Form Ri 1040 2019

What is the Form Ri 1040

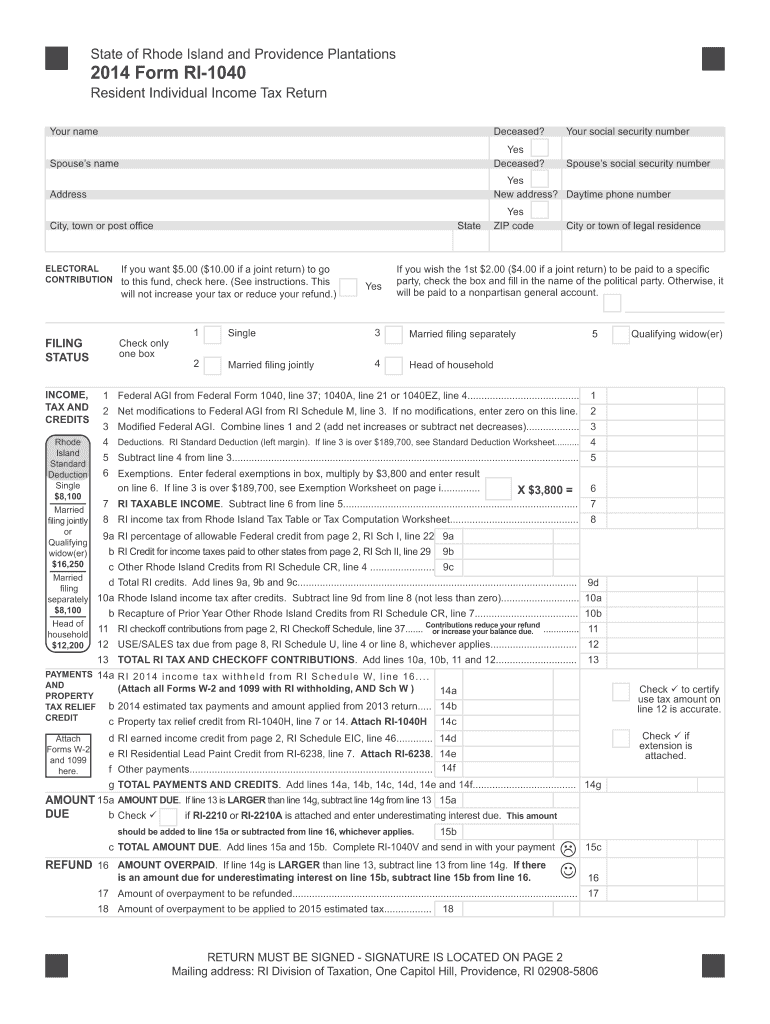

The Form Ri 1040 is a state-specific tax form used by residents of Rhode Island to report their income and calculate their state tax liability. This form is essential for individuals and businesses alike, as it ensures compliance with state tax laws. The information provided on this form is utilized by the Rhode Island Division of Taxation to assess the tax owed or the refund due to the taxpayer. Understanding the purpose and function of the Form Ri 1040 is crucial for accurate tax reporting and financial planning.

How to use the Form Ri 1040

Using the Form Ri 1040 involves several steps to ensure accurate completion and submission. Taxpayers should first gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, individuals will need to fill out the form with their personal information, income details, and applicable deductions. It is important to follow the instructions carefully to avoid errors that could lead to delays or penalties. Once completed, the form can be submitted either electronically or by mail, depending on the taxpayer's preference.

Steps to complete the Form Ri 1040

Completing the Form Ri 1040 requires a systematic approach to ensure all information is accurately reported. Here are the key steps:

- Gather Documentation: Collect all relevant income statements and deduction records.

- Fill Out Personal Information: Enter your name, address, and Social Security number at the top of the form.

- Report Income: Include all sources of income, such as wages, interest, and dividends.

- Claim Deductions: Identify any eligible deductions that apply to your situation, such as student loan interest or retirement contributions.

- Calculate Tax Liability: Use the provided tax tables to determine the amount of tax owed based on your income.

- Review and Sign: Double-check all entries for accuracy and sign the form before submission.

Legal use of the Form Ri 1040

The legal use of the Form Ri 1040 is governed by state tax laws and regulations. To ensure that the form is legally binding, it must be filled out accurately and submitted by the designated deadlines. Additionally, any signatures provided must be valid, as electronic signatures are recognized under certain conditions. Compliance with these legal requirements is essential to avoid potential penalties and ensure the proper processing of your tax return.

Filing Deadlines / Important Dates

Filing deadlines for the Form Ri 1040 are crucial for taxpayers to keep in mind. Typically, the deadline for submitting the form is April fifteenth of each year, aligning with federal tax deadlines. However, it is important to verify any changes or extensions that may apply. Taxpayers should also be aware of deadlines for estimated tax payments, which are generally due quarterly. Staying informed about these dates helps avoid late fees and ensures compliance with state tax regulations.

Who Issues the Form

The Form Ri 1040 is issued by the Rhode Island Division of Taxation. This state agency is responsible for administering tax laws and collecting revenue for the state. The Division of Taxation provides resources and support for taxpayers, including guidance on how to complete the form and access to necessary documentation. Understanding the role of this agency can help taxpayers navigate the filing process more effectively.

Quick guide on how to complete 2014 form ri 1040

Prepare Form Ri 1040 effortlessly on any device

Online document handling has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as it allows you to easily find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Manage Form Ri 1040 on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to alter and eSign Form Ri 1040 with ease

- Find Form Ri 1040 and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of the documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your adjustments.

- Select your preferred method of sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Form Ri 1040 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 form ri 1040

Create this form in 5 minutes!

How to create an eSignature for the 2014 form ri 1040

The way to make an eSignature for a PDF in the online mode

The way to make an eSignature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The way to make an eSignature straight from your smart phone

The way to make an eSignature for a PDF on iOS devices

The way to make an eSignature for a PDF document on Android OS

People also ask

-

What is Form Ri 1040, and why do I need it?

Form Ri 1040 is a tax form used by residents of Rhode Island to report their personal income to the state. It's essential for accurately declaring your earnings and determining your tax liability. By using airSlate SignNow, you can easily eSign and submit your Form Ri 1040, ensuring a smooth and efficient filing process.

-

How does airSlate SignNow simplify the process of filling out Form Ri 1040?

airSlate SignNow streamlines the process of filling out Form Ri 1040 by providing an intuitive platform for electronic signatures and document management. Users can easily upload their Form Ri 1040, fill it out online, and securely sign it without the hassle of printing and scanning. This not only saves time but also minimizes the risk of errors.

-

Is airSlate SignNow cost-effective for signing Form Ri 1040?

Yes, airSlate SignNow offers a cost-effective solution for businesses and individuals needing to sign Form Ri 1040. With multiple pricing plans designed to suit different needs, you can choose the option that best fits your budget. The savings on paper and postal costs can quickly justify the expense of using the service.

-

Can I integrate airSlate SignNow with other accounting software for managing Form Ri 1040?

Absolutely! airSlate SignNow integrates with various accounting software solutions, allowing you to manage Form Ri 1040 seamlessly alongside your other financial documents. This integration helps streamline your workflow, ensuring that all related tasks, from eSigning to documentation, are efficiently handled in one place.

-

What security measures does airSlate SignNow have for submitting Form Ri 1040?

When using airSlate SignNow to submit Form Ri 1040, you can rest assured that your documents are protected by industry-standard encryption and security protocols. The platform ensures that your data is safeguarded against unauthorized access, making it a reliable choice for your sensitive tax documents.

-

Does airSlate SignNow offer support for completing Form Ri 1040?

Yes, airSlate SignNow provides comprehensive support for users who need assistance completing their Form Ri 1040. Our customer service team is available to guide you through the process and answer any queries you may have, ensuring that you can confidently eSign and file your tax form.

-

How long does it take to complete and eSign Form Ri 1040 using airSlate SignNow?

Completing and eSigning Form Ri 1040 with airSlate SignNow is quick and efficient. Most users can fill out the form and eSign it in just a few minutes, depending on the complexity of their tax situation. This speedy process allows you to focus on what matters most—getting your taxes filed on time.

Get more for Form Ri 1040

Find out other Form Ri 1040

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online