SCHEDULE D 540NR California Capital Gain or Loss Adjustment 2024-2026

Understanding the Schedule D 540NR for California Capital Gain or Loss Adjustment

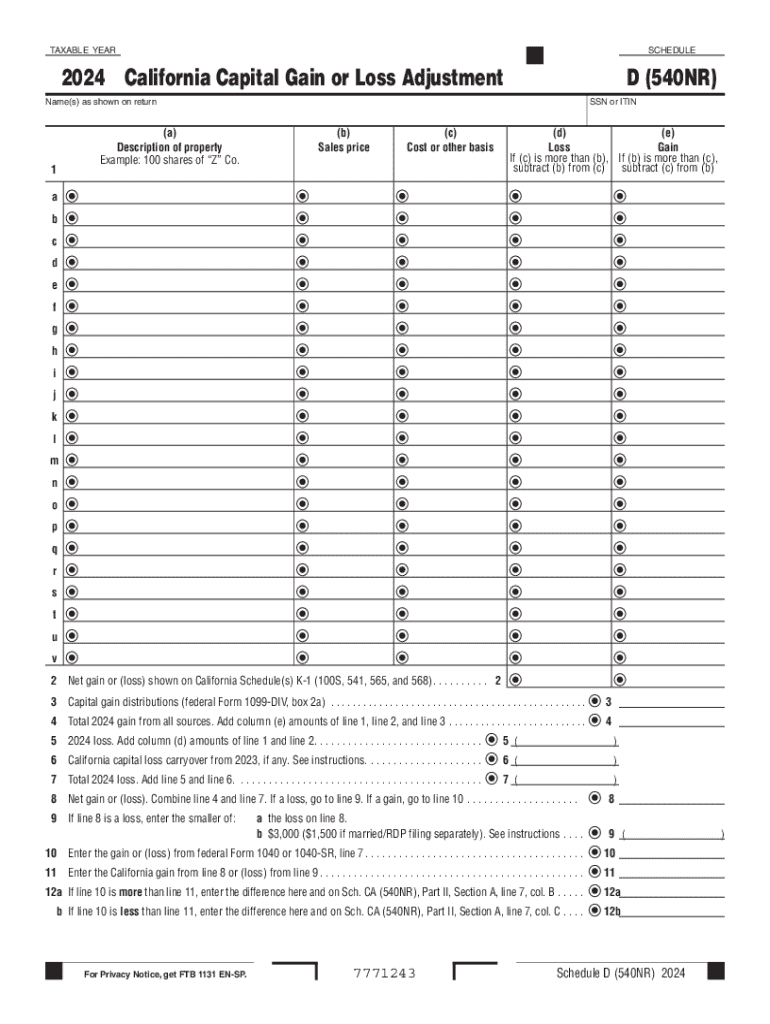

The Schedule D 540NR is a critical form for non-residents of California who need to report capital gains and losses. This form is specifically designed to help taxpayers calculate their capital gains or losses from the sale of assets, such as stocks or real estate, within California. It is essential for ensuring that the correct amount of tax is paid on these transactions, as California has specific rules governing capital gains taxation.

Steps to Complete the Schedule D 540NR

Completing the Schedule D 540NR involves several steps to ensure accuracy and compliance with California tax laws. First, gather all necessary documentation, including records of asset purchases and sales. Next, determine the basis of each asset, which is typically the purchase price plus any associated costs. After that, calculate the gain or loss by subtracting the basis from the sale price. Finally, transfer the calculated amounts to the appropriate sections of the Schedule D 540NR, ensuring that all figures are accurate and complete.

Key Elements of the Schedule D 540NR

The Schedule D 540NR consists of various sections that taxpayers must fill out. Key elements include the identification of the taxpayer, details about each asset sold, and the calculation of gains or losses. Additionally, the form requires information on any adjustments to gains or losses, such as depreciation or improvements made to the asset. Understanding these elements is crucial for accurate reporting and compliance.

Legal Use of the Schedule D 540NR

The Schedule D 540NR is legally required for non-residents who have capital gains from California sources. Filing this form accurately is essential to avoid penalties or legal issues with the California Franchise Tax Board. It is important for taxpayers to be aware of their obligations and ensure that they are following the legal requirements for reporting capital gains and losses.

Filing Deadlines and Important Dates

Taxpayers must adhere to specific deadlines when filing the Schedule D 540NR. Typically, the form is due on the same date as the individual's state income tax return, which is usually April fifteenth for most taxpayers. However, it is advisable to check for any updates or changes in deadlines, as extensions may be available under certain circumstances.

Examples of Using the Schedule D 540NR

Examples of using the Schedule D 540NR can provide clarity on how to report capital gains or losses. For instance, if a taxpayer sells a property in California for $300,000 that they purchased for $200,000, they would report a capital gain of $100,000. This example illustrates the straightforward calculation process and the importance of accurate record-keeping for each transaction.

Create this form in 5 minutes or less

Find and fill out the correct schedule d 540nr california capital gain or loss adjustment

Create this form in 5 minutes!

How to create an eSignature for the schedule d 540nr california capital gain or loss adjustment

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the schedule d 540nr and why is it important?

The schedule d 540nr is a tax form used by non-residents in California to report capital gains and losses. Understanding this form is crucial for compliance with state tax laws and ensuring accurate reporting of your financial activities. Properly completing the schedule d 540nr can help you avoid penalties and maximize your tax benefits.

-

How can airSlate SignNow help with completing the schedule d 540nr?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending documents, including tax forms like the schedule d 540nr. With our solution, you can streamline the process of gathering signatures and ensure that your documents are securely stored and easily accessible. This efficiency can save you time and reduce the stress associated with tax season.

-

Is there a cost associated with using airSlate SignNow for the schedule d 540nr?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our cost-effective solutions ensure that you can manage your document signing and eSigning needs without breaking the bank. You can choose a plan that fits your budget while still gaining access to features that simplify the completion of forms like the schedule d 540nr.

-

What features does airSlate SignNow offer for managing the schedule d 540nr?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and real-time tracking of document status. These tools make it easier to manage the schedule d 540nr and other important documents efficiently. Additionally, our platform allows for easy collaboration, ensuring that all parties can review and sign the necessary forms promptly.

-

Can I integrate airSlate SignNow with other software for handling the schedule d 540nr?

Absolutely! airSlate SignNow offers integrations with various software applications, including accounting and tax preparation tools. This means you can seamlessly incorporate the schedule d 540nr into your existing workflows, enhancing productivity and ensuring that all your documents are in sync across platforms.

-

What are the benefits of using airSlate SignNow for the schedule d 540nr?

Using airSlate SignNow for the schedule d 540nr provides numerous benefits, including increased efficiency, enhanced security, and reduced paper usage. Our platform allows you to complete and sign documents electronically, which can signNowly speed up the process. Additionally, you can track document progress and receive notifications, ensuring that you never miss a deadline.

-

Is airSlate SignNow secure for handling sensitive documents like the schedule d 540nr?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your sensitive documents, including the schedule d 540nr, are protected. We utilize advanced encryption and secure cloud storage to safeguard your information. You can trust that your data is safe while using our platform for your document management needs.

Get more for SCHEDULE D 540NR California Capital Gain Or Loss Adjustment

- Ohio medicaid application pdf 100435822 form

- Itac application forms

- Premiere select ira national financial services form

- Act 151 pa child abuse history clearance dasd sharepoint dasd form

- Pond5 model release form

- Assessable spouse election form 14315809

- W 107 form wt 7 employers annual reconciliation of wisconsin income tax withheld fillable

- Form 9b

Find out other SCHEDULE D 540NR California Capital Gain Or Loss Adjustment

- eSign Michigan Car Dealer Operating Agreement Mobile

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now