Schedule X California Explanation of Amended Return Changes 2024-2026

Understanding the California Schedule X for Amended Returns

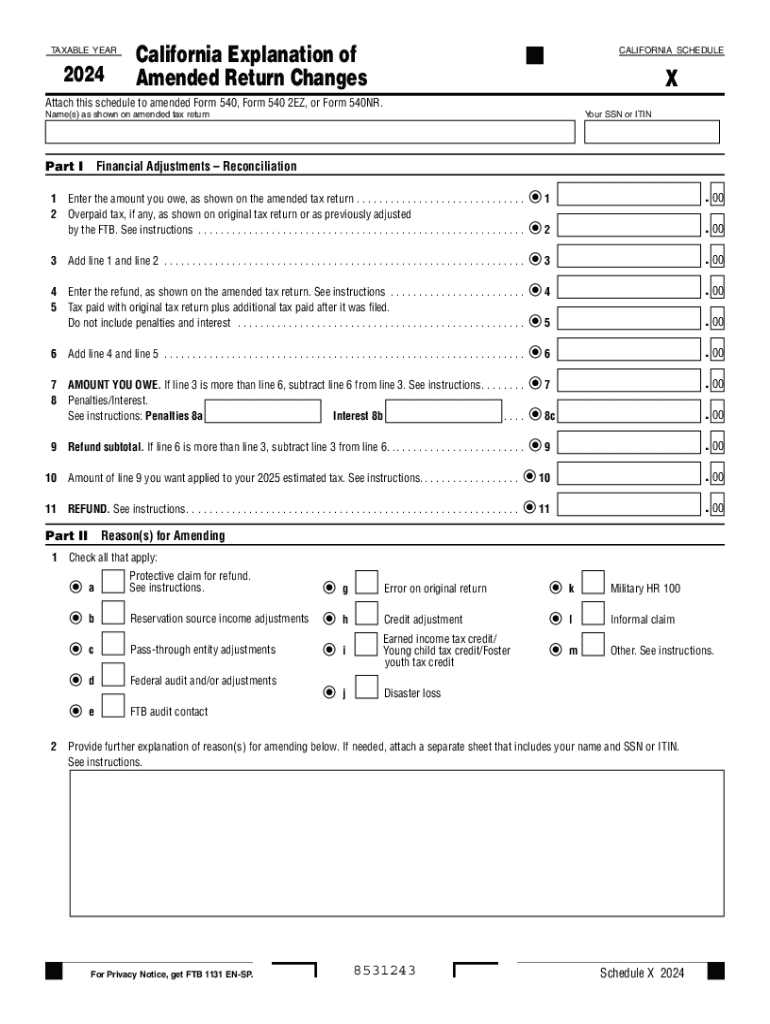

The California Schedule X is a crucial form for taxpayers who need to amend their returns. It provides a structured way to explain changes made to a previously filed tax return. This form is essential for ensuring that the California Franchise Tax Board (FTB) understands the reasons behind the amendments, which can include corrections to income, deductions, or credits. By accurately completing the Schedule X, taxpayers can avoid potential issues with their amended returns.

Steps to Complete the California Schedule X

Filling out the Schedule X involves several key steps:

- Gather all relevant documentation from the original return and any new information.

- Clearly indicate the changes being made in each section of the form.

- Provide a detailed explanation for each amendment in the designated area.

- Review the completed form for accuracy and completeness.

- Submit the Schedule X along with your amended return to the FTB.

Key Elements of the Schedule X

When completing the Schedule X, it is important to include specific information:

- The tax year for which you are amending the return.

- A summary of the changes being made.

- Detailed explanations for each amendment to clarify your reasons.

- Your signature and date to validate the submission.

Legal Considerations for Using the Schedule X

Using the Schedule X is not just a procedural step; it is also a legal requirement when amending a tax return in California. Failure to provide a complete and accurate Schedule X can lead to penalties or delays in processing your amended return. It is advisable to consult with a tax professional if you have questions about the legal implications of your amendments.

Filing Deadlines for Amended Returns

Timely submission of the Schedule X is essential. Generally, amended returns must be filed within four years from the original due date of the return. This timeline ensures that taxpayers can correct errors without facing penalties. Be aware of specific deadlines related to your tax situation to avoid complications.

Obtaining the Schedule X Form

The Schedule X form can be easily obtained from the California Franchise Tax Board's official website. It is available for download in PDF format, allowing taxpayers to print and fill it out at their convenience. Ensure you have the most current version of the form to avoid any issues with your submission.

Create this form in 5 minutes or less

Find and fill out the correct schedule x california explanation of amended return changes

Create this form in 5 minutes!

How to create an eSignature for the schedule x california explanation of amended return changes

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an FTB amended return?

An FTB amended return is a form used to correct errors on a previously filed California tax return. It allows taxpayers to update their information, claim additional deductions, or correct income discrepancies. Using airSlate SignNow can simplify the process of submitting your FTB amended return with eSignature capabilities.

-

How can airSlate SignNow help with filing an FTB amended return?

airSlate SignNow streamlines the process of filing an FTB amended return by allowing users to easily fill out, sign, and send their documents electronically. This reduces the time spent on paperwork and ensures that your amended return is submitted accurately and promptly. Plus, our platform is user-friendly, making it accessible for everyone.

-

What are the costs associated with using airSlate SignNow for FTB amended returns?

airSlate SignNow offers a cost-effective solution for managing your FTB amended return needs. Our pricing plans are designed to fit various budgets, ensuring that you can access essential features without breaking the bank. You can choose from monthly or annual subscriptions based on your usage requirements.

-

Are there any integrations available for airSlate SignNow when filing an FTB amended return?

Yes, airSlate SignNow integrates seamlessly with various applications and platforms, enhancing your workflow when filing an FTB amended return. You can connect with popular tools like Google Drive, Dropbox, and more to easily manage your documents. This integration capability helps streamline your document management process.

-

What features does airSlate SignNow offer for FTB amended returns?

airSlate SignNow provides a range of features tailored for FTB amended returns, including customizable templates, secure eSigning, and document tracking. These features ensure that your amended return is completed efficiently and securely. Additionally, our platform allows for easy collaboration with tax professionals if needed.

-

How secure is airSlate SignNow for submitting an FTB amended return?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure servers to protect your sensitive information when submitting an FTB amended return. You can trust that your data is safe with us, allowing you to focus on completing your tax filings without worry.

-

Can I use airSlate SignNow on mobile devices for my FTB amended return?

Absolutely! airSlate SignNow is fully optimized for mobile devices, allowing you to manage your FTB amended return on the go. Whether you're using a smartphone or tablet, you can easily fill out, sign, and send your documents from anywhere, making it convenient for busy professionals.

Get more for Schedule X California Explanation Of Amended Return Changes

Find out other Schedule X California Explanation Of Amended Return Changes

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online

- eSignature Massachusetts Mechanic's Lien Free

- eSign Ohio Car Insurance Quotation Form Mobile

- eSign North Dakota Car Insurance Quotation Form Online

- eSign Pennsylvania Car Insurance Quotation Form Mobile

- eSignature Nevada Mechanic's Lien Myself

- eSign California Life-Insurance Quote Form Online

- How To eSignature Ohio Mechanic's Lien

- eSign Florida Life-Insurance Quote Form Online

- eSign Louisiana Life-Insurance Quote Form Online

- How To eSign Michigan Life-Insurance Quote Form

- Can I eSign Colorado Business Insurance Quotation Form

- Can I eSign Hawaii Certeficate of Insurance Request

- eSign Nevada Certeficate of Insurance Request Now

- Can I eSign Missouri Business Insurance Quotation Form

- How Do I eSign Nevada Business Insurance Quotation Form