PA Schedule SP Special Tax Forgiveness PA 40 SP FormsPublications 2017

What is the PA Schedule SP Special Tax Forgiveness PA 40 SP FormsPublications

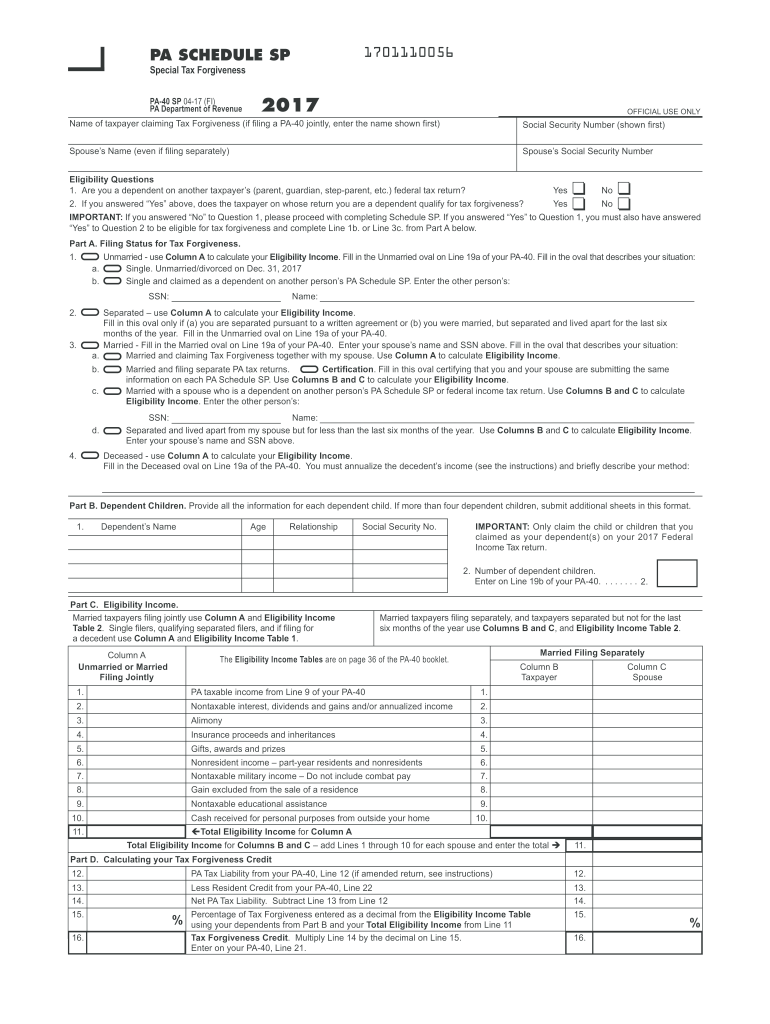

The PA Schedule SP Special Tax Forgiveness PA 40 SP FormsPublications is a tax form used by residents of Pennsylvania to apply for special tax forgiveness. This form is designed to assist eligible taxpayers in reducing their state income tax liability based on specific criteria, such as income levels and family size. By utilizing this form, individuals can ensure they receive the appropriate tax benefits available to them under Pennsylvania law.

Steps to complete the PA Schedule SP Special Tax Forgiveness PA 40 SP FormsPublications

Completing the PA Schedule SP Special Tax Forgiveness PA 40 SP FormsPublications involves several key steps:

- Gather necessary documentation, including income records and family size information.

- Obtain the PA Schedule SP form from the Pennsylvania Department of Revenue website or other authorized sources.

- Fill out the form accurately, ensuring all personal information and income details are correct.

- Review the form for completeness and accuracy before submission.

- Submit the completed form according to the instructions provided, either online, by mail, or in person.

Eligibility Criteria

To qualify for the special tax forgiveness program, applicants must meet specific eligibility criteria. Generally, these criteria include:

- Residency in Pennsylvania for the tax year in question.

- Meeting income thresholds set by the Pennsylvania Department of Revenue.

- Filing a PA-40 tax return for the applicable tax year.

- Providing accurate information regarding family size and income sources.

Legal use of the PA Schedule SP Special Tax Forgiveness PA 40 SP FormsPublications

The PA Schedule SP Special Tax Forgiveness PA 40 SP FormsPublications is legally recognized when completed and submitted according to Pennsylvania tax laws. It is essential for taxpayers to ensure compliance with all legal requirements, including accurate reporting of income and family size, to avoid potential penalties. Utilizing electronic signature solutions can further enhance the legal standing of the submitted form, ensuring that it meets all necessary regulations.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the PA Schedule SP Special Tax Forgiveness PA 40 SP FormsPublications. These methods include:

- Online Submission: Many taxpayers prefer to submit their forms electronically through the Pennsylvania Department of Revenue's online portal.

- Mail: Completed forms can be printed and mailed to the designated address provided in the form instructions.

- In-Person: Taxpayers may also choose to deliver their forms in person at local tax offices or designated locations.

Filing Deadlines / Important Dates

It is crucial for taxpayers to be aware of filing deadlines associated with the PA Schedule SP Special Tax Forgiveness PA 40 SP FormsPublications. Generally, the deadline for submitting this form aligns with the annual tax return deadline, which is typically April 15. However, taxpayers should verify specific dates each year, as they may vary due to weekends or holidays.

Quick guide on how to complete 2017 pa schedule sp special tax forgiveness pa 40 sp formspublications

Facilitate PA Schedule SP Special Tax Forgiveness PA 40 SP FormsPublications on any gadget

Web-based document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without hold-ups. Manage PA Schedule SP Special Tax Forgiveness PA 40 SP FormsPublications on any gadget using airSlate SignNow Android or iOS applications and enhance any document-centric task today.

The simplest method to modify and eSign PA Schedule SP Special Tax Forgiveness PA 40 SP FormsPublications effortlessly

- Obtain PA Schedule SP Special Tax Forgiveness PA 40 SP FormsPublications and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize signNow sections of the documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to preserve your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign PA Schedule SP Special Tax Forgiveness PA 40 SP FormsPublications and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2017 pa schedule sp special tax forgiveness pa 40 sp formspublications

Create this form in 5 minutes!

How to create an eSignature for the 2017 pa schedule sp special tax forgiveness pa 40 sp formspublications

How to generate an eSignature for the 2017 Pa Schedule Sp Special Tax Forgiveness Pa 40 Sp Formspublications online

How to make an electronic signature for your 2017 Pa Schedule Sp Special Tax Forgiveness Pa 40 Sp Formspublications in Google Chrome

How to create an electronic signature for putting it on the 2017 Pa Schedule Sp Special Tax Forgiveness Pa 40 Sp Formspublications in Gmail

How to generate an electronic signature for the 2017 Pa Schedule Sp Special Tax Forgiveness Pa 40 Sp Formspublications from your smartphone

How to create an eSignature for the 2017 Pa Schedule Sp Special Tax Forgiveness Pa 40 Sp Formspublications on iOS

How to make an electronic signature for the 2017 Pa Schedule Sp Special Tax Forgiveness Pa 40 Sp Formspublications on Android devices

People also ask

-

What is the PA Schedule SP Special Tax Forgiveness PA 40 SP FormsPublications?

The PA Schedule SP Special Tax Forgiveness PA 40 SP FormsPublications is a tax form that allows qualifying individuals to request special tax forgiveness on their Pennsylvania state tax returns. This form is essential for those who meet the income requirements and want to maximize their tax benefits. Understanding this form can help taxpayers save money and ensure compliance with state regulations.

-

How can airSlate SignNow help with PA Schedule SP Special Tax Forgiveness PA 40 SP FormsPublications?

airSlate SignNow streamlines the signing and submission process for PA Schedule SP Special Tax Forgiveness PA 40 SP FormsPublications by allowing users to easily prepare, send, and eSign documents from any device. This enhances productivity by reducing delays traditionally associated with paper forms. By using airSlate SignNow, you ensure that your tax documents are handled efficiently and securely.

-

Are there any costs associated with using airSlate SignNow for PA Schedule SP Special Tax Forgiveness PA 40 SP FormsPublications?

airSlate SignNow offers various pricing plans that cater to different business needs. There are no hidden fees, and you can choose a plan that provides the best value for your needs, whether you’re a small business or a larger organization. Investing in airSlate SignNow can save you time and potential costs related to paper handling and delays.

-

What features does airSlate SignNow provide for managing tax documents like the PA Schedule SP Special Tax Forgiveness PA 40 SP FormsPublications?

airSlate SignNow offers a range of features including document templates, customizable workflows, and real-time tracking for your PA Schedule SP Special Tax Forgiveness PA 40 SP FormsPublications. These features help you to manage your tax documents more effectively. Additionally, the platform ensures compliance and security, giving you peace of mind during tax season.

-

Can I integrate airSlate SignNow with other software for handling PA Schedule SP Special Tax Forgiveness PA 40 SP FormsPublications?

Yes, airSlate SignNow supports integration with various software applications, including CRMs, accounting software, and other productivity tools. This allows you to seamlessly manage your PA Schedule SP Special Tax Forgiveness PA 40 SP FormsPublications alongside your existing systems. The integrations can help streamline your workflow and reduce the risk of errors.

-

What are the benefits of using airSlate SignNow for submitting my PA Schedule SP Special Tax Forgiveness PA 40 SP FormsPublications?

Using airSlate SignNow for submitting your PA Schedule SP Special Tax Forgiveness PA 40 SP FormsPublications provides numerous benefits including enhanced speed, improved accuracy, and secure document storage. It simplifies the eSigning process, reduces the use of paper, and helps ensure that your submissions are tracked and managed efficiently. The user-friendly platform also enhances overall productivity.

-

Is airSlate SignNow secure for handling sensitive tax documents like PA Schedule SP Special Tax Forgiveness PA 40 SP FormsPublications?

Absolutely! airSlate SignNow employs industry-standard encryption and security measures to protect sensitive documents including PA Schedule SP Special Tax Forgiveness PA 40 SP FormsPublications. Your data's security is our top priority, ensuring that your tax information remains confidential and safeguarded from unauthorized access.

Get more for PA Schedule SP Special Tax Forgiveness PA 40 SP FormsPublications

- Pitkin county revegetation report city of aspen and pitkin county form

- Electrical permit application city of aspen amp pitkin county form

- 542 0191 form

- Rockdale water resources application form

- Rockdale county business license form

- Firearms license application rockdale county rockdalecounty form

- Compliance inspection application rockdale county rockdalecounty form

- Gun licenses rockdale co form

Find out other PA Schedule SP Special Tax Forgiveness PA 40 SP FormsPublications

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney