Instructions for Form 1065

What are the instructions for Form 1065?

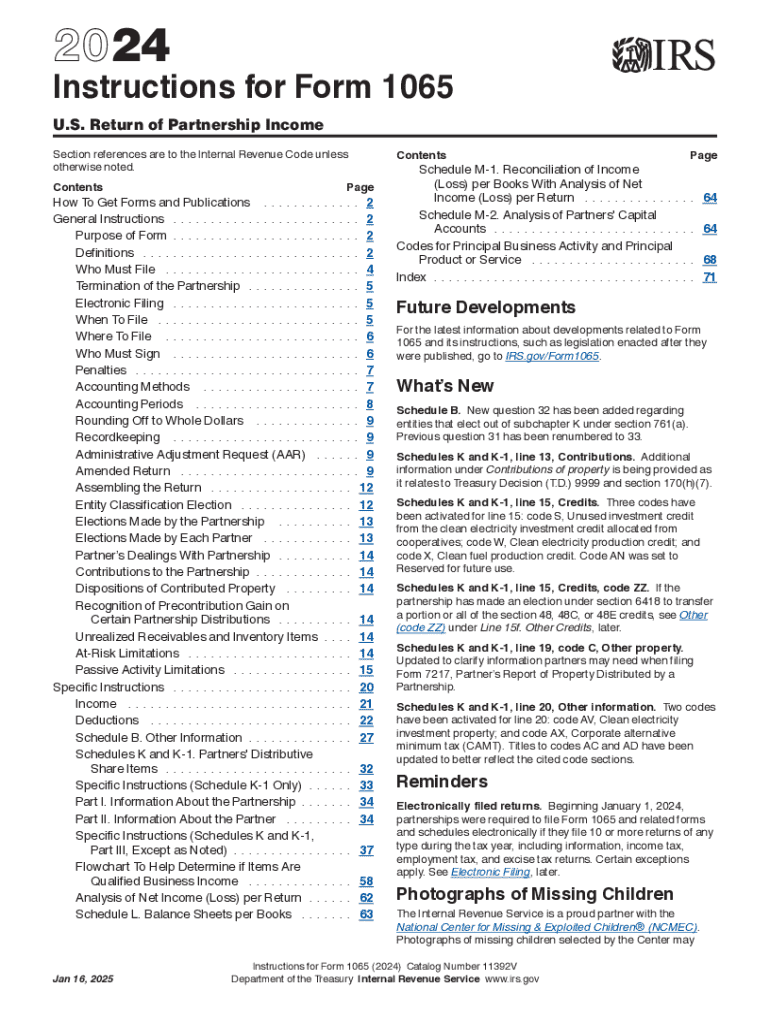

Form 1065 is used by partnerships to report income, deductions, gains, losses, and other important financial information to the IRS. The IRS 1065 instructions provide detailed guidance on how to complete this form accurately. These instructions cover various aspects, including definitions of key terms, eligibility criteria for filing, and specific reporting requirements for different types of income and expenses. Understanding these instructions is crucial for ensuring compliance with federal tax regulations.

Steps to complete Form 1065 instructions

Completing the Form 1065 instruction requires several key steps:

- Gather necessary financial documents, including income statements, expense reports, and previous tax returns.

- Review the instructions carefully to understand the specific sections of the form.

- Complete the form by entering information in the appropriate fields, ensuring accuracy and consistency.

- Attach any required schedules or additional documentation as specified in the instructions.

- Review the completed form for any errors or omissions before submission.

Filing deadlines and important dates for Form 1065

Timely filing of Form 1065 is essential to avoid penalties. Generally, the 1065 form is due on the 15th day of the third month following the end of the partnership's tax year. For partnerships operating on a calendar year, this means the due date is March 15. If additional time is needed, partnerships can file for an extension, which typically allows for an additional six months. However, it is important to note that an extension to file does not extend the time to pay any taxes owed.

Required documents for Form 1065

When preparing to file Form 1065, certain documents are necessary to ensure accurate reporting. These include:

- Partnership financial statements, including income and balance sheets.

- Records of all income received and expenses incurred during the tax year.

- Details of each partner's contributions and distributions.

- Any relevant schedules or forms that support the information reported on Form 1065.

Who issues Form 1065?

The IRS (Internal Revenue Service) is the authoritative body that issues Form 1065. This form is specifically designed for partnerships to report their financial activities and ensure compliance with federal tax laws. It is essential for partnerships to use the most current version of the form and adhere to the accompanying instructions provided by the IRS.

Penalties for non-compliance with Form 1065

Failure to file Form 1065 on time or providing inaccurate information can result in significant penalties. The IRS may impose a penalty for each month the form is late, up to a maximum amount. Additionally, inaccuracies in reporting can lead to further scrutiny and potential audits. It is important for partnerships to take the filing of this form seriously to avoid unnecessary financial repercussions.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 1065

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the form 1065 instructions for filing partnership tax returns?

The form 1065 instructions provide detailed guidance on how to complete the partnership tax return. They outline the necessary information required, including income, deductions, and partner details. Following these instructions ensures compliance with IRS regulations and helps avoid potential penalties.

-

How can airSlate SignNow assist with form 1065 instructions?

airSlate SignNow simplifies the process of completing and submitting form 1065 by allowing users to eSign documents securely. Our platform provides templates and guidance to help you fill out the form accurately. This streamlines the filing process and ensures that you adhere to the form 1065 instructions.

-

What features does airSlate SignNow offer for managing form 1065?

airSlate SignNow offers features such as document templates, eSignature capabilities, and real-time collaboration. These tools help you manage the preparation and submission of form 1065 efficiently. By utilizing these features, you can ensure that all necessary information is included according to the form 1065 instructions.

-

Is there a cost associated with using airSlate SignNow for form 1065 instructions?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan provides access to essential features for managing documents, including those related to form 1065 instructions. You can choose a plan that fits your budget while ensuring compliance with tax requirements.

-

Can I integrate airSlate SignNow with other software for form 1065 instructions?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, enhancing your workflow for managing form 1065 instructions. This integration allows for easy data transfer and ensures that your documents are always up-to-date and compliant with IRS guidelines.

-

What are the benefits of using airSlate SignNow for form 1065 instructions?

Using airSlate SignNow for form 1065 instructions offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows for quick eSigning and document sharing, which can save you time during tax season. Additionally, you can rest assured that your documents are securely stored and easily accessible.

-

How does airSlate SignNow ensure compliance with form 1065 instructions?

airSlate SignNow is designed to help users comply with form 1065 instructions by providing templates and step-by-step guidance. Our platform also includes features that allow for easy tracking of document status and reminders for important deadlines. This ensures that you stay on top of your filing requirements.

Get more for Instructions For Form 1065

- Living trust for husband and wife with no children new mexico form

- New mexico living trust form

- Living trust for individual who is single divorced or widow or widower with children new mexico form

- Living trust for husband and wife with one child new mexico form

- Living trust for husband and wife with minor and or adult children new mexico form

- Nm trust form

- Living trust property record new mexico form

- Financial account transfer to living trust new mexico form

Find out other Instructions For Form 1065

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online

- Can I Electronic signature Delaware General Power of Attorney Template

- Can I Electronic signature Michigan General Power of Attorney Template

- Can I Electronic signature Minnesota General Power of Attorney Template

- How Do I Electronic signature California Distributor Agreement Template

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement