When the Last Day on Which a Tax Return May Be Fil 2024-2026

Understanding the Virginia Pass Through Entity

A Virginia pass through entity is a business structure that allows income to be passed directly to its owners without being subject to corporate income tax. This means that the income is reported on the individual tax returns of the owners, which can simplify tax obligations. Common types of pass through entities in Virginia include partnerships, limited liability companies (LLCs), and S corporations. Understanding how these entities function can help business owners make informed decisions about their tax strategies.

Key Elements of the Virginia Pass Through Entity Withholding Form

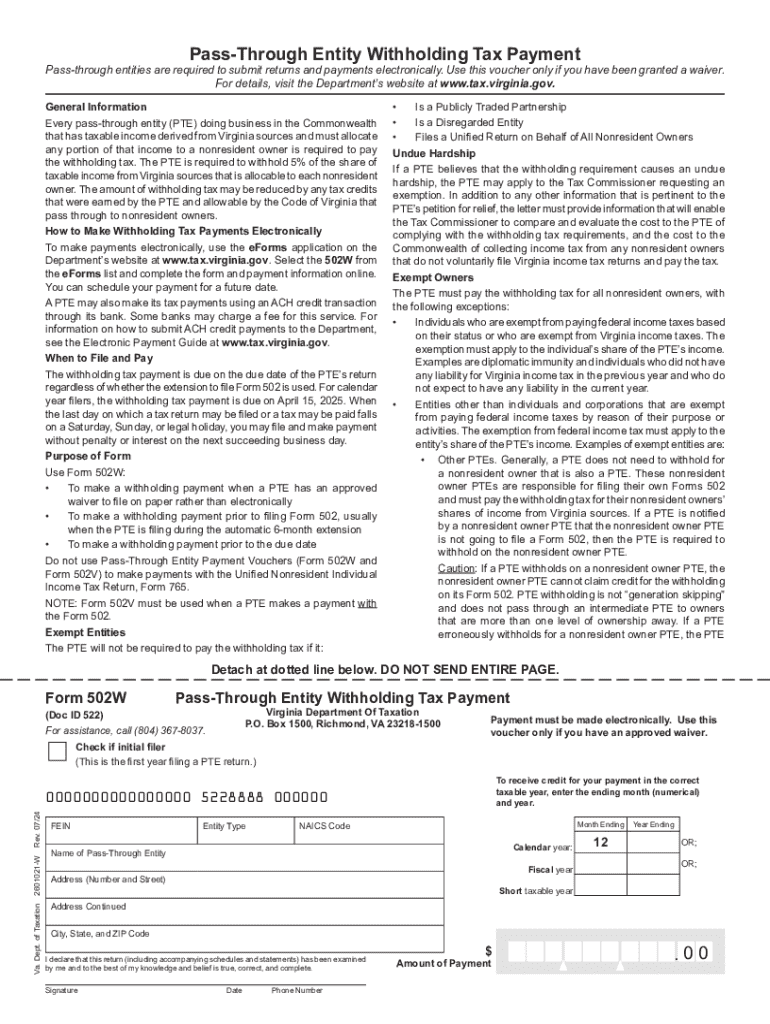

The Virginia Pass Through Entity Withholding Form, known as the 502W, is essential for reporting and remitting withholding taxes on behalf of non-resident owners. This form requires specific information, including the entity's name, federal identification number, and details about the non-resident owners. It is crucial to complete this form accurately to avoid penalties and ensure compliance with state tax laws.

Filing Deadlines for the Virginia Pass Through Entity

Timely filing of the Virginia Pass Through Entity Withholding Form is vital. The form must be submitted by the due date of the entity's income tax return. For most entities, this means the form is due on the fifteenth day of the fourth month following the end of the tax year. Understanding these deadlines can help business owners avoid late fees and ensure that they remain compliant with Virginia tax regulations.

Steps to Complete the Virginia Pass Through Entity Withholding Form

Completing the Virginia Pass Through Entity Withholding Form involves several key steps:

- Gather necessary information about the entity and its owners.

- Fill out the form accurately, ensuring all required fields are completed.

- Calculate the withholding amount based on the income distributed to non-resident owners.

- Submit the form by the appropriate deadline, either electronically or via mail.

Following these steps can help ensure that the form is completed correctly and submitted on time.

Penalties for Non-Compliance with Virginia Pass Through Entity Regulations

Failure to comply with the requirements related to the Virginia pass through entity can result in significant penalties. These may include fines for late filing or failure to withhold the appropriate taxes. Additionally, the entity may be subject to interest on unpaid taxes. Understanding these potential consequences can motivate business owners to prioritize compliance and timely filing.

Who Issues the Virginia Pass Through Entity Withholding Form

The Virginia Department of Taxation is responsible for issuing the Virginia Pass Through Entity Withholding Form. This state agency provides guidelines and resources to assist businesses in understanding their tax obligations. It is advisable for business owners to consult the Department of Taxation's resources for the most current information regarding the form and related regulations.

Create this form in 5 minutes or less

Find and fill out the correct when the last day on which a tax return may be fil

Create this form in 5 minutes!

How to create an eSignature for the when the last day on which a tax return may be fil

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a VA pass through entity?

A VA pass through entity is a business structure that allows income to be passed directly to its owners without being taxed at the corporate level. This structure is beneficial for tax purposes, as it can help reduce overall tax liability for business owners. Understanding how a VA pass through entity works is essential for maximizing your business's financial efficiency.

-

How does airSlate SignNow support VA pass through entities?

airSlate SignNow provides a seamless eSigning solution that is ideal for VA pass through entities. With our platform, businesses can easily send, sign, and manage documents online, ensuring compliance and efficiency. This is particularly useful for VA pass through entities that require quick turnaround times for contracts and agreements.

-

What are the pricing options for airSlate SignNow for VA pass through entities?

airSlate SignNow offers flexible pricing plans tailored to the needs of VA pass through entities. Our plans are designed to be cost-effective, ensuring that businesses of all sizes can access our powerful eSigning features. You can choose from monthly or annual subscriptions, allowing you to select the best option for your budget.

-

What features does airSlate SignNow offer for VA pass through entities?

airSlate SignNow includes a variety of features that benefit VA pass through entities, such as customizable templates, bulk sending, and advanced security options. These features streamline the document signing process, making it easier for businesses to manage their paperwork efficiently. Additionally, our platform is user-friendly, ensuring that all team members can utilize it effectively.

-

Can airSlate SignNow integrate with other tools for VA pass through entities?

Yes, airSlate SignNow offers integrations with various tools that are beneficial for VA pass through entities. You can connect our platform with popular applications like Google Drive, Salesforce, and more, enhancing your workflow and document management. These integrations help ensure that your business processes remain efficient and organized.

-

What are the benefits of using airSlate SignNow for a VA pass through entity?

Using airSlate SignNow provides numerous benefits for VA pass through entities, including increased efficiency, reduced turnaround times, and enhanced security for sensitive documents. Our platform simplifies the signing process, allowing businesses to focus on their core operations rather than paperwork. Additionally, the cost-effective nature of our solution makes it an attractive option for budget-conscious entities.

-

Is airSlate SignNow compliant with regulations for VA pass through entities?

Absolutely, airSlate SignNow is designed to comply with various regulations that affect VA pass through entities. Our platform adheres to industry standards for electronic signatures, ensuring that your documents are legally binding and secure. This compliance helps protect your business and provides peace of mind when managing important documents.

Get more for When The Last Day On Which A Tax Return May Be Fil

Find out other When The Last Day On Which A Tax Return May Be Fil

- Sign Wisconsin Rental Invoice Template Online

- Can I Sign Massachusetts Commercial Lease Agreement Template

- Sign Nebraska Facility Rental Agreement Online

- Sign Arizona Sublease Agreement Template Fast

- How To Sign Florida Sublease Agreement Template

- Sign Wyoming Roommate Contract Safe

- Sign Arizona Roommate Rental Agreement Template Later

- How Do I Sign New York Sublease Agreement Template

- How To Sign Florida Roommate Rental Agreement Template

- Can I Sign Tennessee Sublease Agreement Template

- Sign Texas Sublease Agreement Template Secure

- How Do I Sign Texas Sublease Agreement Template

- Sign Iowa Roommate Rental Agreement Template Now

- How Do I Sign Louisiana Roommate Rental Agreement Template

- Sign Maine Lodger Agreement Template Computer

- Can I Sign New Jersey Lodger Agreement Template

- Sign New York Lodger Agreement Template Later

- Sign Ohio Lodger Agreement Template Online

- Sign South Carolina Lodger Agreement Template Easy

- Sign Tennessee Lodger Agreement Template Secure