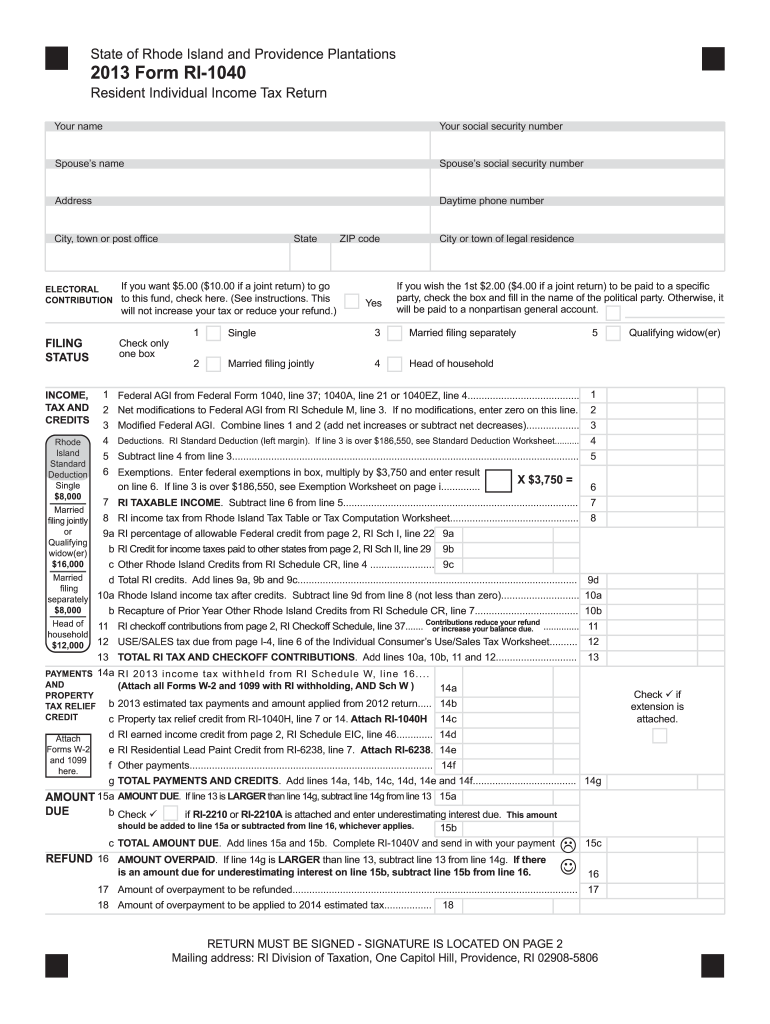

The 13 total RI tax and checkoff contributions form is a crucial document for Rhode Island taxpayers. It serves as a means for individuals to report their tax contributions and select specific checkoff options on their state tax returns. This form allows taxpayers to allocate a portion of their tax payments to various charitable organizations and state programs. Understanding the purpose and implications of this form is essential for accurate tax filing and ensuring that contributions are directed to the intended causes.

Steps to complete the 13 TOTAL RI TAX AND CHECKOFF CONTRIBUTIONS

Completing the 13 total RI tax and checkoff contributions form involves several key steps. First, ensure you have all relevant financial documents, including your income statements and previous tax returns. Next, accurately fill out the personal information section, including your name, address, and Social Security number. Following this, review the list of checkoff options available and select the ones you wish to support. Finally, double-check all entries for accuracy before submitting the form with your state tax return.

Legal use of the 13 TOTAL RI TAX AND CHECKOFF CONTRIBUTIONS

The legal use of the 13 total RI tax and checkoff contributions form is governed by state tax regulations. This form must be completed and submitted in compliance with Rhode Island tax laws to ensure that your contributions are valid. Proper execution of the form is critical for it to be recognized by the state as a legitimate allocation of funds. Additionally, maintaining accurate records of your contributions can provide necessary documentation in case of audits or inquiries by tax authorities.

Form Submission Methods (Online / Mail / In-Person)

Submitting the 13 total RI tax and checkoff contributions form can be done through various methods. Taxpayers have the option to file online through the Rhode Island Division of Taxation's website, which provides a secure and efficient way to submit forms. Alternatively, you can mail the completed form along with your tax return to the designated address provided by the state. For those who prefer a personal touch, in-person submissions can be made at local tax offices, ensuring that you receive immediate confirmation of receipt.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the 13 total RI tax and checkoff contributions form is essential for compliance. Typically, the deadline aligns with the standard state tax return due date, which is usually April fifteenth. However, taxpayers should be aware of any changes or extensions that may apply to specific tax years. Keeping track of these important dates helps ensure that contributions are made on time, avoiding potential penalties for late submissions.

Key elements of the 13 TOTAL RI TAX AND CHECKOFF CONTRIBUTIONS

The key elements of the 13 total RI tax and checkoff contributions form include personal identification information, income details, and specific checkoff options. Each section of the form is designed to capture essential data needed for accurate tax processing. The checkoff options allow taxpayers to indicate their preferred charitable contributions, making it clear where their funds will be directed. Understanding these elements is vital for ensuring that the form is filled out correctly and that contributions are allocated as intended.

Quick guide on how to complete 13 total ri tax and checkoff contributions

Prepare 13 TOTAL RI TAX AND CHECKOFF CONTRIBUTIONS effortlessly on any device

Online file management has become increasingly popular among organizations and individuals. It represents an ideal eco-friendly substitute for conventional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your paperwork swiftly without interruptions. Manage 13 TOTAL RI TAX AND CHECKOFF CONTRIBUTIONS on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign 13 TOTAL RI TAX AND CHECKOFF CONTRIBUTIONS without hassle

- Locate 13 TOTAL RI TAX AND CHECKOFF CONTRIBUTIONS and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to deliver your form, whether by email, text message (SMS), invite link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form navigation, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign 13 TOTAL RI TAX AND CHECKOFF CONTRIBUTIONS and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 13 total ri tax and checkoff contributions

Create this form in 5 minutes!

How to create an eSignature for the 13 total ri tax and checkoff contributions

The way to make an eSignature for a PDF document in the online mode

The way to make an eSignature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature right from your mobile device

The way to make an eSignature for a PDF document on iOS devices

The way to make an electronic signature for a PDF on Android devices

People also ask

-

What are the 13 TOTAL RI TAX AND CHECKOFF CONTRIBUTIONS?

The 13 TOTAL RI TAX AND CHECKOFF CONTRIBUTIONS refer to the various tax and checkoff options that Rhode Island taxpayers can contribute to when filing their tax returns. Understanding these contributions can signNowly affect your overall tax liability. airSlate SignNow can help streamline the documentation process involved in electing these contributions.

-

How does airSlate SignNow simplify the process related to 13 TOTAL RI TAX AND CHECKOFF CONTRIBUTIONS?

airSlate SignNow provides an intuitive platform that allows users to easily eSign and send documents related to the 13 TOTAL RI TAX AND CHECKOFF CONTRIBUTIONS. With this solution, businesses can ensure their contributions documentation is completed efficiently and securely, minimizing delays and errors.

-

What features does airSlate SignNow offer for managing 13 TOTAL RI TAX AND CHECKOFF CONTRIBUTIONS?

airSlate SignNow offers features such as customizable templates, automated workflows, and real-time tracking for managing 13 TOTAL RI TAX AND CHECKOFF CONTRIBUTIONS. This allows users to quickly prepare and send relevant documents while keeping track of their status throughout the submission process.

-

Is there a cost associated with using airSlate SignNow for 13 TOTAL RI TAX AND CHECKOFF CONTRIBUTIONS?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective. The pricing depends on the plan you choose, and each plan provides features that can enhance your efficiency in handling 13 TOTAL RI TAX AND CHECKOFF CONTRIBUTIONS.

-

Can airSlate SignNow integrate with other software for 13 TOTAL RI TAX AND CHECKOFF CONTRIBUTIONS?

Absolutely! airSlate SignNow offers integrations with a variety of software applications, making it easier to incorporate the solution into your existing workflow. This feature is particularly beneficial for managing 13 TOTAL RI TAX AND CHECKOFF CONTRIBUTIONS alongside other financial tools.

-

What benefits do I gain from using airSlate SignNow for 13 TOTAL RI TAX AND CHECKOFF CONTRIBUTIONS?

Using airSlate SignNow for 13 TOTAL RI TAX AND CHECKOFF CONTRIBUTIONS offers numerous benefits, including enhanced document security, reduced processing time, and seamless collaboration. These advantages help ensure that your contributions are managed efficiently and effectively.

-

How secure is airSlate SignNow when dealing with 13 TOTAL RI TAX AND CHECKOFF CONTRIBUTIONS?

airSlate SignNow takes security seriously and employs industry-standard encryption to protect all documents, including those related to 13 TOTAL RI TAX AND CHECKOFF CONTRIBUTIONS. Your sensitive data is safeguarded throughout the signing and submission process.

Get more for 13 TOTAL RI TAX AND CHECKOFF CONTRIBUTIONS

- Printable form to balance check book

- Pdf bipolar depressive mood charts printable form

- Vehicle repair release form

- Arrl vec 605 c cscsa form

- Icbc drivers medical form pdf

- Pet order form fox chase cancer center fccc

- Field trip or other off premises activity notification permission form

- Bellin health hipaa form fill and sign printable template online us

Find out other 13 TOTAL RI TAX AND CHECKOFF CONTRIBUTIONS

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney