Determination of Apportionment Percentage Insert Sheet File with RCT 101 RCT 106 Form

Understanding the Determination Of Apportionment Percentage Insert Sheet File With RCT 101 RCT 106

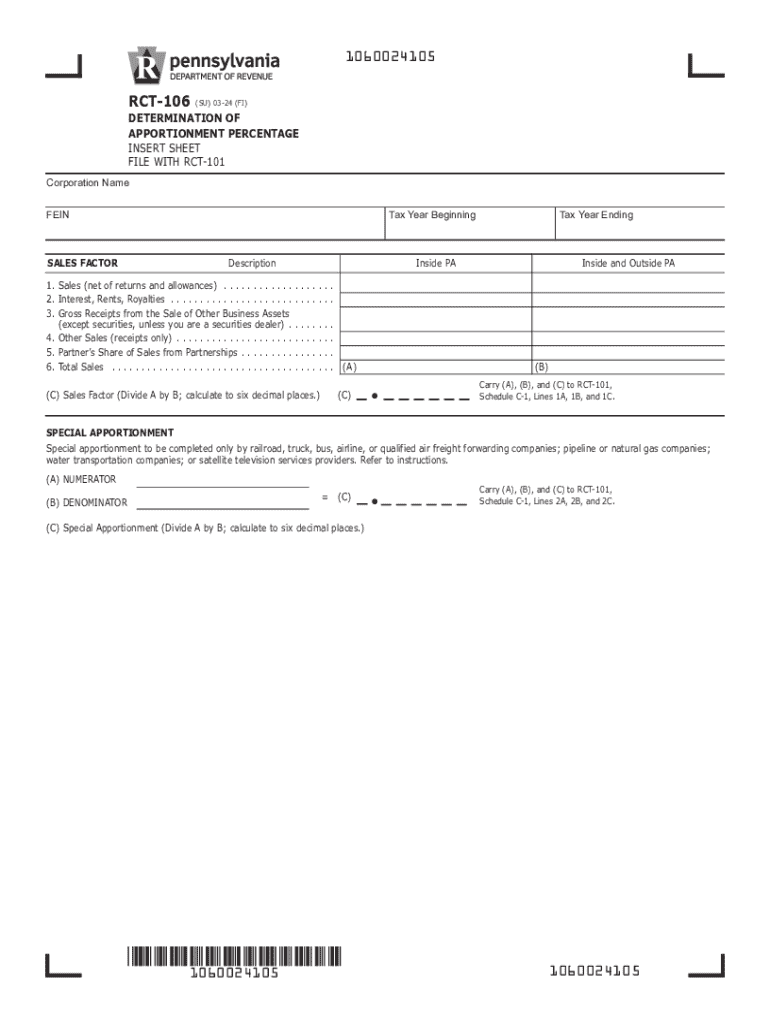

The Determination Of Apportionment Percentage Insert Sheet is a crucial document used in conjunction with RCT 101 and RCT 106 forms. This insert sheet helps businesses allocate their income and expenses accurately among various jurisdictions. It ensures compliance with state tax laws by providing a clear method for determining the apportionment percentage, which is essential for calculating state tax liabilities.

This insert sheet is particularly relevant for corporations and other business entities that operate in multiple states, as it provides the necessary framework for reporting income accurately based on where the business activities occur. Understanding how to fill out this form correctly can significantly impact a business's tax obligations.

Steps to Complete the Determination Of Apportionment Percentage Insert Sheet File With RCT 101 RCT 106

Completing the Determination Of Apportionment Percentage Insert Sheet involves several key steps:

- Gather all relevant financial data for the reporting period, including income, expenses, and any applicable deductions.

- Identify the jurisdictions in which the business operates and determine the specific apportionment factors required for each state.

- Calculate the apportionment percentage by applying the appropriate formulas based on the income and expenses allocated to each jurisdiction.

- Fill out the insert sheet accurately, ensuring that all calculations are clearly documented and that the information aligns with the RCT 101 and RCT 106 forms.

- Review the completed insert sheet for accuracy and completeness before submission.

Legal Use of the Determination Of Apportionment Percentage Insert Sheet File With RCT 101 RCT 106

The Determination Of Apportionment Percentage Insert Sheet is legally required for businesses that need to report income across multiple states. Proper use of this form ensures compliance with state tax regulations and helps avoid potential penalties for misreporting income. It is important for businesses to understand the legal implications of their apportionment calculations, as incorrect filings can lead to audits or additional tax liabilities.

Key Elements of the Determination Of Apportionment Percentage Insert Sheet File With RCT 101 RCT 106

Several key elements are essential when completing the Determination Of Apportionment Percentage Insert Sheet:

- Apportionment Factors: These include sales, payroll, and property factors that determine how income is divided among states.

- Jurisdiction Information: Accurate details about each state where the business operates must be included.

- Calculation Methodology: Clear documentation of how the apportionment percentage was calculated is necessary for transparency.

- Supporting Documentation: Any additional documents that support the calculations should be attached to the submission.

Examples of Using the Determination Of Apportionment Percentage Insert Sheet File With RCT 101 RCT 106

Practical examples can illustrate how to effectively use the Determination Of Apportionment Percentage Insert Sheet:

For instance, a corporation operating in New York and California may need to allocate its total income based on the percentage of sales made in each state. If the business generated one million dollars in total sales, with six hundred thousand dollars in New York and four hundred thousand dollars in California, the apportionment percentage for New York would be sixty percent, and for California, it would be forty percent.

Another example could involve a business with multiple locations in a single state. In this case, the insert sheet would help determine how to allocate expenses among different branches, ensuring that each location's financial performance is accurately represented.

Filing Deadlines and Important Dates for the Determination Of Apportionment Percentage Insert Sheet File With RCT 101 RCT 106

Timely submission of the Determination Of Apportionment Percentage Insert Sheet is critical. Businesses must be aware of the filing deadlines associated with RCT 101 and RCT 106 forms. Typically, these forms are due on the fifteenth day of the fourth month following the end of the tax year. It is advisable to check for any state-specific deadlines or extensions that may apply.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the determination of apportionment percentage insert sheet file with rct 101 rct 106

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Determination Of Apportionment Percentage Insert Sheet File With RCT 101 RCT 106?

The Determination Of Apportionment Percentage Insert Sheet File With RCT 101 RCT 106 is a crucial document used for calculating the apportionment percentage for tax purposes. It helps businesses accurately report their income and expenses across different jurisdictions. Utilizing this insert sheet ensures compliance with tax regulations and simplifies the filing process.

-

How can airSlate SignNow assist with the Determination Of Apportionment Percentage Insert Sheet File With RCT 101 RCT 106?

airSlate SignNow provides a streamlined platform for businesses to create, send, and eSign the Determination Of Apportionment Percentage Insert Sheet File With RCT 101 RCT 106. Our user-friendly interface allows for easy document management and ensures that all necessary signatures are obtained promptly. This efficiency can signNowly reduce the time spent on tax-related paperwork.

-

What are the pricing options for using airSlate SignNow for tax documents?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our plans include features that support the creation and management of documents like the Determination Of Apportionment Percentage Insert Sheet File With RCT 101 RCT 106. You can choose a plan that fits your budget while ensuring you have access to essential tools for efficient document handling.

-

Are there any integrations available for airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications to enhance your workflow. You can connect with popular tools like Google Drive, Dropbox, and CRM systems to easily manage the Determination Of Apportionment Percentage Insert Sheet File With RCT 101 RCT 106. These integrations help streamline your processes and improve overall efficiency.

-

What are the benefits of using airSlate SignNow for document signing?

Using airSlate SignNow for document signing offers numerous benefits, including enhanced security, ease of use, and time savings. With features designed for the Determination Of Apportionment Percentage Insert Sheet File With RCT 101 RCT 106, you can ensure that your documents are signed quickly and securely. This not only speeds up the process but also helps maintain compliance with legal standards.

-

Can I track the status of my documents in airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking for all your documents, including the Determination Of Apportionment Percentage Insert Sheet File With RCT 101 RCT 106. You can easily monitor who has signed, who still needs to sign, and when the document is completed. This feature enhances accountability and keeps your workflow organized.

-

Is airSlate SignNow suitable for small businesses?

Yes, airSlate SignNow is an excellent solution for small businesses looking to manage their documents efficiently. Our platform is designed to be cost-effective and user-friendly, making it easy for small teams to handle the Determination Of Apportionment Percentage Insert Sheet File With RCT 101 RCT 106 without needing extensive training. This accessibility helps small businesses stay competitive.

Get more for Determination Of Apportionment Percentage Insert Sheet File With RCT 101 RCT 106

Find out other Determination Of Apportionment Percentage Insert Sheet File With RCT 101 RCT 106

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online