Rhode Island Tax After Allowable Federal Credit Before Allocation 2019

What is the Rhode Island Tax After Allowable Federal Credit Before Allocation

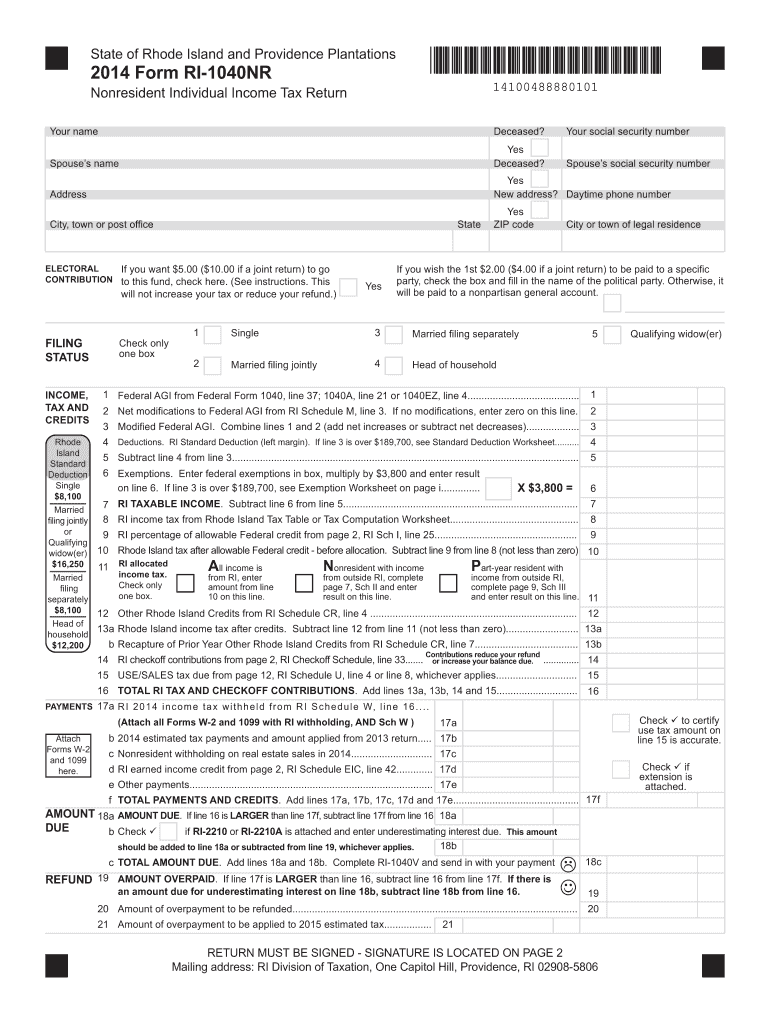

The Rhode Island Tax After Allowable Federal Credit Before Allocation refers to the state tax obligation that individuals or businesses must fulfill after accounting for any federal tax credits they are eligible for. This form is essential for ensuring that taxpayers accurately report their income and tax liability to the state of Rhode Island. It helps in determining the final amount owed to the state after considering any applicable federal credits that reduce the overall tax burden. Understanding this process is crucial for compliance and for optimizing tax obligations.

Steps to Complete the Rhode Island Tax After Allowable Federal Credit Before Allocation

Completing the Rhode Island Tax After Allowable Federal Credit Before Allocation involves several key steps. First, gather all necessary financial documents, including income statements and records of any federal credits claimed. Next, accurately calculate your total income and identify applicable federal credits. Following this, use the provided form to input your financial information, ensuring that all figures are correct and clearly documented. Finally, review the completed form for accuracy before submitting it to the appropriate state authority.

Legal Use of the Rhode Island Tax After Allowable Federal Credit Before Allocation

The Rhode Island Tax After Allowable Federal Credit Before Allocation is legally recognized as a valid document for tax reporting purposes. To ensure its legal standing, taxpayers must adhere to state regulations regarding the completion and submission of the form. This includes providing accurate information and maintaining compliance with relevant tax laws. Utilizing secure electronic signatures through platforms like signNow can enhance the validity of the submission, ensuring that it meets legal requirements for electronic documentation.

Required Documents

To complete the Rhode Island Tax After Allowable Federal Credit Before Allocation, several documents are necessary. These typically include:

- Income statements (W-2s, 1099s)

- Records of federal tax credits claimed

- Previous year’s tax returns for reference

- Any supporting documentation for deductions or exemptions

Having these documents ready will streamline the process and help ensure accurate reporting.

Filing Deadlines / Important Dates

Filing deadlines for the Rhode Island Tax After Allowable Federal Credit Before Allocation are critical for compliance. Typically, the deadline aligns with the federal tax filing date, which is usually April fifteenth. However, it is advisable to check for any updates or changes that may occur annually. Late submissions can result in penalties, so being aware of these dates is essential for all taxpayers.

Examples of Using the Rhode Island Tax After Allowable Federal Credit Before Allocation

Understanding how to apply the Rhode Island Tax After Allowable Federal Credit Before Allocation can clarify its practical use. For instance, an individual who has claimed a federal tax credit for education expenses would report their total income and then apply the federal credit to determine their state tax liability. Similarly, a small business owner claiming federal credits for research and development can use this form to accurately reflect their tax obligations after accounting for those credits. These examples illustrate the importance of the form in accurately calculating state tax responsibilities.

Quick guide on how to complete rhode island tax after allowable federal credit before allocation

Prepare Rhode Island Tax After Allowable Federal Credit Before Allocation effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to find the correct form and safely store it online. airSlate SignNow provides all the essential tools to create, modify, and eSign your documents rapidly without complications. Manage Rhode Island Tax After Allowable Federal Credit Before Allocation on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to adjust and eSign Rhode Island Tax After Allowable Federal Credit Before Allocation with ease

- Obtain Rhode Island Tax After Allowable Federal Credit Before Allocation and click on Get Form to begin.

- Take advantage of the tools provided to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form hunting, or mistakes that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Modify and eSign Rhode Island Tax After Allowable Federal Credit Before Allocation and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct rhode island tax after allowable federal credit before allocation

Create this form in 5 minutes!

How to create an eSignature for the rhode island tax after allowable federal credit before allocation

The way to make an eSignature for a PDF file in the online mode

The way to make an eSignature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature right from your smartphone

The way to make an eSignature for a PDF file on iOS devices

The way to make an electronic signature for a PDF on Android

People also ask

-

What is Rhode Island Tax After Allowable Federal Credit Before Allocation?

Rhode Island Tax After Allowable Federal Credit Before Allocation refers to the state tax amount owed after accounting for applicable federal tax credits. Understanding this concept is crucial for effective tax planning and compliance. Utilizing resources like airSlate SignNow can help you manage and sign necessary tax documents efficiently.

-

How does airSlate SignNow help with Rhode Island Tax After Allowable Federal Credit Before Allocation documentation?

airSlate SignNow streamlines the process of sending and eSigning documents related to Rhode Island Tax After Allowable Federal Credit Before Allocation. Our solution enables users to securely manage tax documents in a digital format, ensuring compliance and reducing processing time effectively. This allows you to focus on your financial strategies without being bogged down by paperwork.

-

What are the pricing plans for airSlate SignNow?

airSlate SignNow offers competitive pricing plans designed to suit various business needs. Our plans provide access to essential features that facilitate the management of tax documents, including those related to Rhode Island Tax After Allowable Federal Credit Before Allocation. You can choose from a monthly or annual subscription, ensuring you find the right option for your budget.

-

Is airSlate SignNow suitable for individual taxpayers in Rhode Island?

Yes, airSlate SignNow is suitable for individual taxpayers in Rhode Island who need assistance with documents related to Rhode Island Tax After Allowable Federal Credit Before Allocation. Our user-friendly platform simplifies the eSigning process, making it accessible for individuals handling their own tax affairs. We aim to empower users by providing a cost-effective solution for document management.

-

What features does airSlate SignNow offer for tax-related documents?

airSlate SignNow offers a range of features tailored for managing tax-related documents, including templates, secure eSigning, and automated reminders. These features are especially useful for taxpayers dealing with Rhode Island Tax After Allowable Federal Credit Before Allocation, helping ensure timely submission and compliance. With our solution, you can seamlessly handle all your tax documentation needs.

-

How do I integrate airSlate SignNow with other tools?

airSlate SignNow provides easy integrations with popular business tools, enhancing your efficiency in managing documents related to Rhode Island Tax After Allowable Federal Credit Before Allocation. You can connect our solution with cloud storage services, CRM platforms, and other productivity applications. This allows for a streamlined workflow, ensuring all your essential tools work together seamlessly.

-

What are the benefits of using airSlate SignNow for tax documentation?

Using airSlate SignNow for tax documentation offers several benefits, including enhanced security, faster processing times, and improved accessibility. You can efficiently handle documents pertinent to Rhode Island Tax After Allowable Federal Credit Before Allocation without worrying about the traditional paperwork hassles. This empowers users to maintain a smooth tax filing experience each year.

Get more for Rhode Island Tax After Allowable Federal Credit Before Allocation

Find out other Rhode Island Tax After Allowable Federal Credit Before Allocation

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement