Rules & Regulations Little Falls Arts & Crafts Fair Form

Understanding the MN ST19 Form

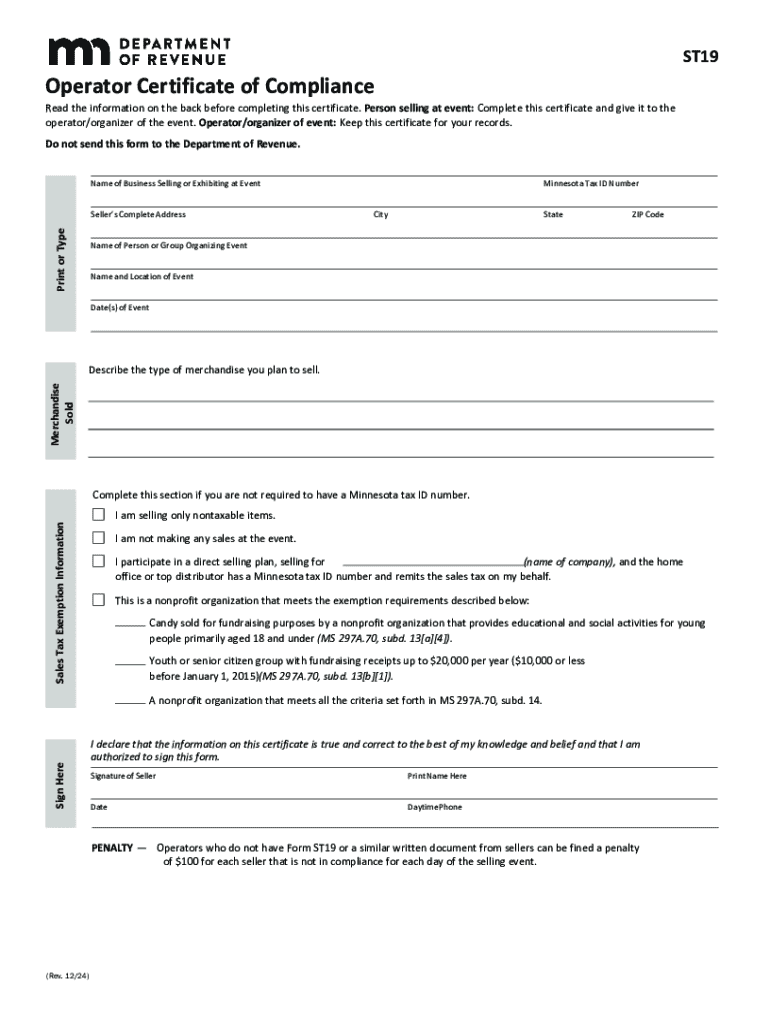

The MN ST19 form, also known as the Minnesota Sales Tax Exemption Certificate, is an essential document for businesses and individuals in Minnesota seeking to make tax-exempt purchases. This form is primarily used by organizations that qualify for sales tax exemption under specific categories, such as nonprofit entities, government agencies, or certain educational institutions. By completing the MN ST19 form, eligible buyers can avoid paying sales tax on qualifying purchases, thereby reducing their overall costs.

Steps to Complete the MN ST19 Form

Filling out the MN ST19 form involves several straightforward steps:

- Obtain the form: The MN ST19 form can be downloaded from the Minnesota Department of Revenue's official website or accessed through authorized sources.

- Provide your information: Fill in your name, address, and contact details. Ensure that the information is accurate to avoid processing delays.

- Indicate your exemption reason: Clearly state the reason for your tax exemption, referencing the applicable Minnesota tax law.

- Sign and date the form: The form must be signed by an authorized representative of the organization claiming the exemption.

Once completed, the form should be presented to the seller at the time of purchase to validate the tax-exempt status.

Eligibility Criteria for Using the MN ST19 Form

To utilize the MN ST19 form, certain eligibility criteria must be met. Typically, the following entities qualify:

- Nonprofit organizations recognized under IRS Section 501(c)(3)

- Government agencies at the federal, state, or local level

- Educational institutions that meet specific guidelines

It is important to review the Minnesota Department of Revenue guidelines to ensure compliance with all requirements before submitting the form.

Form Submission Methods

The MN ST19 form does not require submission to the Minnesota Department of Revenue for approval. Instead, it is presented directly to the seller at the point of sale. Sellers should retain a copy of the form for their records to substantiate the tax-exempt sale during audits.

Penalties for Non-Compliance

Using the MN ST19 form improperly can lead to significant penalties. If a buyer falsely claims tax exemption, they may be liable for unpaid sales tax, interest, and potential fines. Sellers who accept the form without verifying its legitimacy may also face repercussions, including audits and penalties from the Minnesota Department of Revenue. It is crucial for both buyers and sellers to ensure that the form is used correctly and in accordance with state laws.

Key Elements of the MN ST19 Form

The MN ST19 form includes several key elements that must be completed accurately:

- Purchaser Information: Name and address of the individual or organization claiming the exemption.

- Seller Information: Name and address of the seller from whom the purchase is made.

- Reason for Exemption: A clear statement indicating the basis for tax exemption.

- Signature: Signature of an authorized representative, affirming the truthfulness of the information provided.

Each of these components is vital for the validity of the form and must be completed with care.

Handy tips for filling out Rules & Regulations Little Falls Arts & Crafts Fair online

Quick steps to complete and e-sign Rules & Regulations Little Falls Arts & Crafts Fair online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms can be. Obtain access to a GDPR and HIPAA compliant service for optimum straightforwardness. Use signNow to e-sign and share Rules & Regulations Little Falls Arts & Crafts Fair for e-signing.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rules amp regulations little falls arts amp crafts fair

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the mn st19 form and why is it important?

The mn st19 form is a crucial document used in Minnesota for vehicle registration and title transfers. It ensures that all necessary information is accurately recorded, helping to prevent legal issues related to vehicle ownership. Using airSlate SignNow to eSign this form streamlines the process, making it faster and more efficient.

-

How can airSlate SignNow help me with the mn st19 form?

airSlate SignNow provides an easy-to-use platform for electronically signing the mn st19 form. With our solution, you can fill out, sign, and send the form securely from any device. This eliminates the need for printing and scanning, saving you time and effort.

-

Is there a cost associated with using airSlate SignNow for the mn st19 form?

Yes, airSlate SignNow offers various pricing plans to suit different needs, including options for individuals and businesses. Our plans are designed to be cost-effective, ensuring you get the best value while managing documents like the mn st19 form efficiently. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the mn st19 form?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and real-time tracking for the mn st19 form. These tools enhance your document management experience, allowing you to monitor the signing process and ensure timely completion. Additionally, our platform supports multiple file formats for added convenience.

-

Can I integrate airSlate SignNow with other applications for the mn st19 form?

Absolutely! airSlate SignNow offers integrations with various applications, making it easy to manage the mn st19 form alongside your existing workflows. Whether you use CRM systems, cloud storage, or project management tools, our platform can seamlessly connect to enhance your productivity.

-

What are the benefits of using airSlate SignNow for the mn st19 form?

Using airSlate SignNow for the mn st19 form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are signed quickly and stored securely, allowing you to focus on other important tasks. Additionally, the user-friendly interface makes it accessible for everyone.

-

Is airSlate SignNow secure for signing the mn st19 form?

Yes, airSlate SignNow prioritizes security, employing advanced encryption and authentication measures to protect your documents, including the mn st19 form. We comply with industry standards to ensure that your sensitive information remains confidential and secure throughout the signing process.

Get more for Rules & Regulations Little Falls Arts & Crafts Fair

- Mother petition form

- Modification order form

- Request nonprofit form

- Terminate parent 497329328 form

- Employment records form

- Employment agency worker form

- Prenuptial marital property agreement waiving right to elect to take against the surviving spouse separate or community property form

- Living together unmarried form

Find out other Rules & Regulations Little Falls Arts & Crafts Fair

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online