Sba 7a Borrower Information Form 2025-2026

Understanding the Sba 7a Borrower Information Form

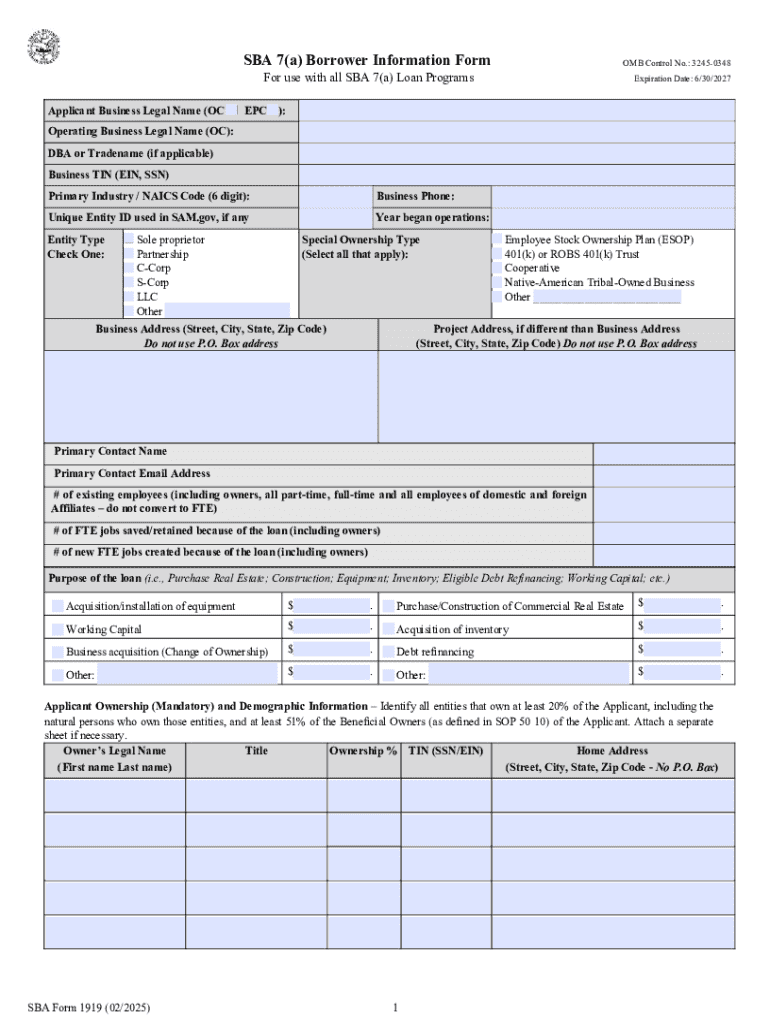

The Sba 7a Borrower Information Form is a crucial document for individuals and businesses seeking financing through the Small Business Administration's (SBA) 7(a) loan program. This form collects essential information about the borrower, including personal details, business structure, and financial history. Completing this form accurately is vital for the loan application process, as it helps lenders assess the borrower's creditworthiness and eligibility for the loan. Understanding the purpose and requirements of this form can significantly enhance the chances of securing funding.

Steps to Complete the Sba 7a Borrower Information Form

Filling out the Sba 7a Borrower Information Form involves several key steps to ensure accuracy and completeness. Start by gathering necessary documentation, such as personal identification, business financial statements, and tax returns. Next, carefully fill in the required fields, which typically include:

- Personal information of the borrower, including name, address, and Social Security number.

- Details about the business, including its structure, ownership, and purpose.

- Financial information, including income, expenses, and existing debts.

After completing the form, review all entries for accuracy. Any discrepancies or missing information can delay the application process. Once verified, the form can be submitted to the lender along with any additional required documentation.

Key Elements of the Sba 7a Borrower Information Form

Several key elements must be included in the Sba 7a Borrower Information Form to ensure it meets the requirements set forth by the SBA. These elements typically encompass:

- Borrower Identification: Full name, address, and contact information.

- Business Details: Type of business entity, ownership structure, and business location.

- Financial Information: Annual revenue, net profit, and existing liabilities.

- Purpose of the Loan: A clear explanation of how the funds will be used to support the business.

Providing comprehensive and accurate information in these sections is essential for a successful loan application.

Obtaining the Sba 7a Borrower Information Form

The Sba 7a Borrower Information Form can be obtained through various channels. It is typically available on the official SBA website or directly from participating lenders. Many lenders provide the form as part of their loan application package. Additionally, some financial institutions may offer the form in a digital format, allowing for easier access and completion. Ensure that you are using the most current version of the form to avoid any issues during the application process.

Legal Use of the Sba 7a Borrower Information Form

The Sba 7a Borrower Information Form must be used in compliance with all relevant legal and regulatory requirements. This includes ensuring that all information provided is truthful and accurate. Misrepresentation or falsification of information can lead to serious consequences, including denial of the loan application or legal penalties. It is important for borrowers to understand their obligations under the law and to seek assistance if needed to ensure compliance throughout the borrowing process.

Eligibility Criteria for the Sba 7a Borrower Information Form

To qualify for the SBA 7(a) loan program, borrowers must meet specific eligibility criteria outlined by the SBA. These criteria generally include:

- The business must be a for-profit entity operating in the United States.

- The business must meet the SBA's size standards, which vary by industry.

- The borrower must have a reasonable amount of equity in the business.

- The borrower must demonstrate the ability to repay the loan.

Understanding these eligibility requirements is essential for potential borrowers to assess their suitability for the loan program before completing the form.

Handy tips for filling out Sba 7a Borrower Information Form online

Quick steps to complete and e-sign Sba 7a Borrower Information Form online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing documents can be. Obtain access to a HIPAA and GDPR compliant solution for optimum simpleness. Use signNow to e-sign and send out Sba 7a Borrower Information Form for e-signing.

Create this form in 5 minutes or less

Find and fill out the correct sba 7a borrower information form 779641687

Create this form in 5 minutes!

How to create an eSignature for the sba 7a borrower information form 779641687

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Sba 7a Borrower Information Form?

The Sba 7a Borrower Information Form is a crucial document required for businesses seeking SBA 7(a) loans. It collects essential information about the borrower, including business details and financial history, to facilitate the loan approval process. Completing this form accurately is vital for a smooth application experience.

-

How can airSlate SignNow help with the Sba 7a Borrower Information Form?

airSlate SignNow provides an efficient platform for businesses to complete and eSign the Sba 7a Borrower Information Form. Our user-friendly interface allows for easy document management and ensures that all necessary signatures are collected promptly. This streamlines the loan application process, saving you time and effort.

-

Is there a cost associated with using airSlate SignNow for the Sba 7a Borrower Information Form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our plans are designed to be cost-effective, providing excellent value for the features offered, including the ability to manage the Sba 7a Borrower Information Form efficiently. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for the Sba 7a Borrower Information Form?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking specifically for the Sba 7a Borrower Information Form. These features enhance the user experience by ensuring that documents are completed accurately and efficiently. Additionally, our platform allows for easy collaboration among team members.

-

Can I integrate airSlate SignNow with other tools for the Sba 7a Borrower Information Form?

Absolutely! airSlate SignNow offers integrations with various business tools and applications, making it easy to manage the Sba 7a Borrower Information Form alongside your existing workflows. This flexibility allows you to streamline your processes and enhance productivity by connecting with tools you already use.

-

What are the benefits of using airSlate SignNow for the Sba 7a Borrower Information Form?

Using airSlate SignNow for the Sba 7a Borrower Information Form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are stored securely and are easily accessible. Additionally, the eSigning feature speeds up the approval process, allowing you to focus on growing your business.

-

Is airSlate SignNow secure for handling the Sba 7a Borrower Information Form?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling the Sba 7a Borrower Information Form. We utilize advanced encryption and security protocols to protect your sensitive information. You can trust that your documents are secure while using our platform.

Get more for Sba 7a Borrower Information Form

- Laboratory result form template

- Surplus lines statement sl 8 form and instruction professional

- Member claims mc 0010 form

- Ca 7 llc form

- Oklahoma license horse racing form

- The childrens hospital collection labeling and transport of form

- Member appointment form

- Email new jersey state disability claim your standard form

Find out other Sba 7a Borrower Information Form

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF