Form Mwr 2025-2026

Understanding the Form MWR

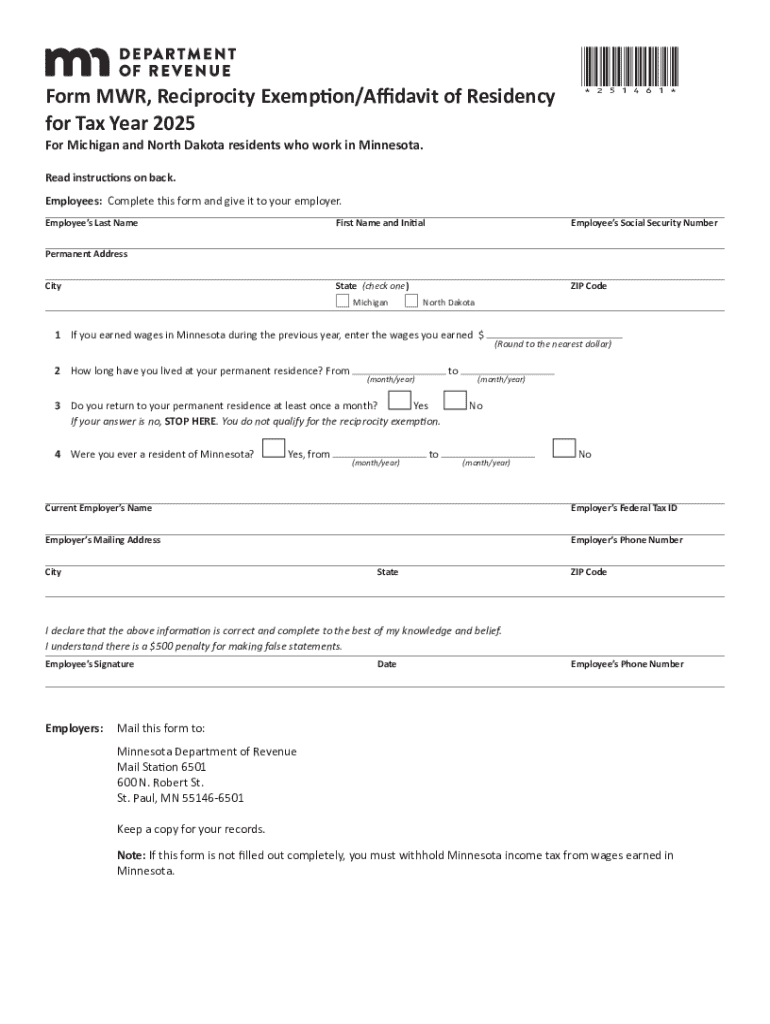

The Form MWR, or Minnesota Withholding Reconciliation Form, is essential for employers in Minnesota to report and reconcile the state income tax withheld from employees' wages. This form helps ensure that the correct amount of tax has been withheld and remitted to the state. It is typically used by businesses to summarize their withholding tax obligations for a specific tax year.

How to Obtain the Form MWR

The 2024 MN Form PDF can be easily obtained from the Minnesota Department of Revenue's official website. It is available for download in a fillable PDF format, allowing users to complete the form digitally. Employers can also request a physical copy by contacting the Department of Revenue directly. Ensuring that you have the correct version of the form is crucial for compliance.

Steps to Complete the Form MWR

Completing the Form MWR involves several key steps:

- Gather all necessary payroll records for the tax year, including W-2 forms and any other relevant documentation.

- Enter the total amount of state income tax withheld from employees' wages in the designated section.

- Calculate any adjustments needed for over- or under-withholding.

- Review all entries for accuracy before submission.

Once completed, the form must be submitted to the Minnesota Department of Revenue by the designated deadline.

Legal Use of the Form MWR

The legal use of the Form MWR is mandated by Minnesota state law. Employers are required to file this form annually to report the total amount of state income tax withheld from employee wages. Failure to submit the form accurately and on time can result in penalties and interest charges. It is important for employers to understand their obligations to avoid non-compliance.

Filing Deadlines and Important Dates

The filing deadline for the Form MWR is typically January 31 of the year following the tax year being reported. Employers should be aware of this date to ensure timely submission. Additionally, any payments for withheld taxes must also be made by this deadline to avoid penalties. It is advisable to keep track of any changes to these dates, as they can vary from year to year.

Required Documents for Form MWR Submission

To complete the Form MWR, employers must have several documents on hand:

- W-2 forms for all employees, which detail the wages paid and taxes withheld.

- Records of any adjustments made throughout the year, including over- or under-withholding.

- Any correspondence from the Minnesota Department of Revenue regarding withholding tax obligations.

Having these documents readily available simplifies the completion process and ensures accuracy.

Create this form in 5 minutes or less

Find and fill out the correct form mwr

Create this form in 5 minutes!

How to create an eSignature for the form mwr

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2024 MN form PDF and how can I access it?

The 2024 MN form PDF is a state-specific document required for various administrative purposes in Minnesota. You can easily access it through the airSlate SignNow platform, which allows you to download, fill out, and eSign the form seamlessly.

-

How does airSlate SignNow simplify the process of filling out the 2024 MN form PDF?

airSlate SignNow streamlines the process by providing an intuitive interface that allows users to fill out the 2024 MN form PDF quickly. With features like auto-fill and template saving, you can complete your forms efficiently and accurately.

-

Is there a cost associated with using airSlate SignNow for the 2024 MN form PDF?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Each plan provides access to features that facilitate the completion and eSigning of documents, including the 2024 MN form PDF.

-

Can I integrate airSlate SignNow with other applications for managing the 2024 MN form PDF?

Absolutely! airSlate SignNow integrates with numerous applications, allowing you to manage the 2024 MN form PDF alongside your other business tools. This integration enhances workflow efficiency and document management.

-

What are the benefits of using airSlate SignNow for the 2024 MN form PDF?

Using airSlate SignNow for the 2024 MN form PDF offers several benefits, including enhanced security, ease of use, and the ability to track document status. These features ensure that your forms are completed accurately and securely.

-

Is it possible to eSign the 2024 MN form PDF using airSlate SignNow?

Yes, airSlate SignNow allows you to eSign the 2024 MN form PDF effortlessly. The platform ensures that your electronic signatures are legally binding and compliant with state regulations.

-

How can I ensure my 2024 MN form PDF is compliant with state regulations?

airSlate SignNow provides templates and guidelines to help you ensure that your 2024 MN form PDF meets all necessary state regulations. Additionally, the platform offers support to assist you with any compliance questions.

Get more for Form Mwr

Find out other Form Mwr

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation