Printable California Form 540 NR Schedule D California Capital Gain or Loss Adjustment 2020

What is the Printable California Form 540 NR Schedule D California Capital Gain Or Loss Adjustment

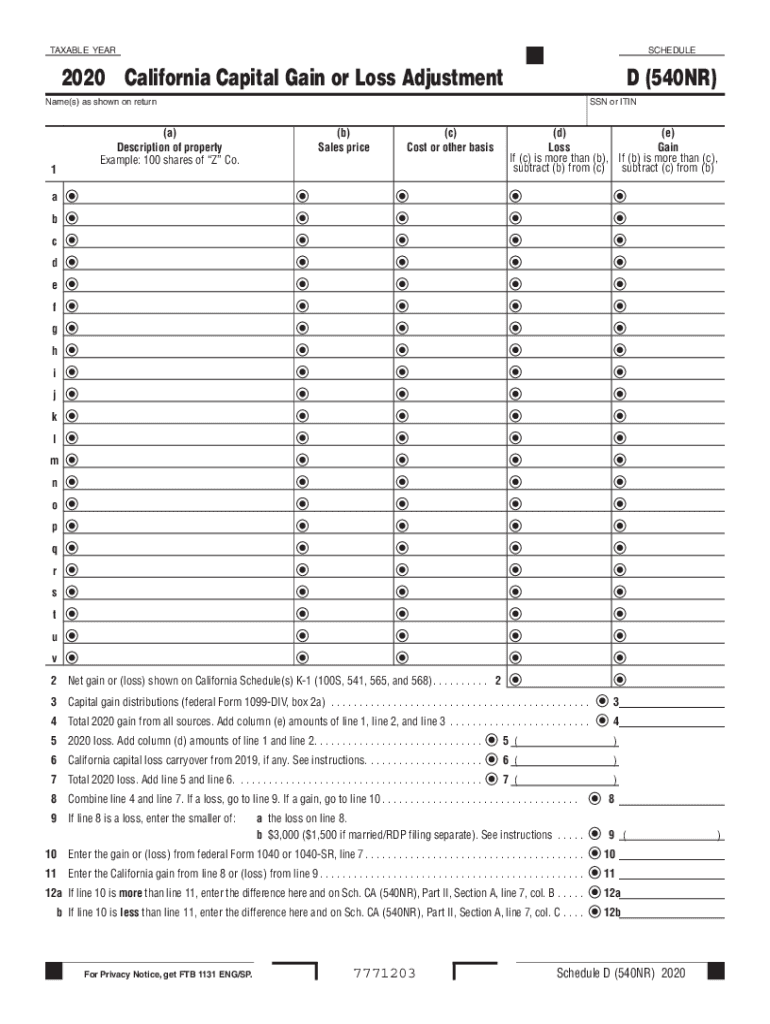

The Printable California Form 540 NR Schedule D is a critical document used by non-resident taxpayers in California to report capital gains and losses. This form is specifically designed for individuals who earn income from California sources but do not reside in the state. It allows taxpayers to detail their capital transactions, including sales of stocks, bonds, and real estate, ensuring that they accurately report their financial activities for tax purposes.

How to use the Printable California Form 540 NR Schedule D California Capital Gain Or Loss Adjustment

Using the Printable California Form 540 NR Schedule D involves several steps. First, gather all necessary documentation related to your capital transactions, such as purchase and sale records. Next, fill out the form by listing each transaction, including the date of acquisition, date of sale, and the amounts involved. After completing the form, ensure that you review it for accuracy before submitting it with your tax return. This form is essential for calculating any tax owed on capital gains or for reporting losses that may offset other income.

Steps to complete the Printable California Form 540 NR Schedule D California Capital Gain Or Loss Adjustment

Completing the Printable California Form 540 NR Schedule D requires careful attention to detail. Follow these steps:

- Gather documentation: Collect all relevant records of your capital transactions.

- Fill out the form: Enter details for each transaction, including acquisition and sale dates, amounts, and any adjustments.

- Calculate gains or losses: Determine the total capital gains or losses by subtracting the cost basis from the sale price for each transaction.

- Review the form: Double-check for any errors or omissions before finalizing.

- Submit with your tax return: Include the completed form with your California tax return to ensure compliance.

Key elements of the Printable California Form 540 NR Schedule D California Capital Gain Or Loss Adjustment

Key elements of the Printable California Form 540 NR Schedule D include sections for reporting short-term and long-term capital gains and losses. It also features a summary section that allows taxpayers to calculate their overall gain or loss. Understanding these elements is essential for accurate reporting, as they directly impact the taxpayer's overall tax liability. Additionally, the form requires information on any carryover losses from previous years, which can be used to offset current year gains.

Legal use of the Printable California Form 540 NR Schedule D California Capital Gain Or Loss Adjustment

The legal use of the Printable California Form 540 NR Schedule D is governed by California tax laws. This form must be completed accurately and submitted alongside your tax return to ensure compliance with state regulations. Failure to properly file this form can result in penalties and interest on unpaid taxes. It is important for taxpayers to understand their obligations under California law to avoid potential legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the Printable California Form 540 NR Schedule D typically align with the general tax return deadlines. For most taxpayers, the deadline is April fifteenth each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is crucial for taxpayers to stay informed about specific deadlines to avoid late penalties. Additionally, if you are filing for an extension, be aware of the extended deadlines that apply to your situation.

Quick guide on how to complete printable 2020 california form 540 nr schedule d california capital gain or loss adjustment

Complete Printable California Form 540 NR Schedule D California Capital Gain Or Loss Adjustment seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Handle Printable California Form 540 NR Schedule D California Capital Gain Or Loss Adjustment on any device using the airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to edit and eSign Printable California Form 540 NR Schedule D California Capital Gain Or Loss Adjustment with ease

- Locate Printable California Form 540 NR Schedule D California Capital Gain Or Loss Adjustment and click Get Form to begin.

- Utilize the tools available to fill out your form.

- Highlight pertinent sections of the documents or black out sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method to submit your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Printable California Form 540 NR Schedule D California Capital Gain Or Loss Adjustment and ensure excellent communication at every stage of the form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct printable 2020 california form 540 nr schedule d california capital gain or loss adjustment

Create this form in 5 minutes!

How to create an eSignature for the printable 2020 california form 540 nr schedule d california capital gain or loss adjustment

The best way to create an electronic signature for a PDF file online

The best way to create an electronic signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The best way to generate an eSignature right from your mobile device

The way to create an eSignature for a PDF file on iOS

The best way to generate an eSignature for a PDF on Android devices

People also ask

-

What is the 540nr schedule d used for?

The 540nr schedule d is used for reporting capital gains and losses for non-residents in California. This form allows individuals to detail their investment income and the applicable exemptions. Understanding how to properly fill out the 540nr schedule d can help you maximize your tax benefits.

-

How does airSlate SignNow streamline the process of filing my 540nr schedule d?

airSlate SignNow simplifies the documentation process by allowing you to eSign necessary forms, including the 540nr schedule d, securely online. This eliminates the need for physical paperwork and speeds up the submission process. Our user-friendly interface ensures that you can complete your forms quickly and efficiently.

-

Is airSlate SignNow affordable for users needing to file the 540nr schedule d?

Absolutely! airSlate SignNow offers cost-effective pricing plans that cater to various user needs, making it accessible for anyone requiring assistance with their 540nr schedule d. Our competitive rates provide signNow value, especially for small businesses and individuals.

-

What features does airSlate SignNow offer that assist with the 540nr schedule d?

airSlate SignNow provides features such as customizable templates, document collaboration, and secure storage, which are essential for handling the 540nr schedule d efficiently. With eSigning capabilities, you can also ensure that all parties involved can sign documents in real-time, enhancing productivity.

-

Can I integrate airSlate SignNow with other tools for filing my 540nr schedule d?

Yes, airSlate SignNow offers seamless integrations with popular tools and software, making it easy to import or export information related to your 540nr schedule d. These integrations enhance your workflow, allowing for quick access to financial data and improved document management.

-

How does airSlate SignNow ensure the security of my 540nr schedule d data?

We prioritize your data security by implementing advanced encryption and compliance standards for all transactions. When you use airSlate SignNow to handle your 540nr schedule d, you can be confident that your personal and financial information is protected against unauthorized access.

-

What are the benefits of using airSlate SignNow for my 540nr schedule d?

Using airSlate SignNow for your 540nr schedule d offers numerous benefits, including reduced processing time, increased accuracy, and enhanced collaboration with tax professionals. The platform's easy-to-use design allows any user, regardless of tech experience, to navigate the filing process efficiently.

Get more for Printable California Form 540 NR Schedule D California Capital Gain Or Loss Adjustment

- Clinical privilege form

- Cunninghamj oannetheres 1091128434 usmepcom form

- Civil air patrol command specialty track form

- Uninterruptible power supply ups inspection checklist da form 7472 r aug 2002 armypubs army

- Frontotemporal dementia primary progressive aphasia form

- Frontotemporal disorders information for patients families and carefivers on frontotemporal disorders

- Head bump form template

- Permanent change of station orders example form

Find out other Printable California Form 540 NR Schedule D California Capital Gain Or Loss Adjustment

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple