MWR, Reciprocity ExemptionAffidavit of Residency 2021

What is the Minnesota Form Reciprocity?

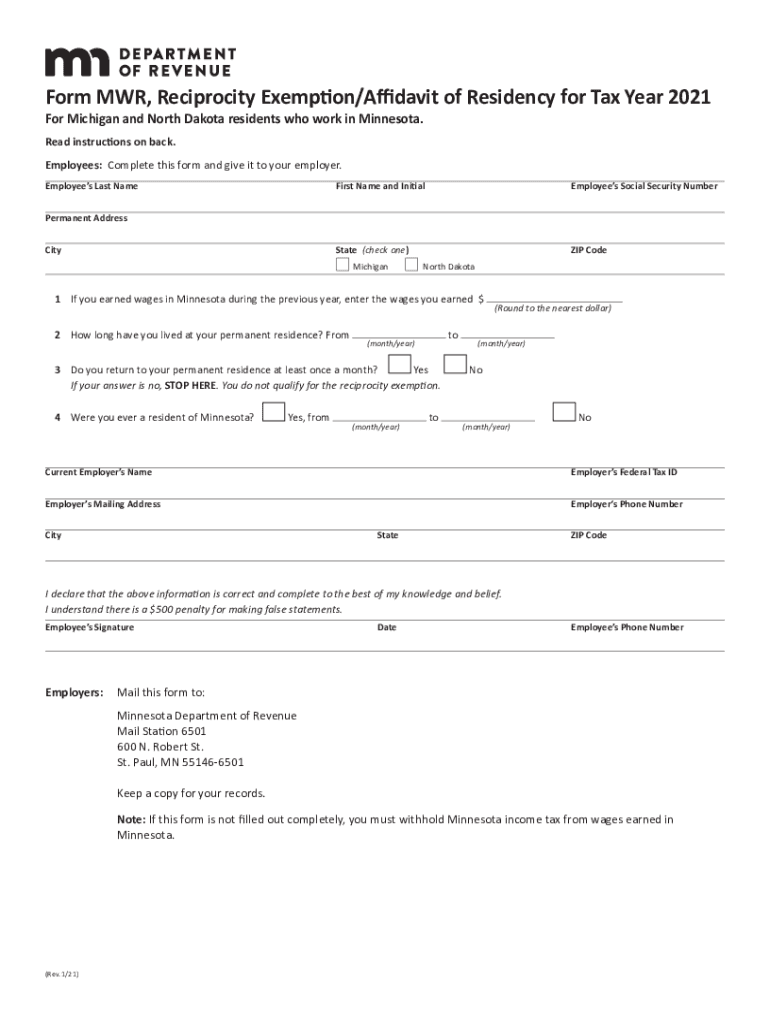

The Minnesota Form Reciprocity, often referred to as the MWR, is a tax document that allows residents of Minnesota to claim exemption from state income tax on income earned in other states. This form is particularly relevant for individuals who work in a state that has a reciprocal agreement with Minnesota, enabling them to avoid double taxation. The MWR is essential for ensuring that taxpayers only pay taxes in their state of residence, simplifying the tax process for those who commute across state lines.

How to Use the Minnesota Form Reciprocity

To effectively use the Minnesota Form Reciprocity, individuals must first determine if they qualify based on their residency and the state where they earn income. Once eligibility is confirmed, the form should be filled out accurately, providing necessary personal details and the relevant state information. After completing the form, it must be submitted to the employer to ensure that no state income tax is withheld from earnings. This process helps streamline tax obligations and prevents unnecessary deductions from paychecks.

Steps to Complete the Minnesota Form Reciprocity

Completing the Minnesota Form Reciprocity involves several key steps:

- Obtain the MWR form from the Minnesota Department of Revenue website or your employer.

- Fill in your personal information, including name, address, and Social Security number.

- Indicate the state where you work and confirm that it has a reciprocity agreement with Minnesota.

- Sign and date the form to validate your submission.

- Submit the completed form to your employer for processing.

Legal Use of the Minnesota Form Reciprocity

The Minnesota Form Reciprocity is legally binding when completed correctly and submitted to the appropriate employer. It is important to understand that providing false information on this form can lead to penalties, including back taxes owed and potential fines. Compliance with state tax laws is crucial, and the MWR should be used in accordance with the Minnesota Department of Revenue guidelines to ensure its validity.

Required Documents for the Minnesota Form Reciprocity

When completing the Minnesota Form Reciprocity, individuals may need to gather specific documents to support their claims. These can include:

- Proof of residency in Minnesota, such as a driver's license or utility bill.

- Documentation of employment in a reciprocal state.

- Previous year’s tax returns, if applicable, to show income sources.

Having these documents readily available can facilitate the completion process and ensure that all necessary information is provided.

Filing Deadlines for the Minnesota Form Reciprocity

It is essential to be aware of filing deadlines associated with the Minnesota Form Reciprocity. Typically, the form should be submitted to your employer at the start of your employment or when your residency status changes. Additionally, it is advisable to keep track of any updates or changes in tax laws that may affect the filing timeline. Staying informed can help prevent any issues with state tax obligations.

Quick guide on how to complete 2021 mwr reciprocity exemptionaffidavit of residency

Easily Prepare MWR, Reciprocity ExemptionAffidavit Of Residency on Any Device

Web-based document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, enabling you to locate the appropriate form and securely archive it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Handle MWR, Reciprocity ExemptionAffidavit Of Residency on any device with the airSlate SignNow apps for Android or iOS, and simplify any document-centric task today.

The most efficient way to modify and eSign MWR, Reciprocity ExemptionAffidavit Of Residency effortlessly

- Locate MWR, Reciprocity ExemptionAffidavit Of Residency and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize signNow portions of your documents or obscure sensitive information with the tools that airSlate SignNow specifically provides for this purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review all information and click the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign MWR, Reciprocity ExemptionAffidavit Of Residency and guarantee excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 mwr reciprocity exemptionaffidavit of residency

Create this form in 5 minutes!

How to create an eSignature for the 2021 mwr reciprocity exemptionaffidavit of residency

How to create an electronic signature for a PDF document in the online mode

How to create an electronic signature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The best way to create an eSignature from your mobile device

How to create an eSignature for a PDF document on iOS devices

The best way to create an eSignature for a PDF file on Android devices

People also ask

-

What is Minnesota form reciprocity and how does it work?

Minnesota form reciprocity refers to the mutual agreements between Minnesota and other states that recognize each other's licensing requirements. This allows professionals from reciprocal states to work in Minnesota without additional licensing. Understanding Minnesota form reciprocity is essential for smooth professional transitions.

-

How can airSlate SignNow help with Minnesota form reciprocity documents?

airSlate SignNow provides an efficient platform to manage and eSign documents required under Minnesota form reciprocity. Our intuitive interface makes it easy to upload, sign, and share necessary paperwork seamlessly. This ensures compliance and speeds up the licensing process.

-

What are the pricing options for airSlate SignNow?

We offer competitive pricing plans tailored to fit various business needs. Whether you're a small business or a large organization, you can find a suitable plan that includes features for managing Minnesota form reciprocity and other documents effectively. Request a free trial to explore our offerings.

-

What features does airSlate SignNow provide for managing Minnesota form reciprocity?

Our platform includes templates specifically for Minnesota form reciprocity, ensuring you have the correct documents ready when needed. Features like automated reminders, document tracking, and secure storage further streamline your workflow. SignNow is designed to make document management hassle-free.

-

Are there any integrations available with airSlate SignNow?

Yes, airSlate SignNow integrates with many popular applications such as Google Drive, Dropbox, and CRM systems. These integrations help you manage your Minnesota form reciprocity documents alongside other business processes effortlessly. Connect your tools for a more efficient operation.

-

What benefits does airSlate SignNow offer for businesses dealing with Minnesota form reciprocity?

Using airSlate SignNow simplifies the process of managing Minnesota form reciprocity documents, which can be cumbersome. With secure eSigning and easy document sharing, businesses can save time and reduce paperwork errors. Enjoy cost-effective solutions tailored to enhance productivity.

-

Is airSlate SignNow suitable for both individuals and businesses regarding Minnesota form reciprocity?

Absolutely! airSlate SignNow caters to both individuals and businesses needing to manage Minnesota form reciprocity. Whether you're a professional applying for a license or a company helping employees with licensing, our platform adapts to your specific needs.

Get more for MWR, Reciprocity ExemptionAffidavit Of Residency

Find out other MWR, Reciprocity ExemptionAffidavit Of Residency

- How To Sign Arkansas Collateral Agreement

- Sign New York Codicil to Will Now

- Sign Oregon Codicil to Will Later

- How Do I Sign Oregon Bank Loan Proposal Template

- Help Me With Sign Oregon Bank Loan Proposal Template

- Sign Michigan Gift Affidavit Mobile

- How To Sign North Carolina Gift Affidavit

- How Do I Sign Oregon Financial Affidavit

- Sign Maine Revocation of Power of Attorney Online

- Sign Louisiana Mechanic's Lien Online

- How To Sign New Mexico Revocation of Power of Attorney

- How Can I Sign Ohio Revocation of Power of Attorney

- Sign Michigan Mechanic's Lien Easy

- How To Sign Texas Revocation of Power of Attorney

- Sign Virginia Revocation of Power of Attorney Easy

- Can I Sign North Carolina Mechanic's Lien

- Sign Maine Payment Guaranty Myself

- Help Me With Sign Oklahoma Mechanic's Lien

- Sign Oregon Mechanic's Lien Simple

- How To Sign Utah Mechanic's Lien