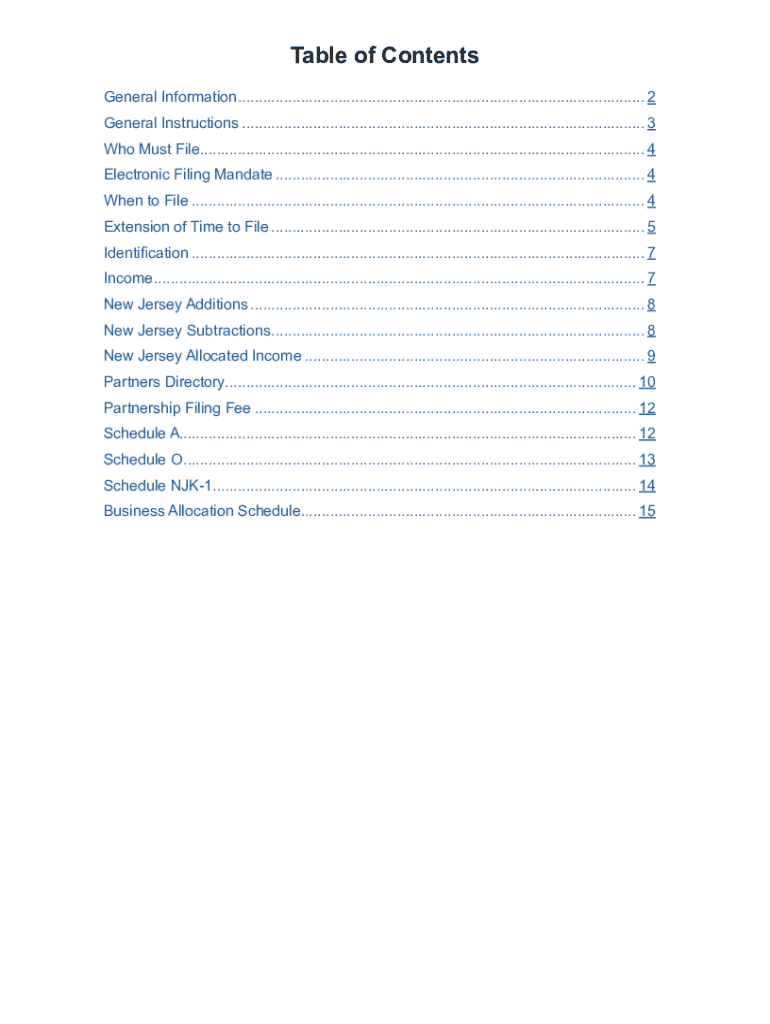

NJ 1065 Instructions Form

What is the NJ 1065 Instructions

The NJ 1065 Instructions provide essential guidance for partnerships operating in New Jersey. This document outlines the necessary steps for completing the New Jersey Partnership Return (Form NJ-1065), which is required for partnerships to report income, deductions, and credits. It is crucial for ensuring compliance with state tax laws and accurately reporting the financial activities of the partnership.

Steps to complete the NJ 1065 Instructions

Completing the NJ 1065 Instructions involves several key steps:

- Gather all necessary financial documents, including income statements and expense records.

- Review the specific instructions for each section of the NJ-1065 form to understand what information is required.

- Complete the form accurately, ensuring all calculations are correct and all required fields are filled out.

- Double-check the form for any errors or omissions before submission.

- Submit the completed form by the designated deadline to avoid penalties.

Legal use of the NJ 1065 Instructions

The NJ 1065 Instructions serve as a legal framework for partnerships in New Jersey to report their income and expenses. Adhering to these instructions is essential for compliance with state tax regulations. Failure to follow the guidelines may result in penalties or legal repercussions. It is important for partnerships to maintain accurate records and ensure that all information reported aligns with state laws.

Filing Deadlines / Important Dates

Partnerships must be aware of specific filing deadlines associated with the NJ 1065 form. Typically, the return is due on the fifteenth day of the fourth month following the end of the partnership's tax year. For partnerships operating on a calendar year, this means the form is due by April 15. It is essential to mark these dates on your calendar to ensure timely submission and avoid late fees.

Required Documents

When completing the NJ 1065 Instructions, partnerships must have several documents on hand:

- Financial statements, including profit and loss statements.

- Records of all income and expenses incurred during the tax year.

- Any supporting documentation for deductions and credits claimed.

- Partner information, including Social Security numbers or Employer Identification Numbers.

Who Issues the Form

The NJ 1065 form is issued by the New Jersey Division of Taxation. This governmental body is responsible for overseeing tax compliance and ensuring that partnerships adhere to state tax laws. It is important for partnerships to refer to the official guidelines provided by the Division of Taxation to ensure they are using the most current version of the form and instructions.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nj 1065 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the instructions njk 1 for using airSlate SignNow?

The instructions njk 1 for using airSlate SignNow involve a straightforward process of uploading your document, adding signers, and sending it for eSignature. Our platform provides step-by-step guidance to ensure you can easily navigate through the signing process. Additionally, you can access tutorials and support resources for further assistance.

-

How much does airSlate SignNow cost?

Pricing for airSlate SignNow varies based on the plan you choose, with options designed to fit different business needs. The instructions njk 1 for pricing can be found on our website, where you can compare features and select the best plan for your organization. We also offer a free trial to help you evaluate our services.

-

What features does airSlate SignNow offer?

airSlate SignNow includes a variety of features such as document templates, real-time tracking, and secure cloud storage. The instructions njk 1 for accessing these features are clearly outlined in our user guide. These tools are designed to streamline your document management and enhance productivity.

-

How can airSlate SignNow benefit my business?

Using airSlate SignNow can signNowly improve your business's efficiency by reducing the time spent on document signing and management. The instructions njk 1 highlight how our platform can help you save costs and improve workflow. By automating the signing process, you can focus more on your core business activities.

-

Does airSlate SignNow integrate with other applications?

Yes, airSlate SignNow offers integrations with various applications such as Google Drive, Salesforce, and Microsoft Office. The instructions njk 1 for setting up these integrations are available in our support section. This allows you to seamlessly incorporate eSigning into your existing workflows.

-

Is airSlate SignNow secure for sensitive documents?

Absolutely, airSlate SignNow prioritizes the security of your documents with advanced encryption and compliance with industry standards. The instructions njk 1 for ensuring document security are part of our user guidelines. You can trust that your sensitive information is protected throughout the signing process.

-

Can I customize my documents in airSlate SignNow?

Yes, airSlate SignNow allows you to customize your documents with various fields, branding options, and templates. The instructions njk 1 for document customization are easy to follow, enabling you to create a personalized signing experience for your clients. This feature enhances your brand's professionalism.

Get more for NJ 1065 Instructions

- Criminal procedure rule 8 assignment of counselmassgov form

- Punctual appearances form

- Negligent drivingdui laws in washington statejonathan form

- Fillable online sacred heart of mary girls school fax form

- Defendants name case no form

- What is restitution who is eligible for victim compensation form

- To the above named defendant form

- Petition for certificate ampamp order of discharge whatcom county form

Find out other NJ 1065 Instructions

- How To Sign Arkansas Collateral Debenture

- Sign Arizona Bill of Lading Simple

- Sign Oklahoma Bill of Lading Easy

- Can I Sign Massachusetts Credit Memo

- How Can I Sign Nevada Agreement to Extend Debt Payment

- Sign South Dakota Consumer Credit Application Computer

- Sign Tennessee Agreement to Extend Debt Payment Free

- Sign Kentucky Outsourcing Services Contract Simple

- Sign Oklahoma Outsourcing Services Contract Fast

- How Can I Sign Rhode Island Outsourcing Services Contract

- Sign Vermont Outsourcing Services Contract Simple

- Sign Iowa Interview Non-Disclosure (NDA) Secure

- Sign Arkansas Resignation Letter Simple

- Sign California Resignation Letter Simple

- Sign Florida Leave of Absence Agreement Online

- Sign Florida Resignation Letter Easy

- Sign Maine Leave of Absence Agreement Safe

- Sign Massachusetts Leave of Absence Agreement Simple

- Sign Connecticut Acknowledgement of Resignation Fast

- How To Sign Massachusetts Resignation Letter