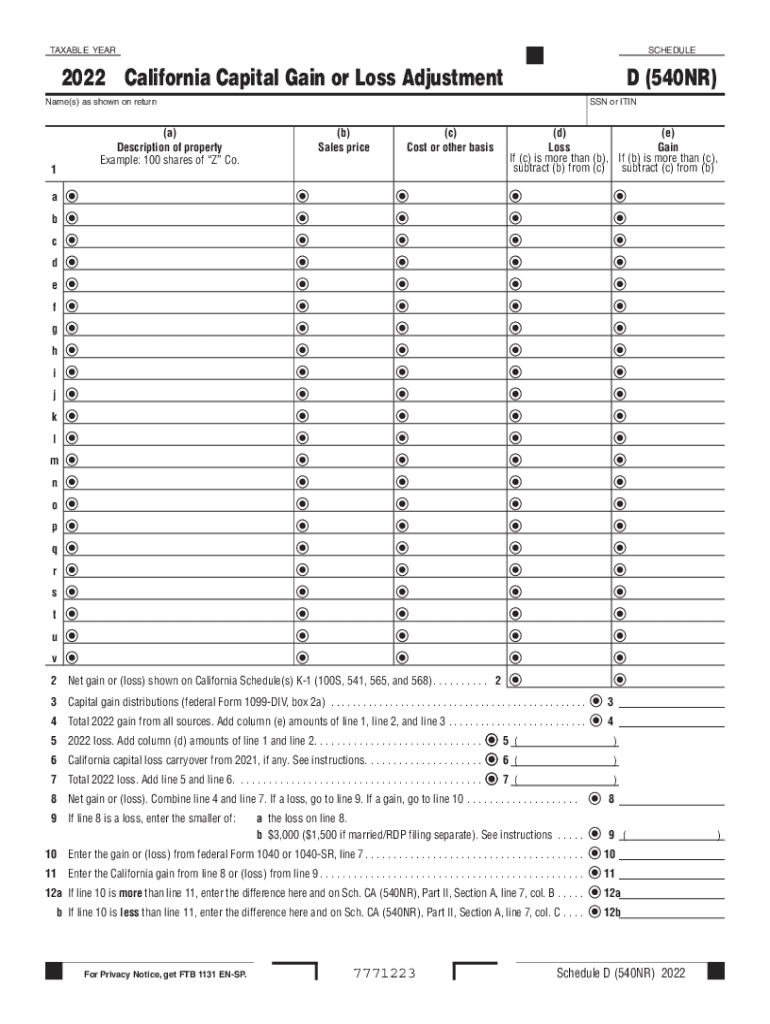

Form 540NR Schedule D "California Capital Gain or Loss Adjustment 2022

What is the Form 540NR Schedule D

The Form 540NR Schedule D, also known as the California Capital Gain or Loss Adjustment, is a crucial document for individuals who have capital gains or losses and are filing a non-resident California tax return. This form allows taxpayers to report their capital gains and losses from the sale of assets such as stocks, bonds, and real estate. Understanding how to accurately complete this form is essential for ensuring compliance with California tax laws and for calculating any potential tax liabilities or refunds.

Steps to complete the Form 540NR Schedule D

Completing the Form 540NR Schedule D involves several key steps:

- Gather necessary documents: Collect all relevant financial documents, including records of asset purchases and sales, as well as any supporting documentation for capital gains or losses.

- Report capital gains and losses: Enter the details of your capital transactions on the form, including the date of acquisition, date of sale, and the amount realized from each transaction.

- Calculate net capital gain or loss: Subtract your total capital losses from your total capital gains to determine your net capital gain or loss.

- Complete the tax calculation: Use the net capital gain or loss to complete the tax calculation section of the form, which will determine your tax obligation.

- Review and submit: Carefully review all entries for accuracy before submitting the form with your tax return.

Legal use of the Form 540NR Schedule D

The Form 540NR Schedule D is legally binding when filled out accurately and submitted in compliance with California tax regulations. To ensure the legal validity of your submission, it is important to follow the guidelines set forth by the California Franchise Tax Board. This includes maintaining accurate records of all transactions and ensuring that all calculations are correct. Utilizing a reliable electronic signature platform can also enhance the security and legality of your submitted documents.

Filing Deadlines / Important Dates

For the 2022 tax year, the deadline to file the Form 540NR Schedule D typically aligns with the federal tax filing deadline, which is usually April 15. However, if you require an extension, it is important to file the appropriate extension forms to avoid penalties. Always check for any updates or changes to deadlines that may arise due to state-specific regulations or changes in tax law.

Required Documents

To complete the Form 540NR Schedule D, you will need several key documents:

- Records of all capital asset transactions, including purchase and sale agreements.

- Brokerage statements detailing capital gains and losses.

- Any supporting documentation for deductions related to capital losses.

- Previous year’s tax returns, if applicable, for reference on carryover losses.

Examples of using the Form 540NR Schedule D

Consider a scenario where an individual sells stocks for a profit and also realizes a loss from selling a rental property. The Form 540NR Schedule D allows the taxpayer to report both transactions, offsetting the gains with the losses to potentially reduce their overall tax liability. Another example includes a taxpayer who has a capital loss carryover from the previous year; they can utilize the Schedule D to report this carryover and apply it against current year gains.

Quick guide on how to complete form 540nr schedule d ampquotcalifornia capital gain or loss adjustment

Effortlessly Complete Form 540NR Schedule D "California Capital Gain Or Loss Adjustment on Any Device

Managing documents online has gained traction among both companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily access the necessary form and securely save it online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents swiftly without any hold-ups. Handle Form 540NR Schedule D "California Capital Gain Or Loss Adjustment on any device using the airSlate SignNow applications for Android or iOS and enhance any document-centric task today.

How to Modify and Electronically Sign Form 540NR Schedule D "California Capital Gain Or Loss Adjustment with Ease

- Obtain Form 540NR Schedule D "California Capital Gain Or Loss Adjustment and click Get Form to begin.

- Utilize the tools at your disposal to complete your document.

- Emphasize important sections of your documents or redact sensitive information using features that airSlate SignNow specifically provides for that purpose.

- Formulate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and hit the Done button to save your changes.

- Choose your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form navigation, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you select. Modify and electronically sign Form 540NR Schedule D "California Capital Gain Or Loss Adjustment while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 540nr schedule d ampquotcalifornia capital gain or loss adjustment

Create this form in 5 minutes!

People also ask

-

Where do I find capital loss carryover on my tax return?

You can find capital loss carryover on your tax return by looking at Schedule D. This form is where capital gains and losses are reported, including any losses carried over from previous years. You'll need to calculate your total capital losses and refer to the capital loss carryover section to see your available amounts.

-

What is the benefit of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents streamlines the eSigning process, ensuring that your important files are securely signed and stored. This ease of access allows you to manage tax documents effectively, including those related to your capital loss carryover. Furthermore, the intuitive interface simplifies the overall experience for users.

-

Is there a cost associated with airSlate SignNow for businesses?

Yes, airSlate SignNow offers various pricing plans tailored to business needs. Each plan provides different features, allowing you to choose one that best fits your requirements, including handling documents that pertain to capital loss carryovers on your tax return. Those seeking cost-effective solutions will find plans that suit their budgets.

-

Can I integrate airSlate SignNow with my tax software?

Absolutely! airSlate SignNow offers integrations with popular tax software solutions. This feature allows you to easily manage and eSign documents related to your taxes, helping you to efficiently track where you find capital loss carryover on your tax return without disrupting your workflow.

-

How does airSlate SignNow ensure the security of my sensitive tax documents?

airSlate SignNow prioritizes the security of your documents through end-to-end encryption and secure access controls. This means your sensitive information, including those related to capital loss carryovers, remains protected throughout the eSigning process. You can send and store documents confidently, knowing they are safeguarded.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as document templates, real-time collaboration, and customizable workflows. These tools enhance your document management experience, especially when dealing with tax documents where you find capital loss carryover on your tax return. It helps to organize and track all your important files easily.

-

Can I use airSlate SignNow on mobile devices?

Yes, airSlate SignNow is fully accessible on mobile devices, allowing you to sign and send documents wherever you are. This mobility is particularly useful for professionals managing their tax returns and looking for where they can find capital loss carryover. You can handle everything on-the-go without needing a computer.

Get more for Form 540NR Schedule D "California Capital Gain Or Loss Adjustment

- Warning notice due to complaint from neighbors oklahoma form

- Lease subordination agreement oklahoma form

- Apartment rules and regulations oklahoma form

- Agreed cancellation of lease oklahoma form

- Amendment of residential lease oklahoma form

- Oklahoma unpaid 497323169 form

- Commercial lease assignment from tenant to new tenant oklahoma form

- Tenant consent to background and reference check oklahoma form

Find out other Form 540NR Schedule D "California Capital Gain Or Loss Adjustment

- How Do I Sign Texas Banking Memorandum Of Understanding

- Sign Virginia Banking Profit And Loss Statement Mobile

- Sign Alabama Business Operations LLC Operating Agreement Now

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now