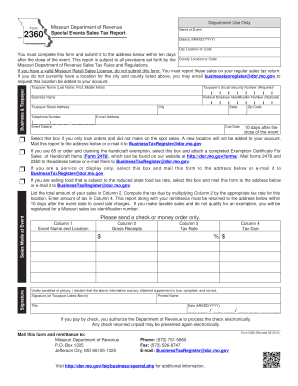

2360 Special Events Sales Tax Report 2015-2026

What is the 2360 Special Events Sales Tax Report

The 2360 Special Events Sales Tax Report is a specific form used by businesses in the United States to report sales tax collected from special events. This form is essential for ensuring compliance with state tax regulations, as it provides a standardized method for documenting sales made during events such as fairs, festivals, and trade shows. By accurately completing this report, businesses can fulfill their tax obligations and avoid potential penalties.

How to use the 2360 Special Events Sales Tax Report

Using the 2360 Special Events Sales Tax Report involves several straightforward steps. First, gather all necessary sales data from the special event, including total sales, sales tax collected, and any exemptions that may apply. Next, fill out the form by entering the required information in the designated fields. Ensure that all figures are accurate to avoid discrepancies. Finally, submit the completed report to the appropriate state tax authority by the specified deadline.

Steps to complete the 2360 Special Events Sales Tax Report

Completing the 2360 Special Events Sales Tax Report requires careful attention to detail. Follow these steps for successful completion:

- Collect sales data: Gather all receipts and records of sales made during the event.

- Determine the total sales: Calculate the total amount of sales, including taxable and non-taxable items.

- Calculate sales tax: Apply the appropriate sales tax rate to the taxable sales amount.

- Fill out the form: Enter the collected data accurately in the form fields.

- Review: Double-check all entries for accuracy before submission.

- Submit: Send the completed report to the relevant tax authority by the deadline.

Key elements of the 2360 Special Events Sales Tax Report

Several key elements must be included in the 2360 Special Events Sales Tax Report to ensure it is complete and compliant. These elements typically include:

- Business information: Name, address, and tax identification number of the business.

- Event details: Description of the event, location, and dates.

- Total sales amount: The gross sales made during the event.

- Sales tax collected: The total sales tax that was collected from customers.

- Exemptions: Any exemptions that apply to specific sales, if applicable.

Filing Deadlines / Important Dates

Filing deadlines for the 2360 Special Events Sales Tax Report can vary by state. It is crucial for businesses to be aware of these dates to avoid late penalties. Generally, reports are due on a monthly or quarterly basis following the event. Check with the local tax authority for specific deadlines and ensure that all reports are submitted on time to maintain compliance.

Penalties for Non-Compliance

Failure to file the 2360 Special Events Sales Tax Report on time or inaccuracies in the report can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential audits by tax authorities. To avoid these consequences, businesses should prioritize accurate reporting and timely submissions. Regular training and updates on tax regulations can also help mitigate risks associated with non-compliance.

Create this form in 5 minutes or less

Find and fill out the correct 2360 special events sales tax report

Create this form in 5 minutes!

How to create an eSignature for the 2360 special events sales tax report

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2360 Special Events Sales Tax Report?

The 2360 Special Events Sales Tax Report is a document that helps businesses accurately report sales tax collected during special events. This report ensures compliance with state tax regulations and simplifies the filing process. By utilizing this report, businesses can avoid penalties and streamline their tax reporting.

-

How can airSlate SignNow assist with the 2360 Special Events Sales Tax Report?

airSlate SignNow provides an efficient platform for businesses to create, send, and eSign the 2360 Special Events Sales Tax Report. Our user-friendly interface allows for quick document preparation and ensures that all necessary information is included. This helps businesses save time and reduce errors in their tax reporting.

-

What are the pricing options for using airSlate SignNow for the 2360 Special Events Sales Tax Report?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of various businesses. Our plans include features that support the creation and management of the 2360 Special Events Sales Tax Report at competitive rates. You can choose a plan that best fits your budget and requirements.

-

Are there any integrations available for the 2360 Special Events Sales Tax Report?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software to facilitate the preparation of the 2360 Special Events Sales Tax Report. These integrations help streamline your workflow and ensure that all data is accurately captured and reported. This enhances efficiency and reduces the risk of errors.

-

What features does airSlate SignNow offer for managing the 2360 Special Events Sales Tax Report?

airSlate SignNow offers features such as customizable templates, eSignature capabilities, and document tracking specifically for the 2360 Special Events Sales Tax Report. These tools make it easy to manage your documents and ensure that all stakeholders can review and sign as needed. This enhances collaboration and speeds up the reporting process.

-

How does airSlate SignNow ensure the security of the 2360 Special Events Sales Tax Report?

Security is a top priority at airSlate SignNow. We implement advanced encryption and secure access protocols to protect your 2360 Special Events Sales Tax Report and other sensitive documents. This ensures that your data remains confidential and secure throughout the signing process.

-

Can I access the 2360 Special Events Sales Tax Report on mobile devices?

Absolutely! airSlate SignNow is designed to be mobile-friendly, allowing you to access and manage the 2360 Special Events Sales Tax Report from any device. This flexibility enables you to work on the go, ensuring that you can complete your tax reporting tasks anytime, anywhere.

Get more for 2360 Special Events Sales Tax Report

Find out other 2360 Special Events Sales Tax Report

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors