This is NOT a Tax Bill OK Gov 2020

Understanding the This Is NOT A Tax Bill OK gov

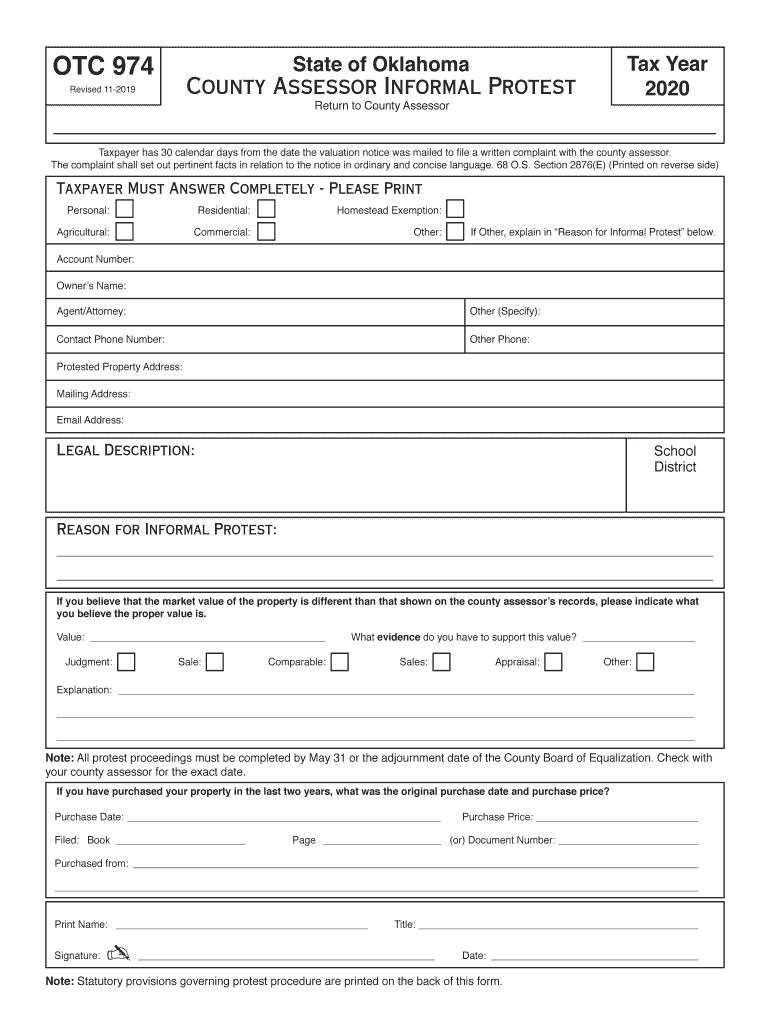

The "This Is NOT A Tax Bill" document is an important notification issued by the Oklahoma government, specifically designed to inform taxpayers about their property assessment. It serves as a reminder of the assessed value of the property, which is essential for understanding potential tax liabilities. This document is not a bill, meaning it does not require immediate payment. Instead, it provides critical information that can help property owners prepare for future tax obligations.

How to Use the This Is NOT A Tax Bill OK gov

To effectively use the "This Is NOT A Tax Bill" document, property owners should first review the assessed value listed on the form. This value is crucial for understanding how much property tax may be owed in the future. If there are discrepancies or concerns regarding the assessment, property owners can use this document to initiate discussions with local tax officials or to file an appeal if necessary. Keeping this document on hand is beneficial for record-keeping and future reference.

Steps to Complete the This Is NOT A Tax Bill OK gov

Completing the "This Is NOT A Tax Bill" process involves a few straightforward steps:

- Review the assessed value of your property indicated on the document.

- Check for any errors or discrepancies in the assessment.

- If you believe the assessment is inaccurate, gather supporting documentation.

- Contact your local tax authority for clarification or to file an appeal.

- Keep a copy of the document and any correspondence for your records.

Key Elements of the This Is NOT A Tax Bill OK gov

The key elements of the "This Is NOT A Tax Bill" document include:

- The assessed value of the property.

- The property owner's name and address.

- Details regarding the property, such as its location and parcel number.

- Information on how to contact local tax authorities for questions or disputes.

- Any relevant deadlines for appeals or responses.

Legal Use of the This Is NOT A Tax Bill OK gov

This document plays a significant role in the legal framework surrounding property taxation in Oklahoma. It is essential for property owners to understand that while this document is not a bill, it is a formal notification that can influence future tax assessments. Property owners are legally obligated to address any discrepancies and may use this document as evidence in appeals or discussions with tax authorities.

Obtaining the This Is NOT A Tax Bill OK gov

Property owners typically receive the "This Is NOT A Tax Bill" document via mail from their local county assessor's office. If a property owner does not receive this document, they can request a copy directly from the assessor's office. It is advisable to ensure that contact information with the local tax authority is current to avoid missing important notifications.

Create this form in 5 minutes or less

Find and fill out the correct this is not a tax bill ok gov

Create this form in 5 minutes!

How to create an eSignature for the this is not a tax bill ok gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of 'This Is NOT A Tax Bill OK gov.'?

'This Is NOT A Tax Bill OK gov.' is a crucial statement that helps clarify the nature of certain documents. It ensures that recipients understand they are not receiving a tax bill, which can alleviate confusion and anxiety regarding financial obligations.

-

How does airSlate SignNow help with document management?

airSlate SignNow provides an intuitive platform for sending and eSigning documents efficiently. By using our service, businesses can streamline their document workflows, ensuring that important notices like 'This Is NOT A Tax Bill OK gov.' are handled promptly and securely.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. Our cost-effective solutions ensure that you can manage documents, including those marked 'This Is NOT A Tax Bill OK gov.', without breaking the bank.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow seamlessly integrates with a variety of applications, enhancing your document management capabilities. This allows you to manage documents labeled 'This Is NOT A Tax Bill OK gov.' alongside your existing tools for a more efficient workflow.

-

What features does airSlate SignNow offer for eSigning?

airSlate SignNow offers a range of features for eSigning, including customizable templates and secure signing options. This ensures that documents, including those stating 'This Is NOT A Tax Bill OK gov.', are signed quickly and securely, improving overall efficiency.

-

How can airSlate SignNow benefit my business?

By using airSlate SignNow, your business can enhance productivity and reduce turnaround times for document processing. This is particularly beneficial for documents that clarify important information, such as 'This Is NOT A Tax Bill OK gov.', ensuring clarity and compliance.

-

Is airSlate SignNow secure for sensitive documents?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance measures. This ensures that all documents, including those marked 'This Is NOT A Tax Bill OK gov.', are protected throughout the signing process.

Get more for This Is NOT A Tax Bill OK gov

Find out other This Is NOT A Tax Bill OK gov

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer