PRESTON COUNTY ASSESSOR S OFFICE 106 W Main St, S 2023-2026

Understanding the Preston County Assessor’s Office

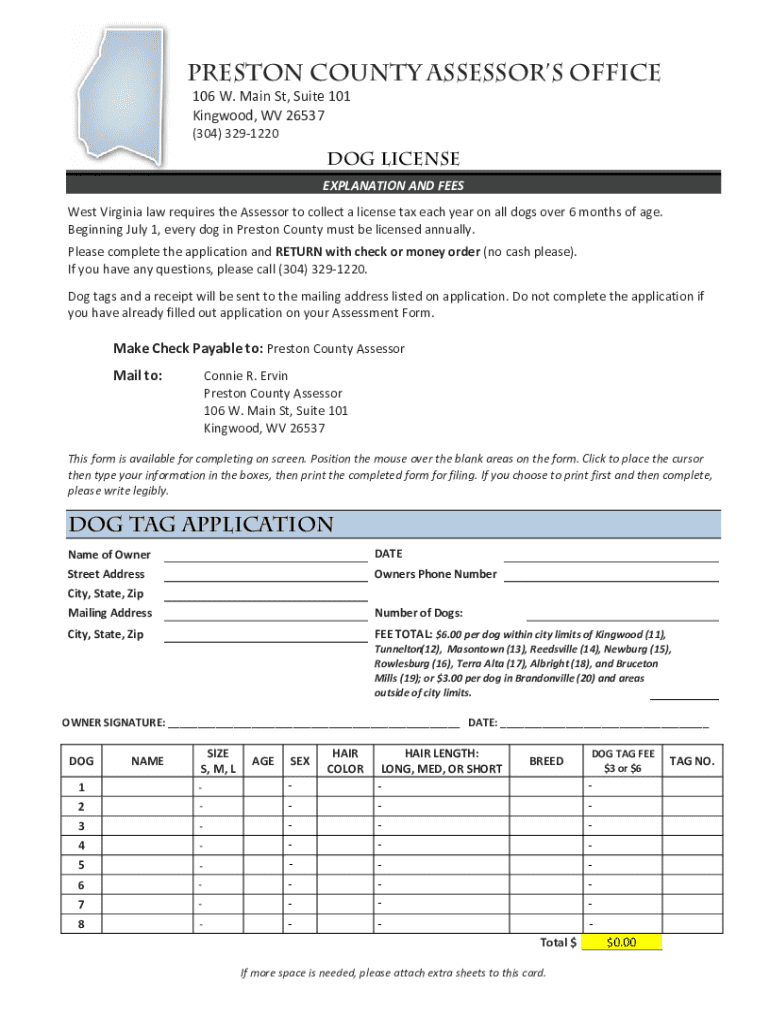

The Preston County Assessor’s Office, located at 106 W Main St, S, serves as a crucial government entity responsible for property assessments within the county. This office evaluates real estate values for taxation purposes, ensuring that property taxes are fairly distributed among residents. The assessment process involves determining the market value of properties, which directly impacts local funding for schools, infrastructure, and public services.

How to Utilize the Preston County Assessor’s Office

To effectively use the services offered by the Preston County Assessor’s Office, residents can visit in person or access resources online. The office provides various forms and documents necessary for property assessment inquiries. Individuals can also seek assistance with understanding their property tax bills, assessment appeals, and exemptions. Engaging with the office can help property owners stay informed about changes in property values and tax obligations.

Steps to Complete Property Assessments

Completing a property assessment through the Preston County Assessor’s Office involves several key steps:

- Gather necessary information about the property, including ownership details and any recent improvements.

- Visit the office or access their website to obtain the required forms.

- Fill out the assessment forms accurately, providing all requested information.

- Submit the completed forms either in person or via mail, ensuring they reach the office by the specified deadlines.

- Await confirmation of your submission and any follow-up communication from the office regarding your assessment.

Required Documentation for Property Assessment

When filing for property assessment through the Preston County Assessor’s Office, specific documentation is typically required. This may include:

- Proof of ownership, such as a deed or title.

- Previous property tax statements to establish a baseline for assessment.

- Documentation of any recent renovations or improvements made to the property.

- Any applicable exemption forms, if claiming tax relief based on eligibility criteria.

Legal Considerations for Property Assessment

Understanding the legal framework surrounding property assessments is vital for residents. The Preston County Assessor’s Office operates under state laws that dictate how properties are valued and taxed. Property owners have the right to appeal their assessments if they believe their property has been incorrectly valued. Familiarity with these legal rights can empower residents to ensure fair taxation.

Eligibility Criteria for Property Assessment Exemptions

Several exemptions may be available to property owners through the Preston County Assessor’s Office. Eligibility criteria often include:

- Age-related exemptions for senior citizens.

- Disability exemptions for individuals with qualifying disabilities.

- Homestead exemptions for primary residences.

- Veteran exemptions for those who have served in the military.

It is essential for property owners to check the specific requirements for each exemption type to determine their eligibility.

Create this form in 5 minutes or less

Find and fill out the correct preston county assessors office 106 w main st s

Create this form in 5 minutes!

How to create an eSignature for the preston county assessors office 106 w main st s

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What services does the PRESTON COUNTY ASSESSOR’S OFFICE 106 W Main St, S. provide?

The PRESTON COUNTY ASSESSOR’S OFFICE 106 W Main St, S. offers a range of services including property assessments, tax information, and public records. They ensure accurate property valuations and provide assistance to residents regarding their property taxes. This office is essential for anyone looking to understand their property tax obligations.

-

How can I contact the PRESTON COUNTY ASSESSOR’S OFFICE 106 W Main St, S.?

You can contact the PRESTON COUNTY ASSESSOR’S OFFICE 106 W Main St, S. by phone or by visiting their office directly. They also provide email support for inquiries. It's recommended to check their official website for the most current contact information and office hours.

-

What are the operating hours of the PRESTON COUNTY ASSESSOR’S OFFICE 106 W Main St, S.?

The PRESTON COUNTY ASSESSOR’S OFFICE 106 W Main St, S. typically operates from Monday to Friday, 8:30 AM to 4:30 PM. However, it's advisable to verify these hours as they may vary due to holidays or special events. Always check their website for the latest updates.

-

Are there any fees associated with services at the PRESTON COUNTY ASSESSOR’S OFFICE 106 W Main St, S.?

Yes, there may be fees for certain services at the PRESTON COUNTY ASSESSOR’S OFFICE 106 W Main St, S., such as obtaining copies of documents or specific assessments. It's best to inquire directly with the office for a detailed list of fees and payment methods. They strive to keep costs reasonable for the community.

-

What features does the PRESTON COUNTY ASSESSOR’S OFFICE 106 W Main St, S. offer for property assessments?

The PRESTON COUNTY ASSESSOR’S OFFICE 106 W Main St, S. provides comprehensive property assessments that include detailed reports and valuation methods. They utilize modern technology to ensure accuracy and transparency in their assessments. This helps property owners understand their property values and tax implications better.

-

How does the PRESTON COUNTY ASSESSOR’S OFFICE 106 W Main St, S. benefit local residents?

The PRESTON COUNTY ASSESSOR’S OFFICE 106 W Main St, S. benefits local residents by providing essential information regarding property taxes and assessments. They help ensure fair taxation and assist residents in understanding their rights and responsibilities. This office plays a crucial role in maintaining community trust and transparency.

-

Can I access property records online through the PRESTON COUNTY ASSESSOR’S OFFICE 106 W Main St, S.?

Yes, the PRESTON COUNTY ASSESSOR’S OFFICE 106 W Main St, S. offers online access to certain property records. This feature allows residents to conveniently search for property information from the comfort of their homes. Visit their website for more details on how to access these records.

Get more for PRESTON COUNTY ASSESSOR S OFFICE 106 W Main St, S

Find out other PRESTON COUNTY ASSESSOR S OFFICE 106 W Main St, S

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast