Estimated Tax Payments See Instructions 2011

What is the Estimated Tax Payments see Instructions

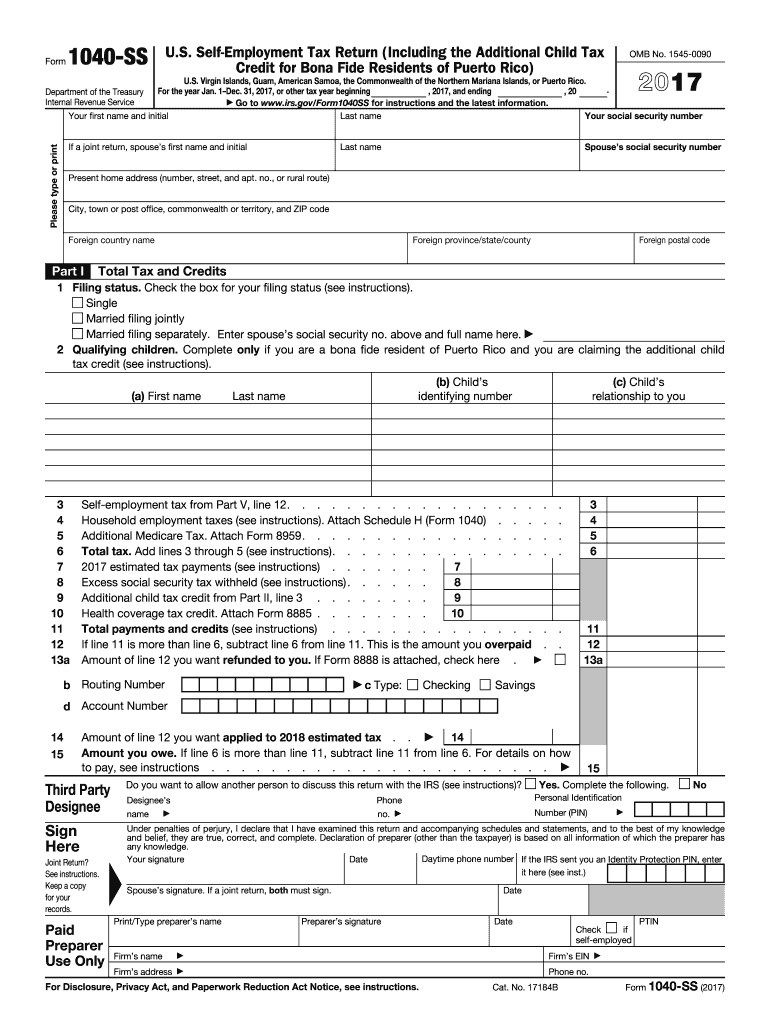

The Estimated Tax Payments see Instructions form is a crucial document for taxpayers who need to estimate their tax liability for the year. This form provides guidelines on how to calculate and submit estimated tax payments, which are typically required for individuals who have income not subject to withholding, such as self-employed individuals or those with significant investment income. Understanding this form is essential for ensuring compliance with IRS regulations and avoiding potential penalties.

Steps to complete the Estimated Tax Payments see Instructions

Completing the Estimated Tax Payments see Instructions form involves several key steps:

- Gather necessary information: Collect your income details, deductions, and credits to accurately estimate your tax liability.

- Calculate your estimated tax: Use the provided worksheets to determine your expected tax for the year based on your income and deductions.

- Determine payment amounts: Divide your estimated tax by the number of payment periods to find out how much you need to pay each quarter.

- Choose a payment method: Decide whether to submit your payments online, by mail, or in person.

- Complete the form: Fill out the Estimated Tax Payments see Instructions form accurately, ensuring all calculations are correct.

Legal use of the Estimated Tax Payments see Instructions

The Estimated Tax Payments see Instructions form is legally binding when completed correctly and submitted to the IRS. It is essential to follow the guidelines provided in the form to ensure that your estimated payments are accepted. Compliance with IRS regulations helps avoid penalties for underpayment or late payment of taxes. Additionally, using a reliable e-signature solution can enhance the legal standing of your submitted documents.

Filing Deadlines / Important Dates

Filing deadlines for estimated tax payments are critical for compliance. Generally, estimated tax payments are due four times a year, on the following dates:

- April 15 for the first quarter

- June 15 for the second quarter

- September 15 for the third quarter

- January 15 of the following year for the fourth quarter

Taxpayers should be aware that if a due date falls on a weekend or holiday, the deadline may be extended to the next business day.

Who Issues the Form

The Estimated Tax Payments see Instructions form is issued by the Internal Revenue Service (IRS). This federal agency is responsible for tax collection and enforcement of tax laws in the United States. Taxpayers can access the form and its instructions directly from the IRS website or through authorized tax professionals.

Examples of using the Estimated Tax Payments see Instructions

There are various scenarios where the Estimated Tax Payments see Instructions form is applicable:

- A self-employed individual who earns income from freelance work needs to estimate their tax liability to avoid penalties.

- A retiree receiving pension income may need to make estimated payments if their withholding is insufficient.

- Investors with significant capital gains must estimate their taxes to account for income not subject to withholding.

Each of these examples illustrates the importance of accurately estimating tax payments to ensure compliance and avoid financial penalties.

Quick guide on how to complete 2017 estimated tax payments see instructions

Effortlessly Prepare Estimated Tax Payments see Instructions on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal environmentally-friendly substitute for conventional printed and signed documents, as you can easily find the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any delays. Manage Estimated Tax Payments see Instructions on any device using the airSlate SignNow applications for Android or iOS and enhance your document-driven processes today.

How to Modify and eSign Estimated Tax Payments see Instructions Effortlessly

- Find Estimated Tax Payments see Instructions and click Get Form to begin.

- Utilize the tools available to complete your document.

- Select important sections of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet-ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred delivery method for your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Estimated Tax Payments see Instructions and ensure seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2017 estimated tax payments see instructions

Create this form in 5 minutes!

How to create an eSignature for the 2017 estimated tax payments see instructions

The best way to create an electronic signature for a PDF document online

The best way to create an electronic signature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The best way to generate an eSignature from your smart phone

The way to create an eSignature for a PDF document on iOS

The best way to generate an eSignature for a PDF file on Android OS

People also ask

-

What are Estimated Tax Payments and why are they important?

Estimated Tax Payments refer to the method by which individuals or businesses pay taxes on income that isn't subject to withholding. Following the Estimated Tax Payments see Instructions is crucial to avoid penalties and interest, ensuring compliance with tax obligations. These payments can help manage tax liability throughout the year.

-

How can I find the Estimated Tax Payments see Instructions for my state?

Each state has specific guidelines for Estimated Tax Payments. You can find the Estimated Tax Payments see Instructions for your state on the official state revenue or taxation department website. There, you'll find detailed information tailored to your local tax laws.

-

What features does airSlate SignNow offer related to tax documentation?

airSlate SignNow provides features that allow users to legally eSign and send tax-related documents securely. With a focus on efficiency, the platform aids in managing essential paperwork while following Estimated Tax Payments see Instructions, ensuring your documents are signed promptly.

-

Is there a cost associated with using airSlate SignNow for managing tax forms?

Yes, airSlate SignNow offers various pricing plans suitable for different business sizes and needs. This cost-effective solution provides a seamless way to handle all your tax documentation while following the guidance of Estimated Tax Payments see Instructions.

-

What are the benefits of using airSlate SignNow for Estimated Tax Payments?

Using airSlate SignNow simplifies the process of managing your Estimated Tax Payments by offering a user-friendly interface for document signing and sharing. This ensures that your tax documents adhere to the Estimated Tax Payments see Instructions, streamlining your tax compliance and saving you time.

-

Can airSlate SignNow integrate with accounting software for tax purposes?

Yes, airSlate SignNow can integrate with various accounting software to enhance your tax management process. This integration makes it easier to align your estimated tax payment documentation with the necessary software tools while adhering to Estimated Tax Payments see Instructions.

-

How secure is airSlate SignNow when handling sensitive tax documents?

airSlate SignNow prioritizes the security of your documents with advanced encryption and security protocols. This ensures that your sensitive tax documents remain safe and compliant with Estimated Tax Payments see Instructions throughout the signing process.

Get more for Estimated Tax Payments see Instructions

- Warranty deed from two individuals to husband and wife connecticut form

- Ct mortgage deed form

- Ct corporation llc form

- Ct disclaimer form

- Connecticut mechanics form

- Quitclaim deed by two individuals to llc connecticut form

- Warranty deed from two individuals to llc connecticut form

- Ct corporation llc 497301003 form

Find out other Estimated Tax Payments see Instructions

- How Do I Electronic signature Nevada Car Dealer PDF

- How To Electronic signature South Carolina Banking Document

- Can I Electronic signature New York Car Dealer Document

- How To Electronic signature North Carolina Car Dealer Word

- How Do I Electronic signature North Carolina Car Dealer Document

- Can I Electronic signature Ohio Car Dealer PPT

- How Can I Electronic signature Texas Banking Form

- How Do I Electronic signature Pennsylvania Car Dealer Document

- How To Electronic signature South Carolina Car Dealer Document

- Can I Electronic signature South Carolina Car Dealer Document

- How Can I Electronic signature Texas Car Dealer Document

- How Do I Electronic signature West Virginia Banking Document

- How To Electronic signature Washington Car Dealer Document

- Can I Electronic signature West Virginia Car Dealer Document

- How Do I Electronic signature West Virginia Car Dealer Form

- How Can I Electronic signature Wisconsin Car Dealer PDF

- How Can I Electronic signature Wisconsin Car Dealer Form

- How Do I Electronic signature Montana Business Operations Presentation

- How To Electronic signature Alabama Charity Form

- How To Electronic signature Arkansas Construction Word