Ri 1040 Fill in Form 2019

What is the Ri 1040 Fill In Form

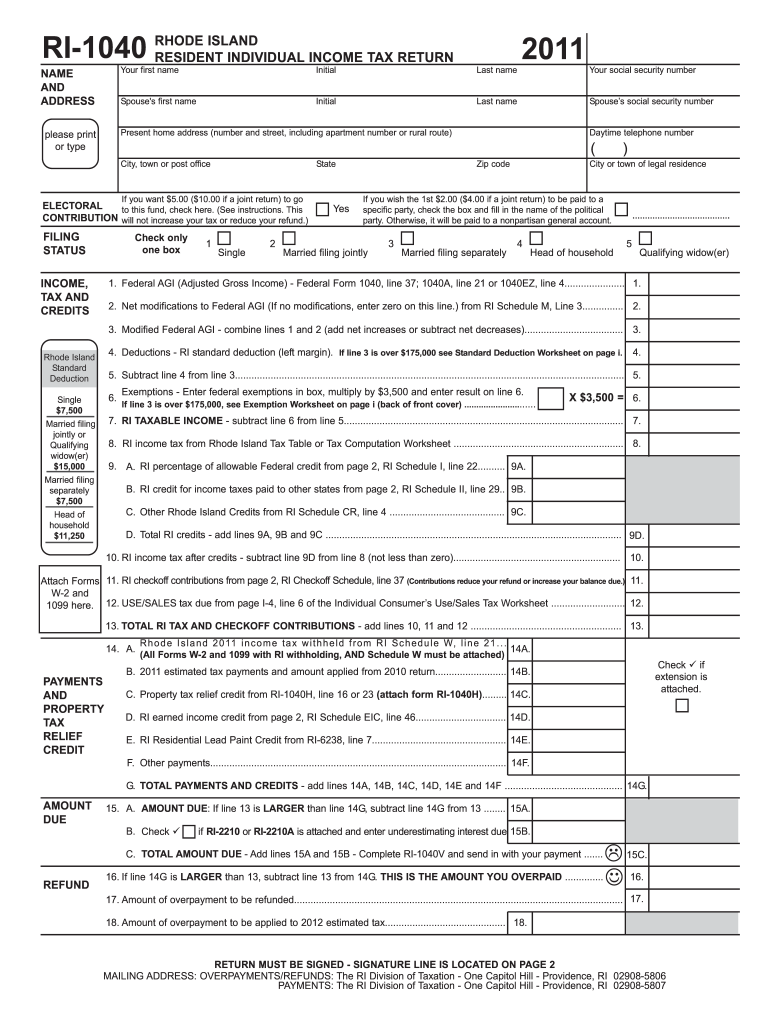

The Ri 1040 Fill In Form is a tax document used by residents of Rhode Island to report their income and calculate their state tax liability. This form is essential for individuals and businesses operating within the state, ensuring compliance with local tax regulations. It collects various financial information, including wages, interest, dividends, and other sources of income, allowing the state to assess the appropriate tax obligations of the filer.

How to use the Ri 1040 Fill In Form

Using the Ri 1040 Fill In Form involves several key steps. First, gather all necessary financial documents, such as W-2s, 1099s, and any other income statements. Next, carefully fill out the form by entering your personal information, including your name, address, and Social Security number. Report your income accurately and apply any deductions or credits for which you may qualify. Once completed, review the form for accuracy before submitting it to ensure compliance with state tax laws.

Steps to complete the Ri 1040 Fill In Form

Completing the Ri 1040 Fill In Form requires a methodical approach:

- Gather all relevant financial documents.

- Provide your personal information at the top of the form.

- Report all sources of income in the appropriate sections.

- Apply any deductions or credits, ensuring you have documentation to support your claims.

- Calculate your total tax liability based on the provided instructions.

- Sign and date the form before submission.

Legal use of the Ri 1040 Fill In Form

The Ri 1040 Fill In Form is legally binding when completed accurately and submitted by the filing deadline. It serves as an official record of income and tax obligations, and failure to file or inaccuracies can lead to penalties. To ensure legal compliance, filers must adhere to all instructions and guidelines provided by the Rhode Island Division of Taxation.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Ri 1040 Fill In Form. Typically, the form must be submitted by April fifteenth of each year for the preceding tax year. Extensions may be available, but it is important to file any necessary paperwork to avoid late penalties. Keeping track of these dates helps ensure timely compliance with state tax obligations.

Form Submission Methods (Online / Mail / In-Person)

The Ri 1040 Fill In Form can be submitted through various methods. Filers have the option to submit the form online via the Rhode Island Division of Taxation's website, which offers a secure and efficient way to file. Alternatively, the form can be mailed to the appropriate tax office or delivered in person. Each submission method has its own requirements and processing times, so it is advisable to choose the one that best fits your needs.

Required Documents

When completing the Ri 1040 Fill In Form, certain documents are necessary to ensure accurate reporting. Required documents typically include:

- W-2 forms from employers

- 1099 forms for other income sources

- Receipts for deductible expenses

- Any relevant tax credit documentation

Having these documents on hand will streamline the completion process and help avoid errors that could lead to delays or penalties.

Quick guide on how to complete ri 1040 fill in 2011 form

Effortlessly Prepare Ri 1040 Fill In Form on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as a fantastic environmentally friendly substitute for traditional printed and signed documents, allowing you to easily find the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to generate, edit, and electronically sign your documents rapidly and without difficulties. Manage Ri 1040 Fill In Form on any device with the airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to Modify and eSign Ri 1040 Fill In Form with Ease

- Find Ri 1040 Fill In Form and click Get Form to initiate the process.

- Utilize the tools we provide to fill out your document.

- Select important sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Ri 1040 Fill In Form and ensure seamless communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ri 1040 fill in 2011 form

Create this form in 5 minutes!

How to create an eSignature for the ri 1040 fill in 2011 form

The way to make an eSignature for your PDF file online

The way to make an eSignature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The way to make an electronic signature from your mobile device

The way to make an electronic signature for a PDF file on iOS

The way to make an electronic signature for a PDF file on Android devices

People also ask

-

What is the Ri 1040 Fill In Form and who needs it?

The Ri 1040 Fill In Form is a tax form used by residents of Rhode Island to report personal income to the state. Individuals who earn income in Rhode Island are required to complete this form to fulfill their tax obligations. Using airSlate SignNow makes the process of filling and signing this form easier and more efficient.

-

How can airSlate SignNow help me with the Ri 1040 Fill In Form?

AirSlate SignNow provides an intuitive platform for creating, filling, and eSigning the Ri 1040 Fill In Form. With our user-friendly interface, you can quickly navigate through the form, input your data, and securely sign it online. This eliminates the need for paper forms and streamlines the filing process.

-

Is there a cost associated with using airSlate SignNow for the Ri 1040 Fill In Form?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, including options for individual users and businesses. While there may be a small fee associated with using the platform, the benefits of time savings and convenience often outweigh the costs. You can review the pricing details on our website.

-

Can I save my progress on the Ri 1040 Fill In Form when using airSlate SignNow?

Absolutely! AirSlate SignNow allows you to save your progress on the Ri 1040 Fill In Form at any time. This means you can complete the form at your own pace, ensuring that all your information is accurate before submission. Saved forms can be accessed anytime for review or editing.

-

What security measures does airSlate SignNow implement for the Ri 1040 Fill In Form?

AirSlate SignNow prioritizes your security by implementing robust encryption protocols to protect your data when filling out the Ri 1040 Fill In Form. Our platform complies with industry standards to ensure that your sensitive information remains confidential and secure throughout the signing process.

-

Does airSlate SignNow integrate with other software for filing the Ri 1040 Fill In Form?

Yes, airSlate SignNow offers seamless integrations with various software applications that can enhance your experience when using the Ri 1040 Fill In Form. These integrations allow you to sync data and easily manage your documents across platforms, making tax filing more streamlined.

-

What are the benefits of using airSlate SignNow for the Ri 1040 Fill In Form compared to traditional methods?

Using airSlate SignNow for the Ri 1040 Fill In Form brings numerous benefits over traditional paper methods, including time efficiency, ease of use, and the ability to eSign documents digitally. This not only speeds up the filing process but also reduces the risk of errors and lost paperwork, making everyday tasks smoother.

Get more for Ri 1040 Fill In Form

- Mortgage amortization template form

- Yoga intake form template 337882907

- Philadelphia police report pdf form

- Maryland failure to pay rent form

- Disclaimer of inheritance form pdf

- Printable biodata form philippines pdf

- Colorado department of human services original application form

- Summer camp daily schedule sample form

Find out other Ri 1040 Fill In Form

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form