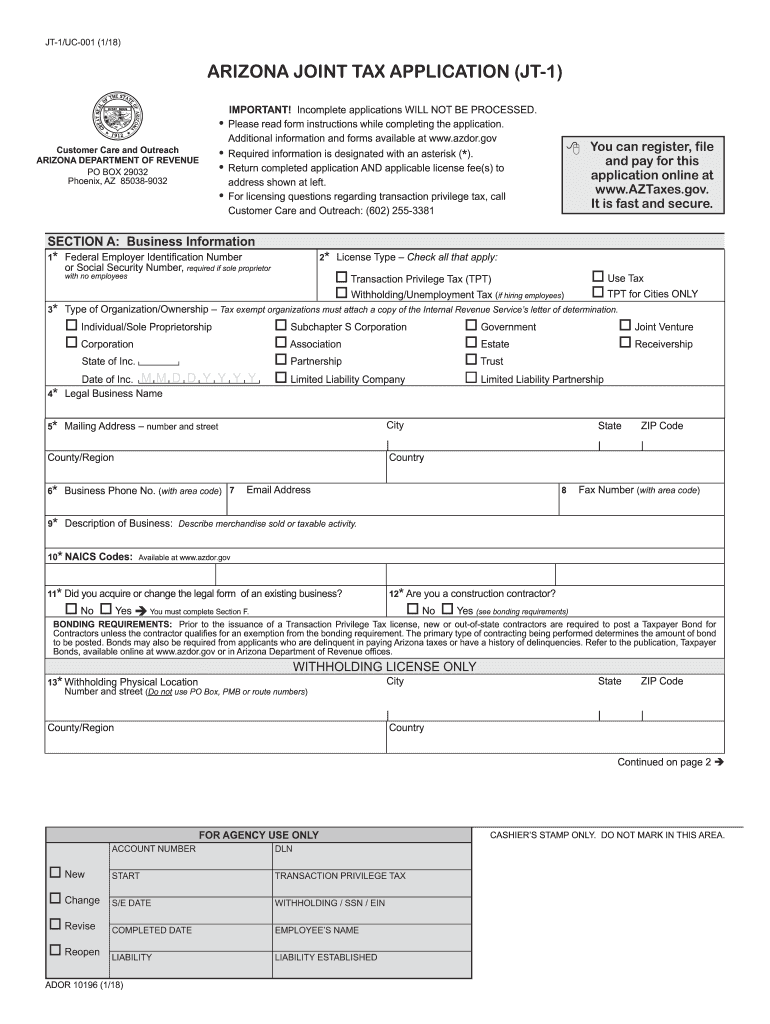

Arizona Sales Tax Permit Application 2018

What is the Arizona Sales Tax Permit Application?

The Arizona Sales Tax Permit Application is a crucial document for businesses operating in Arizona that sell tangible personal property or certain services. This application allows businesses to collect sales tax from customers, which is then remitted to the state. Obtaining this permit is essential for compliance with Arizona tax laws and regulations.

Businesses must ensure they are registered before making sales, as operating without a permit can lead to penalties and legal issues. The application process requires specific information about the business, including its legal structure, ownership details, and the nature of the products or services offered.

Steps to Complete the Arizona Sales Tax Permit Application

Completing the Arizona Sales Tax Permit Application involves several key steps to ensure accuracy and compliance. Businesses should follow these steps:

- Gather Required Information: Collect necessary details such as the business name, address, ownership structure, and type of products or services sold.

- Access the Application: Obtain the application form from the Arizona Department of Revenue's official website or through their office.

- Fill Out the Form: Carefully complete the application, ensuring all information is accurate and up to date.

- Review and Submit: Double-check the application for any errors before submitting it either online or by mail.

Following these steps helps streamline the application process and reduces the likelihood of delays in approval.

How to Obtain the Arizona Sales Tax Permit Application

The Arizona Sales Tax Permit Application can be obtained through the Arizona Department of Revenue. Businesses can access the application online via the department's website or request a physical copy by visiting their local office. It is advisable to use the online method for convenience and faster processing.

Once the application is accessed, businesses should ensure they have all required information ready to facilitate a smooth completion process. This includes having identification numbers, business details, and any necessary supporting documentation at hand.

Eligibility Criteria

To be eligible for the Arizona Sales Tax Permit, businesses must meet specific criteria set by the state. These criteria include:

- Operating a business that sells taxable goods or services in Arizona.

- Having a physical presence in the state, such as a store, office, or warehouse.

- Complying with all local and state business regulations, including obtaining any necessary licenses.

Understanding these eligibility requirements is vital for businesses to ensure they can successfully apply for and maintain their sales tax permit.

Required Documents

When applying for the Arizona Sales Tax Permit, businesses need to prepare several documents to support their application. These documents may include:

- Proof of business registration, such as Articles of Incorporation or a business license.

- Identification numbers, including the Employer Identification Number (EIN).

- Details regarding the business's structure, such as partnership agreements or operating agreements for LLCs.

Having these documents ready can expedite the application process and help avoid potential delays.

Form Submission Methods

The Arizona Sales Tax Permit Application can be submitted through various methods to accommodate different business needs. The available submission methods include:

- Online Submission: Businesses can complete and submit the application electronically through the Arizona Department of Revenue's website.

- Mail Submission: Alternatively, businesses can print the completed application and send it to the appropriate address provided on the form.

- In-Person Submission: Businesses may also choose to submit their application in person at a local Arizona Department of Revenue office.

Choosing the right submission method can help ensure the application is processed efficiently.

Quick guide on how to complete jt 1 2018 2019 form

Your assistance manual on how to prepare your Arizona Sales Tax Permit Application

If you wish to understand how to generate and submit your Arizona Sales Tax Permit Application, here are some quick pointers on how to ease the tax submission process.

To commence, simply set up your airSlate SignNow profile to transform how you manage documents online. airSlate SignNow is a user-friendly and powerful document solution that allows you to modify, draft, and finalize your tax forms effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures and revisit to update information as needed. Streamline your tax administration with advanced PDF editing, eSigning, and easy sharing.

Complete the steps below to finalize your Arizona Sales Tax Permit Application swiftly:

- Create your account and start working on PDFs in moments.

- Utilize our directory to find any IRS tax form; explore various versions and schedules.

- Click Get form to access your Arizona Sales Tax Permit Application in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if necessary).

- Review your document and correct any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this guide to electronically file your taxes with airSlate SignNow. Keep in mind that submitting paper forms can lead to increased return errors and delayed refunds. Moreover, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct jt 1 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill out the JEE Mains 2018 form after 1 Jan?

No students cannot fill the JEE Main 2018 application or admission form after 1 January. If they want to updated with details, so can visit at

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill out the CBSE class 12th compartment 2018 online form?

Here is the details:Step 1: Visit the official website www.cbse.nic.in.Step 2: Check out the “Recent Announcements” section.Step 3: Click on “Online Application for Class XII Compartment”Step 4: Now look for “Online Submission of LOC for Compartment/IOP Exam 2018” or “Online Application for Private Candidate for Comptt/IOP Examination 2018”.Step 5: Select a suitable link as per your class. Enter Roll Number, School Code, Centre Number and click on “Proceed” Button.Step 6: Now a form will be displayed on the screen. Fill the form carefully and submit. Pay attention and fill all your details correctly. If your details are incorrect, your form may get rejected.Step 7: After filling all your details correctly, upload the scanned copy of your photo and signature.Step 8: After uploading all your documents, go to the fee payment option. You can pay the fee via demand draft or e-challan.Step 9: After making the payment click on “Submit” button and take printout of confirmation page.Step 10: Now you have to send your documents to the address of regional office within 7 days. Documents including the photocopy of the confirmation page, photocopy of marksheet and e-challan or if you have paid via demand draft, then the original DD must be sent.Students who have successfully registered themselves for the exam may download their CBSE Compartment Admit Card once it is available on the official website.I hope you got your answer.

Create this form in 5 minutes!

How to create an eSignature for the jt 1 2018 2019 form

How to generate an electronic signature for your Jt 1 2018 2019 Form in the online mode

How to generate an eSignature for your Jt 1 2018 2019 Form in Chrome

How to create an electronic signature for putting it on the Jt 1 2018 2019 Form in Gmail

How to generate an electronic signature for the Jt 1 2018 2019 Form straight from your mobile device

How to generate an eSignature for the Jt 1 2018 2019 Form on iOS devices

How to generate an eSignature for the Jt 1 2018 2019 Form on Android OS

People also ask

-

What is uc 001 and how does it relate to airSlate SignNow?

uc 001 refers to a unique identifier for our eSigning solution within the airSlate SignNow platform. It helps businesses organize and manage their electronic documents efficiently. With uc 001, users can easily track and access signed documents for their records.

-

How does pricing work for the uc 001 service?

The pricing for the uc 001 service is structured to be budget-friendly, with various plans tailored to fit different business sizes and needs. You can choose from monthly or annual subscriptions, allowing flexibility in payment. Our plans often include a free trial, so you can test uc 001 before committing.

-

What features are included in the uc 001 offering?

The uc 001 service comes with a range of powerful features designed to streamline document signing. Key features include document templates, secure storage, and advanced tracking options. With uc 001, you can also integrate third-party applications to enhance your workflow.

-

What are the benefits of using the uc 001 service for businesses?

Using the uc 001 service allows businesses to improve efficiency by reducing the time spent on document handling. It enhances security through encrypted eSignatures, ensuring compliance with industry regulations. Ultimately, uc 001 helps organizations accelerate their document workflow and improve customer satisfaction.

-

Can uc 001 be integrated with other software tools?

Yes, the uc 001 service supports seamless integrations with multiple software applications, including CRM and project management tools. This flexibility enables businesses to enhance their workflow without disrupting current processes. Integration with uc 001 can further increase productivity and streamline operations.

-

Is the uc 001 solution secure for sensitive documents?

The uc 001 service is designed with security as a top priority, utilizing advanced encryption and secure user authentication. All signed documents are stored in a secure cloud environment, ensuring compliance with GDPR and other regulations. You can trust uc 001 for handling your most sensitive documents.

-

How does the customer support for uc 001 work?

We provide exceptional customer support for the uc 001 service, including resources such as FAQs, tutorials, and user guides. Our dedicated support team is available via chat, email, or phone to assist with any inquiries. We are committed to ensuring you have a positive experience with uc 001.

Get more for Arizona Sales Tax Permit Application

- Warriors to work registration form wounded warrior project woundedwarriorproject

- Onepath direct debit form

- Va form 10 3203 65585288

- Certificate of removal form

- Nys vendor responsibility questionnaire for profit business entity form

- Fl home occupation form

- Independent record label contract template form

- Independent sale rep contract template form

Find out other Arizona Sales Tax Permit Application

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile