PA Schedule SP Special Tax Forgiveness PA 40 SP 2024-2026

What is the PA Schedule SP Special Tax Forgiveness PA 40 SP

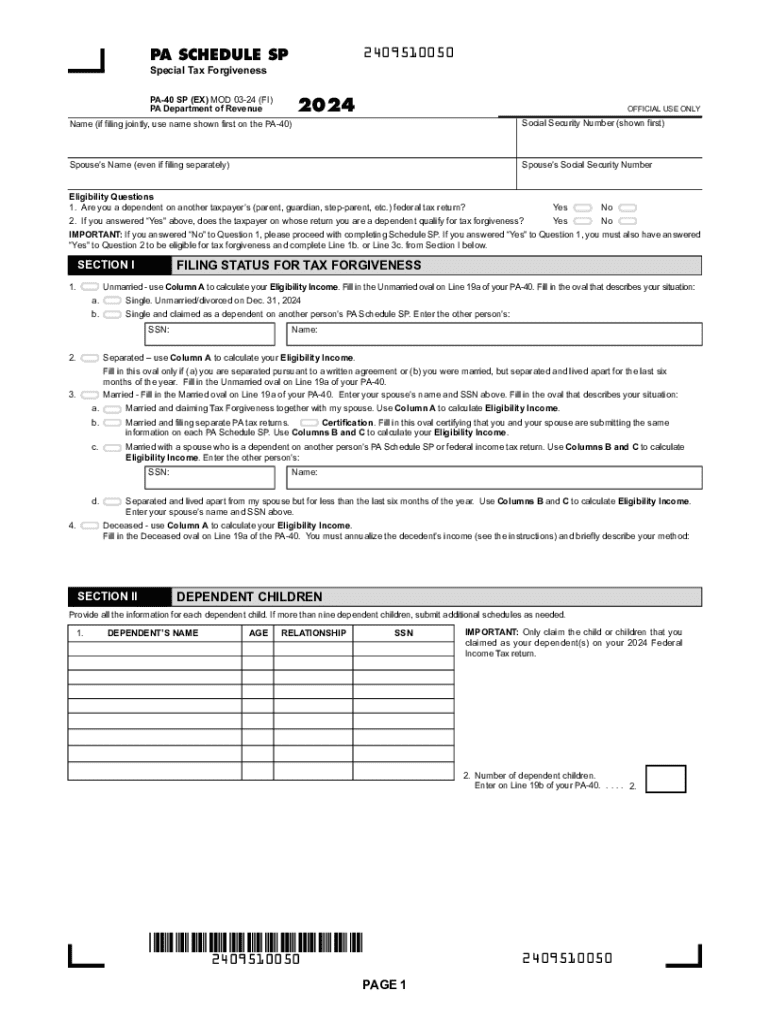

The PA Schedule SP, also known as the Special Tax Forgiveness PA 40 SP, is a tax form used by Pennsylvania residents to apply for special tax forgiveness. This form is designed to help eligible taxpayers reduce their state income tax liability based on specific criteria, including income levels and family size. It is particularly beneficial for low-income individuals and families, offering a way to alleviate some of the financial burdens associated with state taxes.

Eligibility Criteria for the PA Schedule SP Special Tax Forgiveness PA 40 SP

To qualify for the Special Tax Forgiveness program, taxpayers must meet certain eligibility criteria. These criteria typically include:

- Residency in Pennsylvania for the entire tax year.

- Meeting specific income limits, which may vary based on family size.

- Filing a PA-40 income tax return.

- Not being claimed as a dependent on someone else's tax return.

It is essential for applicants to review the current income thresholds and guidelines, as these can change annually.

Steps to Complete the PA Schedule SP Special Tax Forgiveness PA 40 SP

Completing the PA Schedule SP involves several key steps to ensure accurate submission:

- Gather all necessary documents, including your PA-40 tax return and income statements.

- Carefully review the eligibility criteria to confirm your qualification.

- Fill out the PA Schedule SP form, providing accurate information regarding your income and family size.

- Calculate your potential tax forgiveness based on the guidelines provided in the form.

- Attach the completed PA Schedule SP to your PA-40 tax return when submitting.

Following these steps will help streamline the application process and ensure compliance with state requirements.

How to Obtain the PA Schedule SP Special Tax Forgiveness PA 40 SP

The PA Schedule SP can be obtained through various means. Taxpayers can access the form directly from the Pennsylvania Department of Revenue's website or request a physical copy from local tax offices. Additionally, many tax preparation software programs include the PA Schedule SP as part of their offerings, allowing users to complete the form electronically during the filing process.

Form Submission Methods for the PA Schedule SP Special Tax Forgiveness PA 40 SP

Taxpayers have multiple options for submitting the PA Schedule SP. These methods include:

- Online submission through the Pennsylvania Department of Revenue's e-filing system.

- Mailing the completed form along with the PA-40 tax return to the appropriate address specified by the state.

- In-person submission at designated tax offices for those who prefer face-to-face assistance.

Choosing the right submission method can depend on personal preference and the complexity of the tax situation.

Key Elements of the PA Schedule SP Special Tax Forgiveness PA 40 SP

Understanding the key elements of the PA Schedule SP is crucial for effective completion. Important components of the form include:

- Personal information section, where taxpayers provide their name, address, and Social Security number.

- Income details, requiring documentation of all sources of income for the tax year.

- Family size information, which impacts eligibility and the amount of tax forgiveness available.

- Calculation section, where taxpayers determine their tax liability and potential forgiveness amount based on provided guidelines.

Being thorough and accurate in these sections can significantly affect the outcome of the application.

Create this form in 5 minutes or less

Find and fill out the correct pa schedule sp special tax forgiveness pa 40 sp

Create this form in 5 minutes!

How to create an eSignature for the pa schedule sp special tax forgiveness pa 40 sp

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the pa schedule sp feature in airSlate SignNow?

The pa schedule sp feature in airSlate SignNow allows users to set specific times for document signing and management. This ensures that all parties are notified and can sign documents at their convenience, streamlining the signing process. With this feature, businesses can enhance their workflow efficiency and improve document turnaround times.

-

How does airSlate SignNow's pa schedule sp benefit my business?

Using the pa schedule sp feature can signNowly reduce delays in document processing. By scheduling signing times, businesses can ensure timely responses from clients and partners. This leads to faster transactions and improved customer satisfaction, making it a valuable tool for any organization.

-

What are the pricing options for airSlate SignNow with pa schedule sp?

airSlate SignNow offers various pricing plans that include the pa schedule sp feature. These plans are designed to cater to different business sizes and needs, ensuring that you only pay for what you use. For detailed pricing information, you can visit our website or contact our sales team for personalized assistance.

-

Can I integrate pa schedule sp with other tools?

Yes, airSlate SignNow's pa schedule sp feature can be integrated with various third-party applications. This allows for seamless workflows and enhances productivity by connecting your existing tools with our eSigning solution. Popular integrations include CRM systems, project management tools, and cloud storage services.

-

Is the pa schedule sp feature user-friendly?

Absolutely! The pa schedule sp feature in airSlate SignNow is designed with user experience in mind. Its intuitive interface makes it easy for users of all skill levels to schedule document signing without any technical difficulties, ensuring a smooth experience for both senders and signers.

-

What types of documents can I manage with pa schedule sp?

With the pa schedule sp feature, you can manage a wide variety of documents, including contracts, agreements, and forms. This versatility makes it suitable for different industries, from real estate to healthcare. You can easily customize documents to fit your specific needs while ensuring compliance and security.

-

How secure is the pa schedule sp feature?

The pa schedule sp feature in airSlate SignNow is built with robust security measures to protect your documents. We utilize encryption, secure access controls, and compliance with industry standards to ensure that your sensitive information remains safe. You can trust that your documents are handled with the utmost care and security.

Get more for PA Schedule SP Special Tax Forgiveness PA 40 SP

Find out other PA Schedule SP Special Tax Forgiveness PA 40 SP

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile